Beverage Cans Market Introduction and Overview

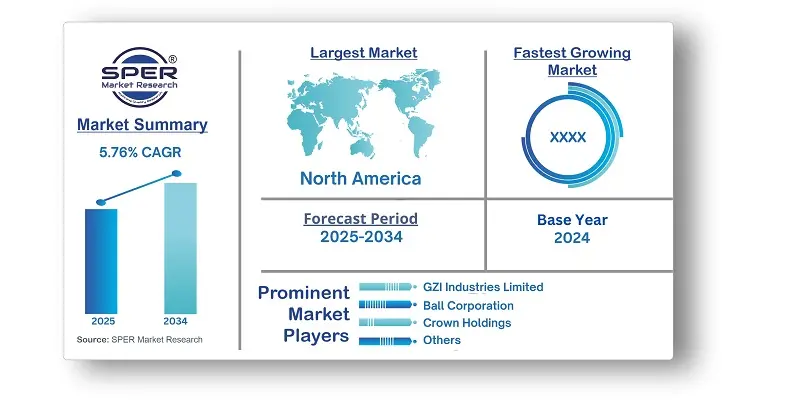

According to SPER Market Research, the Global Beverage Cans Market is estimated to reach USD 41.14 billion by 2034 with a CAGR of 5.76%.

The report includes an in-depth analysis of the Global Beverage Cans Market, including market size and trends, product mix, Applications, and supplier analysis. Global consumption of carbonated soft drinks, beer, and cider is expanding, fuelling demand for beverage cans. Furthermore, the high recycling rate of aluminium cans and the superior physical qualities of metals over their alternatives are projected to boost the growth of the beverage cans market throughout the forecast period. Beverage cans provide outstanding convenience and mobility, making them an appealing option for on-the-go consumption. Furthermore, as consumers and businesses grow more environmentally conscious, the recyclability of beverage cans has emerged as an important driving force. However, the market faces constraints such as rising raw material costs and competition from other packaging solutions such as plastic bottles and cartons.

By Material Insights: The beverage cans market is divided into two materials, aluminium and steel. The Aluminium material dominates, as Aluminium has been a popular raw material for beverage packaging due to its ease of cooling and heating for sterilization, as well as its ability to maintain the structure and integrity of packaged products.

By Application Insights: In the beverage cans market, the application segment is divided into carbonated soft drinks, alcoholic beverages, fruits & vegetables juices, others. The alcoholic beverages segment is dominant, due to rising demand for alcoholic beverages among millennials, an increase in disposable income, and an increase in consumer desire for premium/high-quality alcoholic beverage products.

By Region Insights: The beverage cans market in North America had the highest revenue share, hence dominating the market. This favourable outlook can be ascribed to the increased consumption of canned beverages during Major League Baseball games and other sports events in the region, which, due to their portability, is likely to boost market growth throughout the projection period.

Market Competitive Landscape:

Product innovation is key for companies to meet the rising demand for metal cans. Firms are creating cans with new designs that connect with customers at the point of sale to boost market visibility. Partnerships with beverage makers and expanding capacity are strategies used to enhance global reach and stay competitive. Ball Corporation has thrived by partnering with companies like Coca-Cola and Dr. Pepper. Key market players are Ardagh Group S.A, Ball Corporation, Bangkok Can Manufacturing, CANPACK, CPMC Holdings Limited, Crown Holdings, Inc, Envases Group, GZI Industries Limited, Kian Joo Can Factory Berhad, Mahmood Saeed Can and End Industry Company Limited (MSCANCO), Nampak Ltd, Olayan Group, Orora Packaging Australia Pty. Ltd, SWAN Industries (Thailand) Company Limited, Toyo Seikan Co., Ltd.

Recent Developments:

- January 2024: NOMOQ, a pioneer and leading manufacturer of digitally printed cans in Europe, has introduced a Blank Cans Service for European beverage brands. This new offering includes blank (undecorated) aluminum beverage cans, broadening NOMOQ's product offerings outside its core business of digitally printed cans. This project is designed to give European drink brands more flexibility and customisation options, allowing them to develop distinctive and personalized packaging solutions for their products.

- June 2023: At the BevNET Live Summer 2023 event, Ball Corporation showed off their latest aluminum can and bottle portfolio. This showcase featured new supply sites for 6.8 oz, 8.4 oz, and 250 mL can sizes, as well as their signature Alumi-Tek aluminum bottles. In addition, the company sponsored the BevNET Live Official Happy Hour during the event, enabling guests to learn about the latest beverage packaging innovations.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Material, By Application. |

| Regions covered | North America, Asia-Pacific, Latin America, Middle East & Africa and Europe. |

| Companies Covered | Ardagh Group S.A, Ball Corporation, Bangkok Can Manufacturing, CANPACK, CPMC Holdings Limited, Crown Holdings, Inc, Envases Group, GZI Industries Limited, Kian Joo Can Factory Berhad, Mahmood Saeed Can and End Industry Company Limited (MSCANCO), Nampak Ltd, Olayan Group, Orora Packaging Australia Pty. Ltd, SWAN Industries, Toyo Seikan Co., Ltd. and others. |

Key Topics Covered in the Report:

- Global Beverage Cans Market Size (FY’2021-FY’2034)

- Overview of Global Beverage Cans Market

- Segmentation of Global Beverage Cans Market By Material (Aluminium, Steel)

- Segmentation of Global Beverage Cans Market, By Application (Carbonated Soft Drinks, Alcoholic Beverages, Fruits & Vegetables Juices, Others)

- Statistical Snap of Global Beverage Cans Market

- Expansion Analysis of Global Beverage Cans Market

- Problems and Obstacles in Global Beverage Cans Market

- Competitive Landscape in the Global Beverage Cans Market

- Details on Current Investment in Global Beverage Cans Market

- Competitive Analysis of Global Beverage Cans Market

- Prominent Players in the Global Beverage Cans Market

- SWOT Analysis of Global Beverage Cans Market

- Global Beverage Cans Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Beverage Cans Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Beverage Cans Market

7. Global Beverage Cans Market, By Material (USD Million) 2021-2034

7.1. Aluminium

7.2. Steel

8. Global Beverage Cans Market, By Application (USD Million) 2021-2034

8.1. Carbonated Soft Drinks

8.2. Alcoholic Beverages

8.3. Fruits & Vegetables Juices

8.4. Other Applications

9. Global Beverage Cans Market, (USD Million) 2021-2034

9.1. Global Beverage Cans Market Size and Market Share

10. Global Beverage Cans Market, By Region, (USD Million) 2021-2034

10.1. Asia-Pacific

10.1.1. Australia

10.1.2. China

10.1.3. India

10.1.4. Japan

10.1.5. South Korea

10.1.6. Rest of Asia-Pacific

10.2. Europe

10.2.1. France

10.2.2. Germany

10.2.3. Italy

10.2.4. Spain

10.2.5. United Kingdom

10.2.6. Rest of Europe

10.3. Middle East and Africa

10.3.1. Kingdom of Saudi Arabia

10.3.2. United Arab Emirates

10.3.3. Qatar

10.3.4. South Africa

10.3.5. Egypt

10.3.6. Morocco

10.3.7. Nigeria

10.3.8. Rest of Middle-East and Africa

10.4. North America

10.4.1. Canada

10.4.2. Mexico

10.4.3. United States

10.5. Latin America

10.5.1. Argentina

10.5.2. Brazil

10.5.3. Rest of Latin America

11. Company Profile

11.1. Ardagh Group S.A

11.1.1. Company details

11.1.2. Financial outlook

11.1.3. Product summary

11.1.4. Recent developments

11.2. Ball Corporation

11.2.1. Company details

11.2.2. Financial outlook

11.2.3. Product summary

11.2.4. Recent developments

11.3. Bangkok Can Manufacturing

11.3.1. Company details

11.3.2. Financial outlook

11.3.3. Product summary

11.3.4. Recent developments

11.4. CANPACK

11.4.1. Company details

11.4.2. Financial outlook

11.4.3. Product summary

11.4.4. Recent developments

11.5. CPMC Holdings Limited

11.5.1. Company details

11.5.2. Financial outlook

11.5.3. Product summary

11.5.4. Recent developments

11.6. Crown Holdings, Inc

11.6.1. Company details

11.6.2. Financial outlook

11.6.3. Product summary

11.6.4. Recent developments

11.7. Envases Group

11.7.1. Company details

11.7.2. Financial outlook

11.7.3. Product summary

11.7.4. Recent developments

11.8. GZI Industries Limited

11.8.1. Company details

11.8.2. Financial outlook

11.8.3. Product summary

11.8.4. Recent developments

11.9. Kian Joo Can Factory Berhad

11.9.1. Company details

11.9.2. Financial outlook

11.9.3. Product summary

11.9.4. Recent developments

11.10. Mahmood Saeed Can and End Industry Company Limited (MSCANCO)

11.10.1. Company details

11.10.2. Financial outlook

11.10.3. Product summary

11.10.4. Recent developments

11.11. Nampak Ltd

11.11.1. Company details

11.11.2. Financial outlook

11.11.3. Product summary

11.11.4. Recent developments

11.12. Olayan Group

11.12.1. Company details

11.12.2. Financial outlook

11.12.3. Product summary

11.12.4. Recent developments

11.13. Orora Packaging Australia Pty. Ltd

11.13.1. Company details

11.13.2. Financial outlook

11.13.3. Product summary

11.13.4. Recent developments

11.14. SWAN Industries (Thailand) Company Limited

11.14.1. Company details

11.14.2. Financial outlook

11.14.3. Product summary

11.14.4. Recent developments

11.15. Toyo Seikan Co., Ltd

11.15.1. Company details

11.15.2. Financial outlook

11.15.3. Product summary

11.15.4. Recent developments

11.16. Others

12. Conclusion

13. List of Abbreviations

14. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.