Food Glazing Agents Market Introduction and Overview

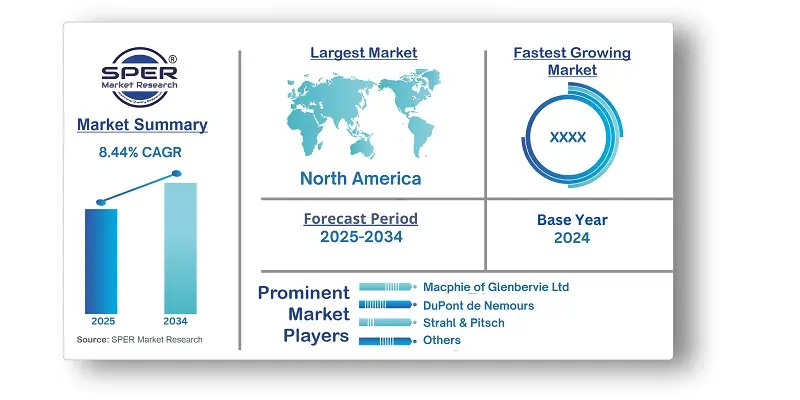

According to SPER Market Research, the Global Food Glazing Agents Market is estimated to reach USD 10.8 billion by 2034 with a CAGR of 8.44%.

The report includes an in-depth analysis of the Global Food Glazing Agents Market, including market size and trends, product mix, Applications, and supplier analysis. The market growth can be attributable to the growing popularity of bakery and confectionery items. As customers seek visually appealing food products, the market for food glazing agents is likely to grow. These glazing ingredients improve the appearance, texture, and shelf life of baked goods, chocolates, and other sweet delicacies by providing a glossy finish to savoury foods. Another important market driver is rising use of processed foods. Food glazing agents serve a variety of purposes, including improving flavor, texture, and shelf life. The market's expansion is also due to increased urbanization and more disposable income among customers in various countries. These compounds are essential in producing a protective barrier for food goods.

By Ingredient Insights: The food glazing agents market is divided into following types, Stearic Acid, Beeswax, Carnauba Wax, Candelilla Wax, Shellac, Paraffin Wax. The Carnauba Wax dominates, owing to its dependability and environmentally beneficial features. Its stiff, white structure makes it extremely durable, with a high melting point and resilience to both heat and moisture. This type of wax is often used in confectionery, baked products, and chewing gum, giving them a glossy sheen that attracts customers and so drives market expansion.

By Function Insights: In the food glazing agents market, this segment is divided as follows, coating agents, surface-finishing agent, firming agents, film formers. The Coating Agents are dominant, due to their capacity to enhance the visual attractiveness of food products. These compounds work as sea sealants, reducing moisture loss and oil retention. They improve food structure and prevent cracking, discolouration, and spoiling. As shelf life and freshness remain popular among packaged food customers, manufacturers rely on coating chemicals to ensure product quality.

By Application Insights: In the food glazing agents market, the application segment includes Bakery, confectionery, processed meat, poultry, & fish, functional food. Confectionery products are currently dominating the market due to rising consumer demand for confectionery products such as chocolates, candies, and other sweet delights that significantly rely on glazing agents. These compounds add shine, minimize moisture loss, and improve visual appeal, making confectionary products more appealing to consumers.

By Region Insights: The Europe food glazing agents market is dominating with the largest share due to the expansion of the food additives sector, which was driven by higher consumption of processed foods. Furthermore, the region's preference for confectionary and bakery products has spurred demand for glazing agents, which improve the visual appeal and texture of baked goods, chocolates, and other delicacies.

Market Competitive Landscape:

ADM Corn Processing, Arla Foods Ingredients Group P/S, British Wax Refining Company Limited, Capol GmbH, DuPont de Nemours, Inc, Kerry Group, Macphie of Glenbervie Ltd, Mantrose-Haeuser Co., Inc, Mantrose UK Ltd, Masterol Foods Pty Ltd, Ningbo J&S Botanics Inc, Poth Hille & Co Ltd, Strahl & Pitsch, Inc, Wuhu Deli Foods Co., Ltd, and Zeelandia International B.V.

Recent Developments:

- July 2024: Tate & Lyle completed the CP Kelco acquisition sale to JM Huber for $1.8 billion (cash and shares) in July 2024, its largest acquisition to date. This was done to incorporate CP Kelco's expertise in generating pectin and specialized gums, which are crucial in food glazing agents, thereby expanding their range. The investment is also intended to strengthen their mouthfeel solution line, which may aid in the development of better-tasting textures and healthier food options.

- October 2023: Mantrose-Haeuser predicted an increase in demand for clean-label raw ingredients in the food industry. To address this gap, they announced the debut of an organic-certified food masking agent aimed at the confectionery and bakery food industries, as this agent is guaranteed to ensure cleanliness with no added artificial chemicals.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Ingredient, By Function, By Application. |

| Regions covered | North America, Asia-Pacific, Latin America, Middle East & Africa and Europe. |

| Companies Covered | ADM Corn Processing, Arla Foods Ingredients Group P/S, British Wax Refining Company Limited, Capol GmbH, DuPont de Nemours, Inc, Kerry Group, Macphie of Glenbervie Ltd, Mantrose-Haeuser Co., Inc, Mantrose UK Ltd, Masterol Foods Pty Ltd, Ningbo J&S Botanics Inc, Poth Hille & Co Ltd, Strahl & Pitsch, Inc, Wuhu Deli Foods Co., Ltd, Zeelandia International B.V. and others. |

Key Topics Covered in the Report:

- Global Food Glazing Agents Market Size (FY’2021-FY’2034)

- Overview of Global Food Glazing Agents Market

- Segmentation of Global Food Glazing Agents Market By Ingredient (Stearic Acid, Beeswax, Carnauba Wax, Candelilla Wax, Shellac, Paraffin Wax)

- Segmentation of Global Food Glazing Agents Market, By Function (Coating Agent, Surface-Finishing Agents, Firming Agents, Film Formers)

- Segmentation of Global Food Glazing Agents Market, By Application (Bakery, Confectionery, Processed Meat, Poultry, & Fish, Functional Foods)

- Statistical Snap of Global Food Glazing Agents Market

- Expansion Analysis of Global Food Glazing Agents Market

- Problems and Obstacles in Global Food Glazing Agents Market

- Competitive Landscape in the Global Food Glazing Agents Market

- Details on Current Investment in Global Food Glazing Agents Market

- Competitive Analysis of Global Food Glazing Agents Market

- Prominent Players in the Global Food Glazing Agents Market

- SWOT Analysis of Global Food Glazing Agents Market

- Global Food Glazing Agents Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Food Glazing Agents Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Food Glazing Agents Market

7. Global Food Glazing Agents Market, By Ingredient (USD Million) 2021-2034

7.1. Stearic Acid

7.2. Beeswax

7.3. Carnauba Wax

7.4. Candelilla Wax

7.5. Shellac

7.6. Paraffin Wax

7.7. Others

8. Global Food Glazing Agents Market, By Function (USD Million) 2021-2034

8.1. Coating Agent

8.2. Surface-Finishing Agent

8.3. Firming Agents

8.4. Film Formers

8.5. Others

9. Global Food Glazing Agents Market, By Application (USD Million) 2021-2034

9.1. Bakery

9.2. Confectionery

9.3. Processed Meat

9.4. Poultry & Fish

9.5. Functional Foods

9.6. Others

10. Global Food Glazing Agents Market, (USD Million) 2021-2034

10.1. Global Food Glazing Agents Market Size and Market Share

11. Global Food Glazing Agents Market, By Region, (USD Million) 2021-2034

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. ADM Corn Processing

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. Arla Foods Ingredients Group P/S

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. British Wax Refining Company Limited

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. Capol GmbH

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. DuPont de Nemours, Inc

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. Kerry Group

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. Macphie of Glenbervie Ltd

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. Mantrose-Haeuser Co., Inc

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. Mantrose UK Ltd

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. Masterol Foods Pty Ltd

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. Ningbo J&S Botanics Inc

12.11.1. Company details

12.11.2. Financial outlook

12.11.3. Product summary

12.11.4. Recent developments

12.12. Poth Hille & Co Ltd

12.12.1. Company details

12.12.2. Financial outlook

12.12.3. Product summary

12.12.4. Recent developments

12.13. Strahl & Pitsch, Inc

12.13.1. Company details

12.13.2. Financial outlook

12.13.3. Product summary

12.13.4. Recent developments

12.14. Wuhu Deli Foods Co., Ltd

12.14.1. Company details

12.14.2. Financial outlook

12.14.3. Product summary

12.14.4. Recent developments

12.15. Zeelandia International B.V

12.15.1. Company details

12.15.2. Financial outlook

12.15.3. Product summary

12.15.4. Recent developments

12.16. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links