Kitchen Appliances Market Introduction and Overview

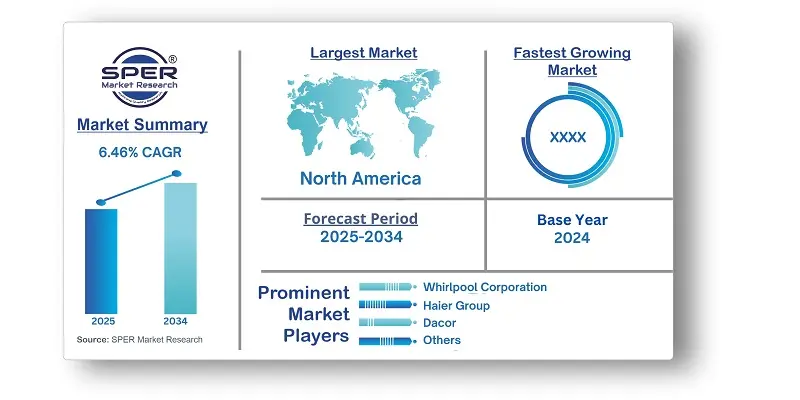

According to SPER Market Research, the Global Kitchen Appliances Market is estimated to reach USD 547.7 billion by 2034 with a CAGR of 6.46%.

Kitchen Appliances Market size was valued at USD 292.87 billion in 2024 and is expected to grow at a rate of 6.46% from 2025 to 2034. Changes in consumer lifestyles are a major reason for this growth. After COVID-19, people began to focus more on health and wellness, increasing the demand for appliances like blenders, juicers, and food processors. Additionally, busy lifestyles have led consumers to prefer convenient appliances like coffee makers, dishwashers, ovens, and toasters, which save time and support health goals.

- In April 2024, Samsung introduced its latest home appliance lineup with improved connectivity and AI features at the Welcome to BESPOKE AI’ Global Launch Event. These appliances include built-in Wi-Fi, internal cameras, and compatibility with the SmartThings app.

- In February 2023, Electrolux expanded its appliance range by adding built-in appliances in India. This new range features microwaves, stoves, burners, cooker caps, dishwashers, and coffee machines. Electrolux appliances include an Eco program for saving water and energy, pre-programmed meal settings, and a steamy mode for cooking food while keeping nutrients and moisture. They also provide conventional cooking options and fan-assisted cooking.

- In December 2022, V-Guard acquired Sunflame Enterprises Private Ltd (SEPL) to strengthen its position in the domestic market. SEPL operates under the Sunflame brand throughout India. This milestone aims to improve consumer engagement with innovative products as V-Guard seeks to lead in the Indian kitchen appliances sector.

By Product Insights:

The market is divided by product into refrigerators, cooking appliances, dishwashers, range hoods, and others. Refrigerators had the highest revenue share in 2024. This growth is due to the rising need for food storage and the replacement of old products with new advanced ones.

By Technology Insights: The market is divided into conventional and smart appliances based on technology. The conventional segment had the largest revenue share in 2024. Many consumers prefer conventional appliances for their familiarity and ease of use. Their lower cost compared to advanced appliances also makes them accessible to consumers, especially those on a budget.

By Application Insights: The market is separated into commercial and residential segments based on application. The residential segment had the largest revenue share in 2024. The growing global population and urbanization have increased residential construction and housing projects, boosting demand for modern and efficient kitchen appliances as people move into new homes or renovate.

By Region Insights: North America emerged as the leading region, generating significant revenue. Its dominance is due to a large consumer base with higher disposable income, leading to investments in high-end kitchen appliances known for efficiency and convenience. Established market players like Haier Group, GE Appliances, and Whirlpool Corporation have strong reputations and invest in research and development to meet changing consumer demands and stay competitive.

Market Competitive Landscape:

The kitchen appliances sector is fragmented, with key firms such as Electrolux AB, LG Electronics, Samsung Electronics, Robert Bosch GmbH, and Whirlpool Corporation accounting for 30% of the market. Manufacturers are taking strategic initiatives, such as mergers, acquisitions, partnerships, and collaborations, to address rising customer demand and strengthen their market position.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Product, By Technology, By Application. |

| Regions covered | North America, Asia-Pacific, Latin America, Middle East & Africa and Europe. |

| Companies Covered | AB Electrolux, Dacor, Inc, Haier Group, LG Electronics, Morphy Richards, Panasonic Holdings Corporation, Koninklijke Philips N.V, Whirlpool Corporation, SAMSUNG, Robert Bosch GmbH. and others. |

Key Topics Covered in the Report:

- Global Kitchen Appliances Market Size (FY’2021-FY’2034)

- Overview of Global Kitchen Appliances Market

- Segmentation of Global Kitchen Appliances Market By Product (Refrigerator, Cooking Appliances, Dishwasher, Range Hood, Others)

- Segmentation of Global Kitchen Appliances Market By Technology (Conventional, Smart Appliances)

- Segmentation of Global Kitchen Appliances Market By Application (Commercial, Residential)

- Statistical Snap of Global Kitchen Appliances Market

- Expansion Analysis of Global Kitchen Appliances Market

- Problems and Obstacles in Global Kitchen Appliances Market

- Competitive Landscape in the Global Kitchen Appliances Market

- Details on Current Investment in Global Kitchen Appliances Market

- Competitive Analysis of Global Kitchen Appliances Market

- Prominent Players in the Global Kitchen Appliances Market

- SWOT Analysis of Global Kitchen Appliances Market

- Global Kitchen Appliances Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Kitchen Appliances Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Kitchen Appliances Market

7. Global Kitchen Appliances Market, By Product (USD Million) 2021-2034

7.1. Refrigerator

7.2. Cooking Appliances

7.2.1. Cooktops & Cooking Range

7.2.2. Ovens

7.2.3. Others

7.3. Dishwasher

7.4. Range Hood

7.5. Others

8. Global Kitchen Appliances Market, By Technology (USD Million) 2021-2034

8.1. Conventional

8.2. Smart Appliances

9. Global Kitchen Appliances Market, By Application (USD Million) 2021-2034

9.1. Commercial

9.2. Residential

10. Global Kitchen Appliances Market, (USD Million) 2021-2034

10.1. Global Kitchen Appliances Market Size and Market Share

11. Global Kitchen Appliances Market, By Region, (USD Million) 2021-2034

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. AB Electrolux

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. Dacor, Inc

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. Haier Group

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. LG Electronics

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. Morphy Richards

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. Panasonic Holdings Corporation

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. Koninklijke Philips N.V

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. Whirlpool Corporation

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. SAMSUNG

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. Robert Bosch GmbH

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.