UV-Curable Resins Market Introduction and Overview

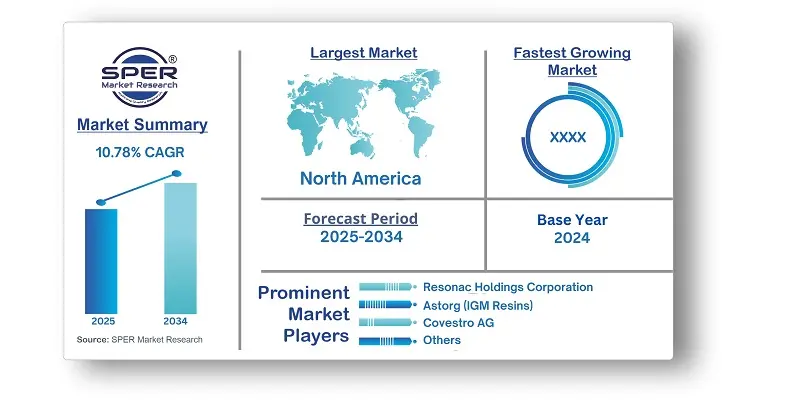

According to SPER Market Research, the Global UV-Curable Resins Market is estimated to reach USD 13.57 billion by 2034 with a CAGR of 10.78%.

The report includes an in-depth analysis of the Global UV-Curable Resins Market, including market size and trends, product mix, Applications, and supplier analysis. The growing emphasis on reducing volatile organic compound (VOC) emissions has driven the demand for ultraviolet (UV) curing technology, which provides an eco-friendly alternative to traditional thermal curing methods. UV-curable resins offer fast curing times and improved chemical resistance, fueling market expansion. Increasing disposable income is encouraging consumers to buy products that enhance both aesthetics and functionality, further boosting the demand for UV-curable coatings. These coatings are commonly used in plastic paints for household items and optical films made from materials like calcium fluoride, UV-fused silica, and sapphire. This leads to greater accessibility, affordability, and ease of fabrication compared to many other UV-transmitting materials. However, Challenges with waterborne UV coatings include grain raising from moisture, leading to uneven surfaces, and the need for proper sanding and humidity control. Additionally, limited substrate compatibility and the requirement for pre-treatments like chemical priming increase complexity and cost in the UV-curing process.

By Product: In 2024, The monomer segment is the leading player in the market, as monomers provide a wide range of functional properties for resin development, tailored to meet specific application needs. Ongoing research to incorporate new monomers into UV resins is improving product performance and broadening their appeal. Additionally, the lower production costs associated with monomers are driving growth in this segment. The photo initiator segment is expected to grow the fastest during the forecast period. Photo initiators enhance curing efficiency by enabling quicker curing, reducing energy consumption, and speeding up production.

By Application: The industrial segment led the market in 2024, driven by the use of UV-curable resins in applications like inks, coatings, sealants, and adhesives. The packaging industry benefits from UV-curable inks and coatings, enabling faster production. The demand for fuel-efficient, lightweight vehicles has also boosted UV-curable resins in 3D printing, coatings, and adhesives. The graphic arts segment is expected to grow significantly, as UV resins improve efficiency, quality, and environmental impact in inks, coatings, and adhesives.

By Regional Insights: The North American UV curable resins market led the industry in 2024, driven by growing environmental concerns pushing businesses to adopt UV-curable resins. In 2024, the U.S. UV curable resins market held a significant share. UV curing provides faster production cycles, immediate curing, and higher output, resulting in less material waste and improved profitability and efficiency. Europe emerged as a promising market for UV curable resins in 2024, fueled by increasing environmental awareness. The demand for eco-friendly products, particularly UV-curable wood coatings with biodegradable features, is driving market growth.

Market Competitive Landscape:

The market is moderately consolidated. Some of the market key players are Arkema Group, Astorg (IGM Resins), BASF SE, Covestro AG, DSM, Geminor, Jiangsu Litian Technology Co., Ltd., Mitsubishi Chemical Europe GmbH (Nippon-Gohsei), Resonac Holdings Corporation, SOLTECH LTD, and TOAGOSEI CO., LTD.

Recent Developments:

- Panacol introduced UV-curable black epoxy resin adhesives in March 2024. There is no requirement for a secondary curing mechanism because they can be cured in thick layers utilizing UV light.

- Sartomer specialty UV/LED curing resins were first produced by Arkema in October 2023. Production at its enlarged site in China has started. In the Asian market, this is anticipated to encourage the development of sustainable solutions for applications like electronics.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Grade, By Carrier Production Process, By Application. |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa. |

| Companies Covered | Arkema Group, Astorg (IGM Resins), BASF SE, Covestro AG, DSM, Geminor, Jiangsu Litian Technology Co., Ltd., Mitsubishi Chemical Europe GmbH (Nippon-Gohsei), Resonac Holdings Corporation, SOLTECH LTD, and TOAGOSEI CO., LTD. and others. |

Key Topics Covered in the Report:

- Global UV-Curable Resins Market Size (FY’2021-FY’2034)

- Overview of Global UV-Curable Resins Market

- Segmentation of Global UV-Curable Resins Market By Product (Monomers, Oligomers, Photo initiators, Others)

- Segmentation of Global UV-Curable Resins Market By Application (Wood Coatings, Graphics Art, Industrial, Automotive, Others)

- Statistical Snap of Global UV-Curable Resins Market

- Expansion Analysis of Global UV-Curable Resins Market

- Problems and Obstacles in Global UV-Curable Resins Market

- Competitive Landscape in the Global UV-Curable Resins Market

- Details on Current Investment in Global UV-Curable Resins Market

- Competitive Analysis of Global UV-Curable Resins Market

- Prominent Players in the Global UV-Curable Resins Market

- SWOT Analysis of Global UV-Curable Resins Market

- Global UV-Curable Resins Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global UV-Curable Resins Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global UV-Curable Resins Market

7. Global UV-Curable Resins Market, By Product, (USD Million) 2021-2034

7.1. Monomers

7.2. Oligomers

7.3. Photo initiators

7.4. Others

8. Global UV-Curable Resins Market, By Application, (USD Million) 2021-2034

8.1. Wood Coatings

8.2. Graphics Art

8.3. Industrial

8.4. Automotive

8.5. Others

9. Global UV-Curable Resins Market, (USD Million) 2021-2034

9.1. Global UV-Curable Resins Market Size and Market Share

10. Global UV-Curable Resins Market, By Region, (USD Million) 2021-2034

10.1. Asia-Pacific

10.1.1. Australia

10.1.2. China

10.1.3. India

10.1.4. Japan

10.1.5. South Korea

10.1.6. Rest of Asia-Pacific

10.2. Europe

10.2.1. France

10.2.2. Germany

10.2.3. Italy

10.2.4. Spain

10.2.5. United Kingdom

10.2.6. Rest of Europe

10.3. Middle East and Africa

10.3.1. Kingdom of Saudi Arabia

10.3.2. United Arab Emirates

10.3.3. Qatar

10.3.4. South Africa

10.3.5. Egypt

10.3.6. Morocco

10.3.7. Nigeria

10.3.8. Rest of Middle-East and Africa

10.4. North America

10.4.1. Canada

10.4.2. Mexico

10.4.3. United States

10.5. Latin America

10.5.1. Argentina

10.5.2. Brazil

10.5.3. Rest of Latin America

11. Company Profile

11.1. Arkema Group

11.1.1. Company details

11.1.2. Financial outlook

11.1.3. Product summary

11.1.4. Recent developments

11.2. Astorg (IGM Resins)

11.2.1. Company details

11.2.2. Financial outlook

11.2.3. Product summary

11.2.4. Recent developments

11.3. BASF SE

11.3.1. Company details

11.3.2. Financial outlook

11.3.3. Product summary

11.3.4. Recent developments

11.4. Covestro AG

11.4.1. Company details

11.4.2. Financial outlook

11.4.3. Product summary

11.4.4. Recent developments

11.5. DSM

11.5.1. Company details

11.5.2. Financial outlook

11.5.3. Product summary

11.5.4. Recent developments

11.6. Geminor

11.6.1. Company details

11.6.2. Financial outlook

11.6.3. Product summary

11.6.4. Recent developments

11.7. Jiangsu Litian Technology Co., Ltd.

11.7.1. Company details

11.7.2. Financial outlook

11.7.3. Product summary

11.7.4. Recent developments

11.8. Mitsubishi Chemical Europe GmbH (Nippon-Gohsei)

11.8.1. Company details

11.8.2. Financial outlook

11.8.3. Product summary

11.8.4. Recent developments

11.9. Resonac Holdings Corporation

11.9.1. Company details

11.9.2. Financial outlook

11.9.3. Product summary

11.9.4. Recent developments

11.10. SOLTECH LTD

11.10.1. Company details

11.10.2. Financial outlook

11.10.3. Product summary

11.10.4. Recent developments

11.11. TOAGOSEI CO., LTD.

11.11.1. Company details

11.11.2. Financial outlook

11.11.3. Product summary

11.11.4. Recent developments

11.12. Others

12. Conclusion

13. List of Abbreviations

14. Reference Links