Pickleball Apparel & Equipment Market Introduction and Overview

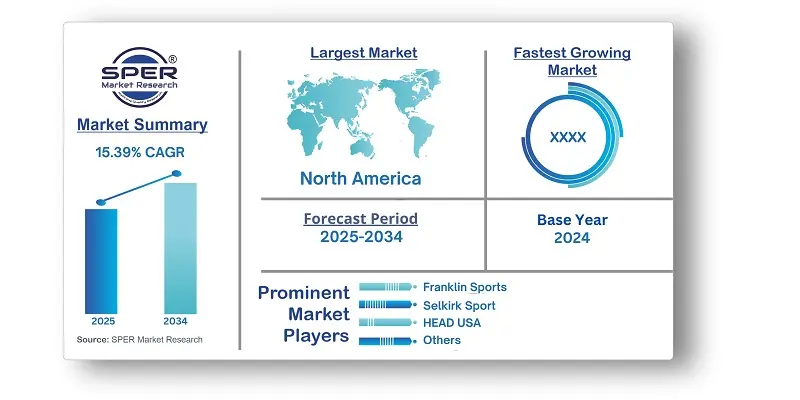

According to SPER Market Research, the Global Pickleball Apparel & Equipment Market is estimated to reach USD 9.56 billion by 2034 with a CAGR of 15.39%.

The report includes an in-depth analysis of the Global Pickleball Apparel & Equipment Market, including market size and trends, product mix, Applications, and supplier analysis. The global pickleball apparel and equipment market is driven by the sport’s rising popularity, increasing participation across all age groups, and growing investments in professional tournaments. Technological advancements in paddle design, lightweight materials, and apparel innovation enhance player performance, further fueling demand. Additionally, endorsements by athletes and expanding e-commerce platforms contribute to market growth. However, challenges such as high equipment costs, limited awareness in certain regions, and competition from other racket sports pose barriers. Supply chain disruptions and fluctuating raw material prices also impact market stability. Despite these challenges, increasing government initiatives and pickleball’s inclusion in community programs create significant opportunities for sustained market expansion.

By Product Insights: In 2024, pickleball equipment had the biggest revenue share. Pickleball's growing appeal has attracted a large number of new players, all of whom must buy some basic equipment in order to get started. Additionally, a lot of schools and community centers are adding pickleball to their curriculum, which results in large purchases of equipment for group play. This will increase demand for and sales of pickleball equipment during the course of the projection period. In order to stay up with the newest fashions and technological developments, players frequently change their equipment, which boosts sales.

By Distribution Channel Insights: In 2024, a portion of revenue came from sales at sporting goods stores. These shops provide a large selection of goods for different sports, such as pickleball-specific equipment. Sales through this channel are boosted by the wide variety offered, which satisfies the various demands and tastes of pickleball aficionados. Sporting goods businesses also offer a customized shopping experience based on the needs of their clients, frequently using skilled employees who provide professional advice and direction on choosing clothing and equipment.

By End User Insights: In 2024, the Male pickleball segment is anticipated to hold the largest market share. In the United States, 43% of women and 57% of men played pickleball, according to the National Sporting Goods Association's 2023 Sports Participation Report. Additionally, the USA Pickleball Association reported that men make up over 60% of its player membership. Throughout the projected period, it is anticipated that the high male participation rate would boost demand and sales for male pickleball gear and apparel.

By Regional Insights: In 2024, the pickleball clothing and equipment market in North America held a global revenue share. The number of pickleball players has significantly increased across all age categories, from young people to older citizens. Its social character, accessibility, and ease of learning are what make it so popular. Additionally, pickleball courts have been added to numerous community centers, leisure centers, and retirement communities, increasing its exposure and participation rates and, consequently, the region's product sales over the forecast period.

Market Competitive Landscape:

Prominent industry participants provide a wide variety of goods, such as paddles, balls, and accessories. Their capacity to satisfy a wide range of customer demands and preferences frequently accounts for their market supremacy. Some of the key market players are Engage Pickleball, LLC, Franklin Sports, Inc., Gamma Sports (Gamma Sports LLC), HEAD USA, Inc. (HEAD Pickleball), Onix Sports, Inc., Paddletek, LLC, Prince Global Sports, LLC.

Recent Developments:

- In June 2024, The AMPED Pro Air, a new pickleball paddle in Selkirk Sport's well-liked lineup, was just released. The paddle's FiberFlex+ Fiberglass Face, which is intended to increase power while maintaining steady performance, is available in five different colors. Furthermore, the paddle features an octagonal grip shape for enhanced comfort and handling, which is crucial for preserving control over extended play.

- In June 2024, The Nano Court, Reebok's first pickleball shoe, was released. The shoe's design places a premium on durability, grip, and stability for sports like tennis, pickleball, and padel. It has Flexweave Pro uppers with zoned stability yarns for tailored support and Reebok's most durable Flexweave knit to date. The shoe also has a 360 Comfort Booty anatomical upper structure for a snug fit and a ToeTection Guard at the toe box for increased durability.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Product, By Distribution Channel, By End User. |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa. |

| Companies Covered | Engage Pickleball, LLC, Franklin Sports, Inc., Gamma Sports (Gamma Sports LLC), HEAD USA, Inc. (HEAD Pickleball), Onix Sports, Inc., Paddletek, LLC, Prince Global Sports, LLC (Prince Pickleball), ProLite Sports, LLC, Selkirk Sport, and Wilson Sporting Goods Co. and others. |

Key Topics Covered in the Report:

- Global Pickleball Apparel & Equipment Market Size (FY’2021-FY’2034)

- Overview of Global Pickleball Apparel & Equipment Market

- Segmentation of Global Pickleball Apparel & Equipment Market By Product (Apparel, Shoes and Equipment)

- Segmentation of Global Pickleball Apparel & Equipment Market By Distribution Channel (Sporting Goods Stores, Hypermarkets & Supermarkets, Exclusive Brand Outlets, Online, Others)

- Segmentation of Global Pickleball Apparel & Equipment Market By End User (Male and Female)

- Statistical Snap of Global Pickleball Apparel & Equipment Market

- Expansion Analysis of Global Pickleball Apparel & Equipment Market

- Problems and Obstacles in Global Pickleball Apparel & Equipment Market

- Competitive Landscape in the Global Pickleball Apparel & Equipment Market

- Details on Current Investment in Global Pickleball Apparel & Equipment Market

- Competitive Analysis of Global Pickleball Apparel & Equipment Market

- Prominent Players in the Global Pickleball Apparel & Equipment Market

- SWOT Analysis of Global Pickleball Apparel & Equipment Market

- Global Pickleball Apparel & Equipment Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Pickleball Apparel & Equipment Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Pickleball Apparel & Equipment Market

7. Global Pickleball Apparel & Equipment Market, By Product (USD Million) 2021-2034

7.1. Apparel

7.1.1. Shirts & Tops

7.1.2. Pants

7.1.3. Shorts & Skorts

7.1.4. Others

7.2. Equipment

7.2.1. Paddles

7.2.2. Balls

7.2.3. Others

7.3. Shoes

8. Global Pickleball Apparel & Equipment Market, By Distribution Channel (USD Million) 2021-2034

8.1. Sporting Goods Stores

8.2. Hypermarkets & Supermarkets

8.3. Exclusive Brand Outlets

8.4. Online

8.5. Others

9. Global Pickleball Apparel & Equipment Market, By End User (USD Million) 2021-2034

9.1. Male

9.2. Female

10. Global Pickleball Apparel & Equipment Market, (USD Million) 2021-2034

10.1. Global Pickleball Apparel & Equipment Market Size and Market Share

11. Global Pickleball Apparel & Equipment Market, By Region, (USD Million) 2021-2034

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. Engage Pickleball, LLC

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. Franklin Sports, Inc.

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. Gamma Sports (Gamma Sports LLC)

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. HEAD USA, Inc. (HEAD Pickleball)

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. Onix Sports, Inc.

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. Paddletek, LLC

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. Prince Global Sports, LLC (Prince Pickleball)

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. ProLite Sports, LLC

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. Selkirk Sport

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. Wilson Sporting Goods Co.

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links