Packaging Coatings Market Introduction and Overview

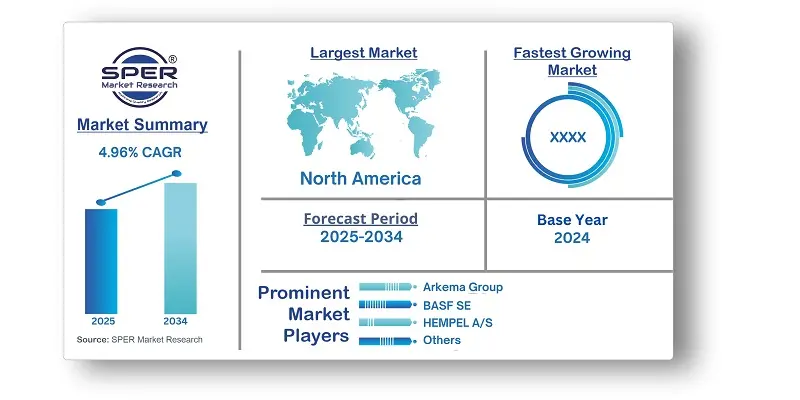

According to SPER Market Research, the Global Packaging Coatings Market is estimated to reach USD 7.2 billion by 2034 with a CAGR of 4.96%.

The primary driving force is the growing demand for flexible packaging coatings. These materials have superior adhesion, durability, and resistance capabilities, making them suitable for a variety of industries, including food and beverage packaging. The advent of online shopping has increased the demand for protective coatings for packing materials to ensure product safety during delivery. Furthermore, rising demand for sustainable packaging solutions has contributed to market growth. Increasing regulations on dangerous chemicals, such as volatile organic compounds (VOCs), have the potential to impact the industry. To comply with these rules, businesses have quickly adopted a variety of environmentally friendly alternatives.

- September, 2023: Sun Chemical has introduced two new stirs in pigment preparations for the coatings market: eXpand Yellow ST 1018 and eXpand Black ST 9005. These pigments have unique qualities for automotive coatings.

- October, 2023: DYRUP paint by PPG created a novel bag in box packaging for their Dyrup Wall Extra Covering paint, which is made from 75% recyclable and biodegradable ingredients.

By Resins: Based on resins, the epoxies segment dominated the market in terms of revenue share.

This segment's large share can be ascribed to another form of resin that is gaining traction on the market. They offer high adhesion, chemical resistance, and durability. Epoxy resins have been used in food packaging to form a protective coating between the food or drink and the metal used to produce cans. This helps to prevent corrosion and keeps the contents safe, fresh, and nutritious.

By Packaging Type: The flexible packaging type segment of the industry is expected to grow at a significant rate. This segment's large share can be due to rigid packaging, which is frequently picked for products requiring strong protection and a higher perceived value. It is widely utilized in high-end beverages, spirits, fragrances, and some cosmetics and wellness goods. Flexible packaging is gaining popularity in the product market since it is less expensive and has a lesser environmental effect than rigid packaging. Flexible pouches, for example, have grown in popularity as food packaging due to their reseal ability, low environmental impact, and low cost.

By End User: Based on end-user, the food and beverage category led the market with the highest revenue share. This segment's significant share can be due to the Food & Beverage industry, which is one of the largest consumers in the global market. Food safety, preservation, and aesthetic appeal are among the elements driving demand for food packaging coatings. Acrylic, epoxie, and polyurethane resins are widely employed in food packaging coatings due to their superior adhesion, chemical resistance, and barrier qualities.

By Region: Asia-Pacific led the packaging coatings industry. This segment's large share can be ascribed to strong demand for packaging coatings in the Asia Pacific region, which is fueled by a number of important factors that contribute to its global supremacy. It is clear from the highest use and demand for packaging coatings. This demand is primarily driven by the growing requirement for flexible packaging coatings, particularly in the food and beverage packaging industry.

Market Competitive Landscape:

The Global Packaging Coatings Market is highly consolidated. Some of the market players are Akzo Nobel NV, Arkema Group, Axalta Coating, BASF SE, Berger Paints India Limited, Chemetall, Chugoku Marine Paints Ltd, DowDuPont, Evonik Industries AG, HEMPEL A/S, Henkel AG & Co. KGaA, Jotun, Kansai Paint Co. Ltd. and others.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Resins, By Packaging Type, By End Use. |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, Middle East & Africa. |

| Companies Covered | Akzo Nobel NV, Arkema Group, Axalta Coating, BASF SE, Berger Paints India Limited, Chemetall, Chugoku Marine Paints Ltd, DowDuPont, Evonik Industries AG, HEMPEL A/S, Henkel AG & Co. KGaA, Jotun, Kansai Paint Co. Ltd. |

Key Topics Covered in the Report:

- Global Packaging Coatings Market Size (FY’2021-FY’2034)

- Overview of Global Packaging Coatings Market

- Segmentation of Global Packaging Coatings Market By Resins (Epoxies, Acrylics, Polyurethane, Polyolefins, Polyester)

- Segmentation of Global Packaging Coatings Market By Packaging Type (Rigid Packaging, Flexible Packaging)

- Segmentation of Global Packaging Coatings Market By End User (Food & Beverages, Cosmetics, Pharmaceuticals, Consumer Electronics)

- Statistical Snap of Global Packaging Coatings Market

- Expansion Analysis of Global Packaging Coatings Market

- Problems and Obstacles in Global Packaging Coatings Market

- Competitive Landscape in the Global Packaging Coatings Market

- Details on Current Investment in Global Packaging Coatings Market

- Competitive Analysis of Global Packaging Coatings Market

- Prominent Players in the Global Packaging Coatings Market

- SWOT Analysis of Global Packaging Coatings Market

- Global Packaging Coatings Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Packaging Coatings Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Packaging Coatings Market

7. Global Packaging Coatings Market, By Resins (USD Million) 2021-2034

7.1. Epoxies

7.2. Acrylics

7.3. Polyurethane

7.4. Polyolefins

7.5. Polyester

8. Global Packaging Coatings Market, By Packaging Type (USD Million) 2021-2034

8.1. Rigid Packaging

8.2. Flexible Packaging

9. Global Packaging Coatings Market, By End User (USD Million) 2021-2034

9.1. Food & Beverages

9.2. Cosmetics

9.3. Pharmaceuticals

9.4. Consumer Electronics

10. Global Packaging Coatings Market Forecast, (USD Million) 2021-2034

10.1. Global Packaging Coatings Market Size and Market Share

11. Global Packaging Coatings Market, By Region, (USD Million) 2021-2034

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. Akzo Nobel NV

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. Arkema Group

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. Axalta Coating

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. BASF SE

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. Berger Paints India Limited

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. Chemetall

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. Chugoku Marine Paints Ltd

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. DowDuPont

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. Evonik Industries AG

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. HEMPEL A/S

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. Henkel AG & Co. KGaA

12.11.1. Company details

12.11.2. Financial outlook

12.11.3. Product summary

12.11.4. Recent developments

12.12. Jotun

12.12.1. Company details

12.12.2. Financial outlook

12.12.3. Product summary

12.12.4. Recent developments

12.13. Kansai Paint Co. Ltd

12.13.1. Company details

12.13.2. Financial outlook

12.13.3. Product summary

12.13.4. Recent developments

12.14. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.