Fortified Dairy Products Market Introduction and Overview

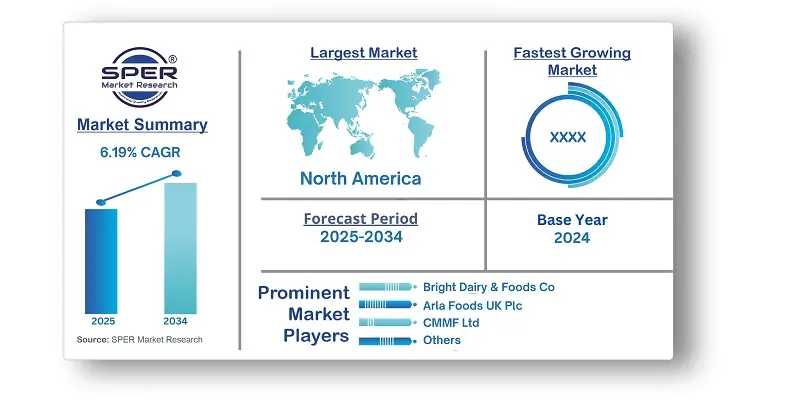

According to SPER Market Research, the Global Fortified Dairy Products Market is estimated to reach USD 227.18 billion by 2034 with a CAGR of 6.19%.

The report includes an in-depth analysis of the Global Fortified Dairy Products Market, including market size and trends, Interface mix, Applications, and supplier analysis. Fortified dairy products are milk-based foods and beverages enriched with essential vitamins and minerals, such as vitamin D, calcium, iron, and probiotics, to enhance their nutritional value. These products are gaining popularity due to increasing consumer awareness of health and wellness, rising cases of nutrient deficiencies, and growing demand for functional foods. Market growth is driven by urbanization, changing dietary habits, and government initiatives promoting fortified foods to combat malnutrition. However, challenges such as high production costs, limited consumer awareness in developing regions, and regulatory complexities hinder market expansion. Additionally, concerns over taste alterations, shelf life, and lactose intolerance further impact the adoption of fortified dairy products in various global markets.

By Product Insights: Based on Product the market is divided into five segments: Milk, Yogurt, Cheese, Ice Cream and Others. In 2024, the milk sector dominated the market. Customers are increasingly looking for products with extra nutritional benefits, such vitamins and minerals, which fortified milk offers, as their health consciousness grows. Consumers are searching for preventative dietary solutions as health problems like osteoporosis and vitamin D deficits become more common. Furthermore, parents are increasingly conscious of the role that nutrition plays in their kids' growth and frequently select fortified milk to guarantee that their kids get the nutrients they need.

By Ingredient Insights: Based on Ingredient the market is divided into six segments: Vitamins, Minerals, Probiotics, Omega-3 Fatty Acids, Proteins and Others. Due to rising consumer awareness of nutrition and health, the vitamins category led the market by ingredient in 2024. Consumers are looking for goods that offer extra health advantages, such dairy products enhanced with vitamins D, A, and B12, which promote bone health and immune function. Additionally, vitamin deficiencies are becoming more common, and the associated health problems are driving the market's expansion. Fortification technological advancements also make it simpler to add vitamins to dairy products without compromising their quality or flavor.

By Flavor Insights: Based on Flavor the market is divided into two segments: Unflavored/Natural and Flavored. In 2024, the unflavored/natural segment dominated the market based on flavor. A pure, adaptable base provided by unflavored fortified dairy products gives cooks and meal preppers more freedom. Additionally, interest in dairy products fortified with vital nutrients without additional tastes or sweets is growing as more people become aware of the advantages of sticking to a natural diet. This demand is also influenced by growing dietary sensitivities and preferences for less processed goods.

By Distribution Channel Insights: Based on Distribution Channel the market is divided into five segments: Hypermarkets & Supermarkets, Convenience Stores, Specialty Stores, Online and Others. In 2024, the hypermarkets & supermarkets segment dominated the market based on distribution channel. Customers may more easily access and select from a variety of options thanks to the large selection of fortified dairy products offered by these retail channels. Supermarkets and hypermarkets draw in budget-conscious customers with their aggressive pricing and promotions, which boost sales. The health advantages of fortified dairy products are also frequently highlighted in these businesses' eye-catching displays and marketing tactics. Supermarkets and hypermarkets' wide reach and heavy foot traffic also help to raise consumer awareness and product visibility.

By Regional Insights: In 2024, the North American market dominated the market for fortified dairy products. Health and wellbeing are becoming more and more important, and consumers are looking for items that provide extra nutritional advantages such vitamins and minerals. The International Dairy Foods Association claims that the region's dairy business is expanding due to growing customer interest in health-conscious dairy products. Furthermore, people in North America are growing increasingly conscious of the advantages of fortified dairy in correcting inadequacies and promoting general health.

Market Competitive Landscape:

The market for Fortified Dairy Products is very competitive. The market features a mix of heritage brands, mainstream footwear companies, and niche sustainable startups. Some of the prominent players in Global Fortified Dairy Products Market are Arla Foods UK Plc., BASF SE., Bright Dairy & Foods Co., China Modern Dairy Holdings Ltd., CMMF Ltd., Danone, Dean Foods Company, Fonterra Group Cooperative Ltd., General Mills Inc., Nestle S.A.

Recent Developments:

- In June 2024, Galaxy Foods, a Tanzanian dairy and nondairy product manufacturer has unveiled a new fortified yogurt under the name "Kilimanjaro Fresh." Promaco provided value-enhancing ingredients for this yogurt, which was created with product innovation support from Arla Foods Ingredients. With an emphasis on helping children, the product is made to give low-income families access to vital nutrients.

- In January 2024, Yoplait introduced Yoplait Protein, a dairy snack with 3g of sugar and 15g of protein per serving. The product ensures a smooth texture without the sour taste typically associated with high-protein yogurts by combining standard yogurt fermentation with ultra-filtered milk.

- In May 2023, Aavin, a prominent state-run cooperative in India recognized for large-scale manufacture of pasteurized skimmed milk has developed a new enriched milk product in a purple sachet. In the past, Aavin sold its milk in sachets that were green, orange, and blue, each of which represented a particular processing technique and price range. The purple sachet, which has its own distinct processing procedure and pricing structure, is an addition to their product line.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Product, By Ingredient, By Flavor, By Distribution Channel. |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa. |

| Companies Covered | Arla Foods UK Plc., BASF SE., Bright Dairy & Foods Co., China Modern Dairy Holdings Ltd., CMMF Ltd., Danone, Dean Foods Company, Fonterra Group Cooperative Ltd., General Mills Inc., Nestle S. A and others. |

Key Topics Covered in the Report:

- Global Fortified Dairy Products Market Size (FY’2021-FY’2034)

- Overview of Global Fortified Dairy Products Market

- Segmentation of Global Fortified Dairy Products Market By Product (Milk, Yogurt, Cheese, Ice Cream and Others)

- Segmentation of Global Fortified Dairy Products Market By Ingredient (Vitamins, Minerals, Probiotics, Omega-3 Fatty Acids, Proteins and Others)

- Segmentation of Global Fortified Dairy Products Market By Flavor (Unflavored/Natural and Flavored)

- Segmentation of Global Fortified Dairy Products Market By Distribution Channel (Hypermarkets & Supermarkets, Convenience Stores, Specialty Stores, Online and Others)

- Statistical Snap of Global Fortified Dairy Products Market

- Expansion Analysis of Global Fortified Dairy Products Market

- Problems and Obstacles in Global Fortified Dairy Products Market

- Competitive Landscape in the Global Fortified Dairy Products Market

- Details on Current Investment in Global Fortified Dairy Products Market

- Competitive Analysis of Global Fortified Dairy Products Market

- Prominent Players in the Global Fortified Dairy Products Market

- SWOT Analysis of Global Fortified Dairy Products Market

- Global Fortified Dairy Products Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Fortified Dairy Products Market Manufacturing Base Distribution, Sales Area, Interface Type

6.2. Mergers & Acquisitions, Partnerships, Interface Launch, and Collaboration in Global Fortified Dairy Products Market

7. Global Fortified Dairy Products Market, By Product (USD Million) 2021-2034

7.1. Milk

7.2. Yogurt

7.3. Cheese

7.4. Ice Cream

7.5. Others

8. Global Fortified Dairy Products Market, By Ingredient (USD Million) 2021-2034

8.1. Vitamins

8.2. Minerals

8.3. Probiotics

8.4. Omega-3 Fatty Acids

8.5. Proteins

8.6. Others

9. Global Fortified Dairy Products Market, By Flavor (USD Million) 2021-2034

9.1. Unflavored/Natural

9.2. Flavored

10. Global Fortified Dairy Products Market, By Distribution Channel (USD Million) 2021-2034

10.1. Hypermarkets & Supermarkets

10.2. Convenience Stores

10.3. Specialty Stores

10.4. Online

10.5. Others

11. Global Fortified Dairy Products Market, (USD Million) 2021-2034

11.1. Global Fortified Dairy Products Market Size and Market Share

12. Global Fortified Dairy Products Market, By Region, (USD Million) 2021-2034

12.1. Asia-Pacific

12.1.1. Australia

12.1.2. China

12.1.3. India

12.1.4. Japan

12.1.5. South Korea

12.1.6. Rest of Asia-Pacific

12.2. Europe

12.2.1. France

12.2.2. Germany

12.2.3. Italy

12.2.4. Spain

12.2.5. United Kingdom

12.2.6. Rest of Europe

12.3. Middle East and Africa

12.3.1. Kingdom of Saudi Arabia

12.3.2. United Arab Emirates

12.3.3. Qatar

12.3.4. South Africa

12.3.5. Egypt

12.3.6. Morocco

12.3.7. Nigeria

12.3.8. Rest of Middle-East and Africa

12.4. North America

12.4.1. Canada

12.4.2. Mexico

12.4.3. United States

12.5. Latin America

12.5.1. Argentina

12.5.2. Brazil

12.5.3. Rest of Latin America

13. Company Profile

13.1. Arla Foods UK Plc.

13.1.1. Company details

13.1.2. Financial outlook

13.1.3. Interface summary

13.1.4. Recent developments

13.2. BASF SE

13.2.1. Company details

13.2.2. Financial outlook

13.2.3. Interface summary

13.2.4. Recent developments

13.3. Bright Dairy & Foods Co.

13.3.1. Company details

13.3.2. Financial outlook

13.3.3. Interface summary

13.3.4. Recent developments

13.4. China Modern Dairy Holdings Ltd.

13.4.1. Company details

13.4.2. Financial outlook

13.4.3. Interface summary

13.4.4. Recent developments

13.5. CMMF Ltd.

13.5.1. Company details

13.5.2. Financial outlook

13.5.3. Interface summary

13.5.4. Recent developments

13.6. Danone

13.6.1. Company details

13.6.2. Financial outlook

13.6.3. Interface summary

13.6.4. Recent developments

13.7. Dean Foods Company

13.7.1. Company details

13.7.2. Financial outlook

13.7.3. Interface summary

13.7.4. Recent developments

13.8. Fonterra Group Cooperative Ltd.

13.8.1. Company details

13.8.2. Financial outlook

13.8.3. Interface summary

13.8.4. Recent developments

13.9. General Mills Inc.

13.9.1. Company details

13.9.2. Financial outlook

13.9.3. Interface summary

13.9.4. Recent developments

13.10. Nestle S.A

13.10.1. Company details

13.10.2. Financial outlook

13.10.3. Interface summary

13.10.4. Recent developments

14. Conclusion

15. List of Abbreviations

16. Reference Links