Beer Kegs Market Introduction and Overview

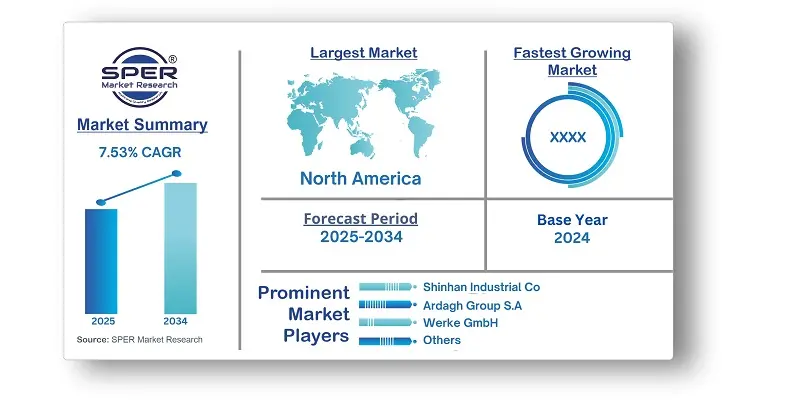

According to SPER Market Research, the Global Beer Kegs Market is estimated to reach USD 158.68 million by 2034 with a CAGR of 7.53%.

The report includes an in-depth analysis of the Global Beer Kegs Market, including market size and trends, product mix, Applications, and supplier analysis. Rising beer consumption worldwide, particularly among millennials, an increase in disposable income levels, an increase in demand for premium category flavored beers, and increased accessibility and availability of beers through multiple offline channels and online platforms are some of the key drivers of market growth. This expansion can be linked to the thriving beer industry, increasing customer preference for draft beer in a variety of locations such as pubs, restaurants, and events, as well as the growing popularity of craft breweries that rely largely on kegs for distribution and dispensing operations. The beer kegs industry is likely to develop and innovate in the next years, driven by increased demand for draft beer and the worldwide beer culture.

By Material Insights: The beer kegs market is divided into two types based on material, steel and plastic. The Steel category dominates, as steel kegs increased acceptance is ascribed to attributes such as their ability to be recycled, durability, and improved aid in retaining the original flavour and freshness of the beer stored in them. These qualities make it suitable for shipping and storage, as well as blocking critical gasses and reducing the risk of contamination. Furthermore, stainless steel kegs are less expensive and last longer, resulting in a higher return on investment.

By Capacity Insights: In the beer kegs market, the Capacity segment is divided into less than 20 litres, 20-40 litres, 40-60 litres, above 60 litres categories. The 20-40 litres kegs segment is dominant, as this style of keg is primarily intended for home brewing, in-house dispensing systems, and bar beer distribution. These kegs can be easily stored in kegerators, coolers, or regular household refrigerators. Furthermore, 20-40L stainless steel beer kegs have a thin design that facilitates everyday consumption and ensures optimal reliability. This segment's growth is expected to be driven by increased beer consumption through beer cafés and shifting customer behaviour patterns.

By Application Insights: In the beer kegs market, the application segment includes Commercial and Residential application. Commercial segment is currently dominating due to they are a cost-effective and efficient way to transport and store beer when produced in large quantities in industries. Additionally, kegs are available in a variety of sizes, styles, and materials, making them suitable for their intended application. Commercial barrel kegs include sixth barrel kegs, half barrel kegs, euro kegs, DIN kegs, and so on. It is critical to maintain the flavor, freshness, and quality of beer, thus industries must carefully look for appropriate kegs, which will result in advancements in keg materials.

By Region Insights: The European beer keg market dominated the global business, accounting for the largest revenue share. This is ascribed to increased beer consumption in the region, continual lifestyle changes, the existence of significant industrial businesses operating in the region, and ease of access. Furthermore, microbreweries are gaining popularity due to their distinct flavour and capacity to manufacture a wide range of products on a smaller scale. This has fueled the proliferation of beer kegs delivered in specific sizes.

Market Competitive Landscape:

American Keg Company (BLEFA GmbH), Ara Partners (Petainer Ltd), Ardagh Group S.A, Blefa GmbH, Julius Kleemann GmbH & Co. KG, NDL Keg Inc, Ningbo BestFriends Beverage Containers Co. Ltd, SCHÄFER Werke GmbH, Shinhan Industrial Co, Ltd, and The Metal Drum Company.

Recent Developments:

- April 2024, The worldwide business section of MicroStar Logistics, Kegstar, has begun construction of its new flagship quality service center. The 15,000-square-foot facility is located in Milton Keynes, United Kingdom. With the help of this facility, the thriving beer keg market in the European region is expected to meet its sustainability targets quickly in the coming years.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Material, By Capacity, By Application. |

| Regions covered | North America, Asia-Pacific, Latin America, Middle East & Africa and Europe. |

| Companies Covered | American Keg Company (BLEFA GmbH), Ara Partners (Petainer Ltd), Ardagh Group S.A, Blefa GmbH, Julius Kleemann GmbH & Co. KG, NDL Keg Inc, Ningbo BestFriends Beverage Containers Co. Ltd, SCHÄFER Werke GmbH, Shinhan Industrial Co, Ltd, The Metal Drum Company. and other. |

Key Topics Covered in the Report:

- Global Beer Kegs Market Size (FY’2021-FY’2034)

- Overview of Global Beer Kegs Market

- Segmentation of Global Beer Kegs Market By Material (Steel, Plastic)

- Segmentation of Global Beer Kegs Market, By Capacity (Less than 20 litres, 20-40 litres, 40-60 litres, above 60 litres)

- Segmentation of Global Beer Kegs Market, By Application (Commercial, Residential)

- Statistical Snap of Global Beer Kegs Market

- Expansion Analysis of Global Beer Kegs Market

- Problems and Obstacles in Global Beer Kegs Market

- Competitive Landscape in the Global Beer Kegs Market

- Details on Current Investment in Global Beer Kegs Market

- Competitive Analysis of Global Beer Kegs Market

- Prominent Players in the Global Beer Kegs Market

- SWOT Analysis of Global Beer Kegs Market

- Global Beer Kegs Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Beer Kegs Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Beer Kegs Market

7. Global Beer Kegs Market, By Material (USD Million) 2021-2034

7.1. Steel

7.2. Plastics

7.3. Others

8. Global Beer Kegs Market, By Capacity (USD Million) 2021-2034

8.1. Less than 20 Litres

8.2. 20-40 Litres

8.3. 40-60 Litres

8.4. Above 60 Litres

9. Global Beer Kegs Market, By Application (USD Million) 2021-2034

9.1. Commercial

9.2. Residential

10. Global Beer Kegs Market, (USD Million) 2021-2034

10.1. Global Beer Kegs Market Size and Market Share

11. Global Beer Kegs Market, By Region, (USD Million) 2021-2034

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. American Keg Company (BLEFA GmbH)

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. Ara Partners (Petainer Ltd)

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. Ardagh Group S.A

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. Blefa GmbH

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. Julius Kleemann GmbH & Co. KG

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. NDL Keg Inc

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. Brook Inc

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. Ningbo BestFriends Beverage Containers Co. Ltd

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. SCHAFER Werke GmbH

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. Shinhan Industrial Co, Ltd

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. The Metal Drum Company.

12.11.1. Company details

12.11.2. Financial outlook

12.11.3. Product summary

12.11.4. Recent developments

12.12. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links