Fishing Drones Market Introduction and Overview

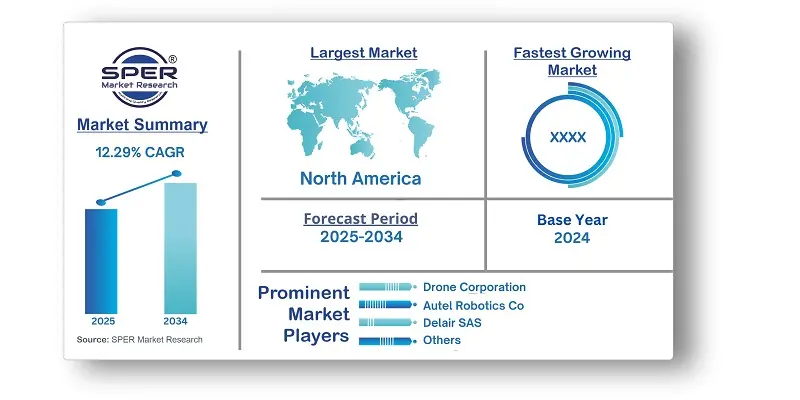

According to SPER Market Research, the Global Fishing Drones Market is estimated to reach USD 2951.89 million by 2034 with a CAGR of 12.29%.

The report includes an in-depth analysis of the Global Fishing Drones Market, including market size and trends, product mix, Applications, and supplier analysis. The market for fishing drones is growing as technology improves conventional fishing techniques with aerial assistance. By monitoring water conditions, dropping bait, and exploring fish spots, fishing drones help anglers increase efficiency and capture rates. The rise in both commercial and recreational fishing, the development of drone technology, and the growing need for smart fishing gear are some of the main motivators. Adoption is being accelerated by features like GPS, high-definition cameras, and AI-powered fish identification. But obstacles including exorbitant prices, legal prohibitions on drone use, short battery life, and possible environmental issues prevent expansion. In spite of these obstacles, advancements in automation, battery efficiency, and lightweight materials are anticipated to propel additional market growth.

By Type Insights: Fishing Drones is classified into three categories based on Type: Fixed Wing Drones, Multi-Rotor Drones and Hybrid Drones. Fixed-wing drones are a major player in the global fishing drone market because of their long-range capabilities and effectiveness in covering large fishing grounds. Multi-rotor drones, on the other hand, are valued for their adaptability and capacity to function in difficult terrain and limited water bodies. As a result, they are essential to local fishing demands. As the market looks for cutting-edge solutions for fishing activities, hybrid drones are important because they combine the benefits of both types, providing flexibility and a greater operational range.

By Payload Capacity Insights: The market for Fishing Drones is segmented based on Payload Capacity, including less than 5 kg, 5 kg to 10 kg and More than 10 kg. Drones with a payload capacity of less than 5 kg have become popular because of their lightweight designs, which make them perfect for recreational and small-scale fishing operations. They are also frequently sought for because of their affordability and ease of usage. On the other hand, the 5 kg to 10 kg capacity drones are designed for more serious fishing activities and provide a compromise between portability and the capacity to carry necessary fishing equipment or tools. The largest capabilities are found in the category of drones weighing more than 10 kg.

By Application Insights: The market for Fishing Drones is segmented based on applications, including Surveillance, Search and Rescue, Fish Spotting, Environmental Monitoring. The dominant share of surveillance indicates its superiority in keeping an eye on fishing operations. The significance of fish spotting in maximizing fishing effectiveness and resource management is also notable. Finally, the section on environmental monitoring highlights the increased attention being paid to ecological evaluations and pollution monitoring in aquatic ecosystems. The growing need for environmentally friendly fishing methods and the development of drone technology are driving the market's rapid expansion.

By End User Insights: The market for Fishing Drones is divided into many end users, including Commercial Fishing, Recreational Fishing, Research and Conservation. Commercial fishing is especially important since it ensures sustainable practices by improving operational efficiency and enabling better fish population monitoring. As enthusiasts look for cutting-edge equipment to enhance their fishing experiences, recreational fishing is becoming more and more popular, which is driving up consumer demand. In order to manage fish stocks and conduct research on aquatic environments, the Research and Conservation divisions are essential to environmental preservation initiatives.

By Regional Insights: The United States leads the world in the use of drone technology for fishing, thereby controlling the majority of the fishing drones market. The United States is becoming a major player in the commercial and recreational fishing industries thanks to developments in UAV technology. Significant market growth is also fuelled by the nation's strong emphasis on innovation and investment in drone-based solutions.

Market Competitive Landscape:

As new technology encourages the use of creative solutions for both commercial and recreational fishing, the global fishing drone market is expanding significantly. Many competitors are fighting for a sizable portion of this market, which makes competition more fierce. Companies are concentrating on improving their products to draw customers as drones are becoming more and more common for surveying and monitoring fishing locations. Some of the key market players are Aerokontiki, AguaDrone, Autel Robotics Co., Ltd., Birds Eye Aerial Drones, LLC, Chasing Innovation, Delair SAS, Drone Corporation, DroneDeploy, Inc., Gannet, Guardian Agriculture, Inc., Harris Aerial, LLC, Insitu Inc., Inspired Flight Technologies, Inc. and PowerVision, PrecisionHawk, Inc.

Recent Developments:

- In May 2022, Throttle Aerospace Systems, a drone manufacturer based in Bengaluru, has been purchased by RattanIndia Enterprises Ltd., the flagship company of the Rattanindia Group to operate its new-age growth enterprises.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Type, By Payload Capacity, By Application, By End User. |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa. |

| Companies Covered | Aerokontiki, AguaDrone, Autel Robotics Co., Ltd., Birds Eye Aerial Drones, LLC, Chasing Innovation, Delair SAS, Drone Corporation, DroneDeploy, Inc., Gannet, Guardian Agriculture, Inc., Harris Aerial, LLC, Insitu Inc., Inspired Flight Technologies, Inc., PowerVision, PrecisionHawk, Inc. and others. |

Key Topics Covered in the Report:

- Global Fishing Drones Market Size (FY’2021-FY’2034)

- Overview of Global Fishing Drones Market

- Segmentation of Global Fishing Drones Market By Type (Fixed Wing Drones, Multi-Rotor Drones, Hybrid Drones)

- Segmentation of Global Fishing Drones Market By Payload Capacity (less than 5 kg, 5 kg to 10 kg and More than 10 kg)

- Segmentation of Global Fishing Drones Market By Application (Surveillance, Search and Rescue, Fish Spotting, Environmental Monitoring)

- Segmentation of Global Fishing Drones Market By End User (Commercial Fishing, Recreational Fishing, Research and Conservation)

- Statistical Snap of Global Fishing Drones Market

- Expansion Analysis of Global Fishing Drones Market

- Problems and Obstacles in Global Fishing Drones Market

- Competitive Landscape in the Global Fishing Drones Market

- Details on Current Investment in Global Fishing Drones Market

- Competitive Analysis of Global Fishing Drones Market

- Prominent Players in the Global Fishing Drones Market

- SWOT Analysis of Global Fishing Drones Market

- Global Fishing Drones Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Fishing Drones Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Fishing Drones Market

7. Global Fishing Drones Market, By Type (USD Million) 2021-2034

7.1. Fixed Wing Drones

7.2. Multi-Rotor Drones

7.3. Hybrid Drones

8. Global Fishing Drones Market, By Payload Capacity (USD Million) 2021-2034

8.1. Less than 5 kg

8.2. 5 kg to 10 kg

8.3. More than 10 kg

9. Global Fishing Drones Market, By Application (USD Million) 2021-2034

9.1. Surveillance

9.2. Search and Rescue

9.3. Fish Spotting

9.4. Environmental Monitoring

10. Global Fishing Drones Market, By End User (USD Million) 2021-2034

10.1. Commercial Fishing

10.2. Recreational Fishing

10.3. Research and Conservation

11. Global Fishing Drones Market, (USD Million) 2021-2034

11.1. Global Fishing Drones Market Size and Market Share

12. Global Fishing Drones Market, By Region, (USD Million) 2021-2034

12.1. Asia-Pacific

12.1.1. Australia

12.1.2. China

12.1.3. India

12.1.4. Japan

12.1.5. South Korea

12.1.6. Rest of Asia-Pacific

12.2. Europe

12.2.1. France

12.2.2. Germany

12.2.3. Italy

12.2.4. Spain

12.2.5. United Kingdom

12.2.6. Rest of Europe

12.3. Middle East and Africa

12.3.1. Kingdom of Saudi Arabia

12.3.2. United Arab Emirates

12.3.3. Qatar

12.3.4. South Africa

12.3.5. Egypt

12.3.6. Morocco

12.3.7. Nigeria

12.3.8. Rest of Middle-East and Africa

12.4. North America

12.4.1. Canada

12.4.2. Mexico

12.4.3. United States

12.5. Latin America

12.5.1. Argentina

12.5.2. Brazil

12.5.3. Rest of Latin America

13. Company Profile

13.1. Aerokontiki

13.1.1. Company details

13.1.2. Financial outlook

13.1.3. Product summary

13.1.4. Recent developments

13.2. AguaDrone

13.2.1. Company details

13.2.2. Financial outlook

13.2.3. Product summary

13.2.4. Recent developments

13.3. Autel Robotics Co., Ltd.

13.3.1. Company details

13.3.2. Financial outlook

13.3.3. Product summary

13.3.4. Recent developments

13.4. Birds Eye Aerial Drones, LLC

13.4.1. Company details

13.4.2. Financial outlook

13.4.3. Product summary

13.4.4. Recent developments

13.5. Chasing Innovation

13.5.1. Company details

13.5.2. Financial outlook

13.5.3. Product summary

13.5.4. Recent developments

13.6. Delair SAS

13.6.1. Company details

13.6.2. Financial outlook

13.6.3. Product summary

13.6.4. Recent developments

13.7. Drone Corporation

13.7.1. Company details

13.7.2. Financial outlook

13.7.3. Product summary

13.7.4. Recent developments

13.8. DroneDeploy, Inc.

13.8.1. Company details

13.8.2. Financial outlook

13.8.3. Product summary

13.8.4. Recent developments

13.9. Gannet

13.9.1. Company details

13.9.2. Financial outlook

13.9.3. Product summary

13.9.4. Recent developments

13.10. Guardian Agriculture, Inc.

13.10.1. Company details

13.10.2. Financial outlook

13.10.3. Product summary

13.10.4. Recent developments

13.11. Others

14. Conclusion

15. List of Abbreviations

16. Reference Links