Bioadhesives Market Introduction and Overview

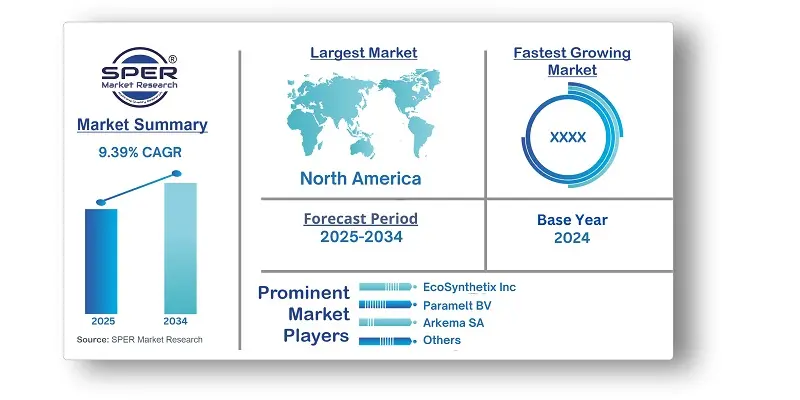

According to SPER Market Research, the Global Bioadhesives Market is estimated to reach USD 12.61 billion by 2034 with a CAGR of 9.39%.

The report includes an in-depth analysis of the Global Bioadhesives Market, including market size and trends, product mix, Applications, and supplier analysis. This growth is driven by advancements in bioadhesive formulations and their enhanced effectiveness. Furthermore, there has been a rise in the development of innovative bioadhesives with superior characteristics. These are available in various types, including naturally occurring polymeric materials with adhesive properties and synthetic substances engineered to bond with biological surfaces. This category also includes glues derived from biological intermediates like cellulose, starch, and gelatin. However, A major challenge in the bioadhesives market growth is strong competition from traditional synthetic adhesives, which are widely used due to their proven reliability, lower cost, and established presence across various industries, offering strong performance, affordability, and versatility.

By Source: Plant-based bioadhesives lead the market due to their popularity, as they are free from petrochemicals and have low formaldehyde emissions. The growing demand for sustainable and eco-friendly solutions has driven the rise of plant-based adhesives, which are made from materials like rubber, lignin, starch, and soy. On the other hand, animal-based bioadhesives are projected to grow at a steady rate. They are primarily used in specific fields like wound care and tissue engineering in healthcare, but their applications are more limited compared to plant-based alternatives. Additionally, animal-based adhesives face potential restrictions in certain industries due to ethical concerns.

By End Use: The paper and packaging sector led the market, accounting for the largest share of revenue in 2024. This sector significantly drives the demand for bioadhesives, as they are used in various packaging materials like specialty packaging, bags, cartons, filters, flexible packaging, disposables, envelopes, foil laminates, labels, cigarettes, and laminating printed sheets. Additionally, adhesive components used in packaging for frozen food and beverages are mineral oil-based, which pose no health risks. The construction segment is expected to experience notable growth in the coming years, with bioadhesives being widely used in the production of wood composites like particleboard and fiberboard, as well as wood products such as furniture, doors, and windows.

By Regional Insights: The North America bioadhesives market led the global market, holding the largest share in 2024. This growth is driven by rising demand across various application sectors, particularly in packaging, paper, and construction. The increasing need for packaging and healthcare solutions continues to fuel market expansion in the region.

Market Competitive Landscape:

The market is moderately consolidated. Some of the market key players are Arkema SA, Ashland Global Holdings Inc, Beardow Adams Group, DuPont De Nemours Inc, eBay Inc., EcoSynthetix Inc, Henkel AG & Company KGaA, Ingredion Incorporated, Jowat SE, Paramelt BV, Tate & Lyle PLC, and others.

Recent Developments:

- H.B. Fuller obtained Beardow Adams, a UK-based manufacturer of industrial glue with clients throughout the world, in May 2023. The acquisition is expected to boost H.B. Fullers market position by expanding its clientele and providing technology and manufacturing capacity across the US and Europe.

- DuPont introduced the DuPont Liveo MG 7-9960 Soft Skin Adhesive in October 2023. Advanced wound care dressings and the sensitive and durable skin-attachment of medical devices are the two applications for this novel glue.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Source, By End Use. |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa. |

| Companies Covered | Arkema SA, Ashland Global Holdings Inc, Beardow Adams Group, DuPont De Nemours Inc, eBay Inc., EcoSynthetix Inc, Henkel AG & Company KGaA, Ingredion Incorporated, Jowat SE, Paramelt BV, Tate & Lyle PLC, and others. |

Key Topics Covered in the Report:

- Global Bioadhesives Market Size (FY’2021-FY’2034)

- Overview of Global Bioadhesives Market

- Segmentation of Global Bioadhesives Market By Source (Plant-based, Animal-based)

- Segmentation of Global Bioadhesives Market By End Use, (Paper & Packaging, Construction, Woodworking, Personal Care & Cosmetics, Medical, Others)

- Statistical Snap of Global Bioadhesives Market

- Expansion Analysis of Global Bioadhesives Market

- Problems and Obstacles in Global Bioadhesives Market

- Competitive Landscape in the Global Bioadhesives Market

- Details on Current Investment in Global Bioadhesives Market

- Competitive Analysis of Global Bioadhesives Market

- Prominent Players in the Global Bioadhesives Market

- SWOT Analysis of Global Bioadhesives Market

- Global Bioadhesives Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Bioadhesives Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Bioadhesives Market

7. Global Bioadhesives Market, By Source (USD Million) 2021-2034

7.1. Plant-based

7.2. Animal-based

8. Global Bioadhesives Market, By End Use, (USD Million) 2021-2034

8.1. Paper & Packaging

8.2. Construction

8.3. Woodworking

8.4. Personal Care & Cosmetics

8.5. Medical

8.6. Others

9. Global Bioadhesives Market, (USD Million) 2021-2034

9.1. Global Bioadhesives Market Size and Market Share

10. Global Bioadhesives Market, By Region, (USD Million) 2021-2034

10.1. Asia-Pacific

10.1.1. Australia

10.1.2. China

10.1.3. India

10.1.4. Japan

10.1.5. South Korea

10.1.6. Rest of Asia-Pacific

10.2. Europe

10.2.1. France

10.2.2. Germany

10.2.3. Italy

10.2.4. Spain

10.2.5. United Kingdom

10.2.6. Rest of Europe

10.3. Middle East and Africa

10.3.1. Kingdom of Saudi Arabia

10.3.2. United Arab Emirates

10.3.3. Qatar

10.3.4. South Africa

10.3.5. Egypt

10.3.6. Morocco

10.3.7. Nigeria

10.3.8. Rest of Middle-East and Africa

10.4. North America

10.4.1. Canada

10.4.2. Mexico

10.4.3. United States

10.5. Latin America

10.5.1. Argentina

10.5.2. Brazil

10.5.3. Rest of Latin America

11. Company Profile

11.1. Arkema SA

11.1.1. Company details

11.1.2. Financial outlook

11.1.3. Product summary

11.1.4. Recent developments

11.2. Ashland Global Holdings Inc

11.2.1. Company details

11.2.2. Financial outlook

11.2.3. Product summary

11.2.4. Recent developments

11.3. Beardow Adams Group

11.3.1. Company details

11.3.2. Financial outlook

11.3.3. Product summary

11.3.4. Recent developments

11.4. DuPont De Nemours Inc

11.4.1. Company details

11.4.2. Financial outlook

11.4.3. Product summary

11.4.4. Recent developments

11.5. eBay Inc.

11.5.1. Company details

11.5.2. Financial outlook

11.5.3. Product summary

11.5.4. Recent developments

11.6. EcoSynthetix Inc

11.6.1. Company details

11.6.2. Financial outlook

11.6.3. Product summary

11.6.4. Recent developments

11.7. Henkel AG & Company KGaA

11.7.1. Company details

11.7.2. Financial outlook

11.7.3. Product summary

11.7.4. Recent developments

11.8. Ingredion Incorporated

11.8.1. Company details

11.8.2. Financial outlook

11.8.3. Product summary

11.8.4. Recent developments

11.9. Jowat SE

11.9.1. Company details

11.9.2. Financial outlook

11.9.3. Product summary

11.9.4. Recent developments

11.10. Paramelt BV

11.10.1. Company details

11.10.2. Financial outlook

11.10.3. Product summary

11.10.4. Recent developments

11.11. Tate & Lyle PLC

11.11.1. Company details

11.11.2. Financial outlook

11.11.3. Product summary

11.11.4. Recent developments

11.12. Others

12. Conclusion

13. List of Abbreviations

14. Reference Links