Interventional Radiology Market Introduction and Overview

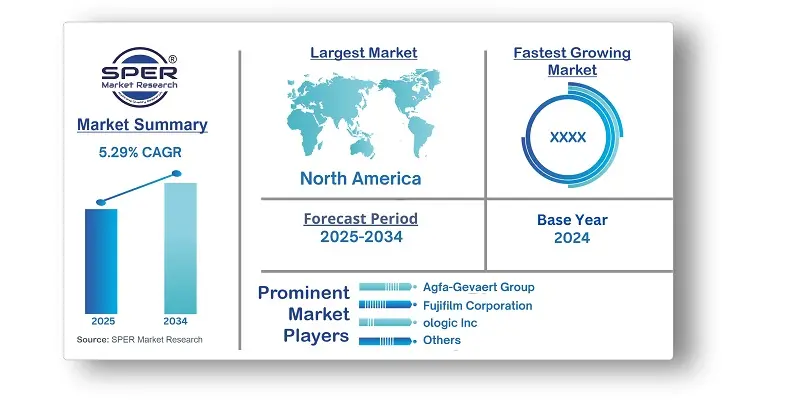

According to SPER Market Research, the Global Interventional Radiology Market is estimated to reach USD 49.54 billion by 2034 with a CAGR of 5.29%.

The report includes an in-depth analysis of the Global Interventional Radiology Market, including market size and trends, product mix, Applications, and supplier analysis. The global interventional radiology market is expanding rapidly, driven primarily by the rising frequency of chronic disorders such as cardiovascular disease and cancer. The growing desire for minimally invasive procedures, which provide less patient discomfort and shorter recovery times than standard surgeries, fuels this expansion. Technological improvements, such as the integration of high-resolution imaging and artificial intelligence, improve diagnostic accuracy and procedural efficiency, contributing to the market's increasing trend. However, challenges remain, most notably the high costs associated with advanced interventional radiology equipment, which might limit access, particularly in resource-constrained areas. Furthermore, an absence of qualified interventional radiologists complicates the general use of these new techniques. Regulatory barriers and compliance difficulties complicate market growth dynamics.

By Product Insights: The Global Interventional Radiology Market’s product segment is further segmented into 6 categories: Angiography Systems, Ultrasound Imaging Systems, CT Scanners, MRI Systems, Fluoroscopy Systems and Biopsy Devices. The angiography systems segment had the biggest revenue in 2024. Angiography systems are commonly used in interventional radiology to diagnose and treat numerous cardiovascular diseases because they produce detailed images of blood vessels, allowing for accurate navigation during treatments like angioplasty, stent implantation, and embolization. The increasing demand for these systems in both diagnostic and therapeutic applications, combined with ongoing technological improvements that improve picture quality and reduce radiation exposure, has established angiography systems as the market's main product segment.

By Application Insights: The application segment of the Global Interventional Radiology Market is further segmented into 6 categories: Cardiology, Oncology, Gynaecology, Obstetrics, Urology and Gastroenterology. In 2024, the cardiology sector dominated the market, accounting for the highest market share. Cardiovascular diseases (CVDs) are one of the main causes of death worldwide, creating a considerable demand for diagnostic and therapeutic approaches. Interventional radiology treatments such as angioplasty, stenting, and embolization are essential for treating coronary artery disease, stroke, and peripheral vascular disease. Due to the prevalence of these disorders, cardiology is the most common application segment.

By End-Use Insights: The End-Use of the Global Interventional Radiology Market is further segmented into 3 categories: Hospitals, Clinic, Ambulatory Surgical Centres and Others. The hospital industry dominated the market in 2024. Hospitals have the most advanced and extensive infrastructure, including cutting-edge imaging technology and interventional radiology suites. This enables them to execute a wide range of difficult treatments that necessitate specialist equipment, including angioplasty, embolization, and biopsies. Because of their ability to deliver these advanced treatments, hospitals are the preferred location for interventional radiology operations.

By Regional Insights: North Americas interventional radiology market accounted for the most market revenue in 2024 and is expected to expand between 2025 and 2034. North America, particularly the United States, has a high prevalence of chronic illnesses such as cardiovascular disease, cancer, and diabetes, all of which increase demand for interventional radiology operations. There is a high desire for minimally invasive treatments to control these illnesses, which is driving market expansion. Furthermore, North America's superior healthcare infrastructure and advantageous reimbursement regulations support the implementation of innovative interventional radiology technology, which drives market expansion.

Market Competitive Landscape:

Global Interventional Radiology Market is very competitive, with top companies focusing on product innovation, organic certifications, and strategic collaborations to increase market share. Some of the key market players are Agfa-Gevaert Group, Canon Medical Systems Corporation, Carestream Healthcare Inc., Esaote SPA, Fujifilm Corporation, GE Healthcare, Hologic Inc., Samsung Healthcare (Samsung Electronics Co. Ltd.), Siemen Healthineers and Teleflex Incorporated.

Recent Developments:

- In June 2024, GE HealthCare and MediView XR Inc. have announced the first installation of the OmnifyXR interventional suite at North Star Vascular and Interventional (NSVI) in Minneapolis, MN. This introduction represents a significant expansion of the company's interventional radiology product, and it is intended to extend its customer base.

- In June 2024, Following FDA approval, Royal Philips reported the first implantation of the Duo Venous Stent System, a device designed to treat symptomatic venous outflow blockage in patients with chronic venous insufficiency (CVI). This milestone is expected to boost the company's market reputation and increase its position in the industry.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Product, By Application, By End-Use. |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa. |

| Companies Covered | Agfa-Gevaert Group, Canon Medical Systems Corporation, Carestream Healthcare Inc., Esaote SPA, Fujifilm Corporation, GE Healthcare, Hologic Inc., Samsung Healthcare (Samsung Electronics Co. Ltd.), Siemen Healthineers and Teleflex Incorporated and others. |

Key Topics Covered in the Report:

- Global Interventional Radiology Market Size (FY’2021-FY’2034)

- Overview of Global Interventional Radiology Market

- Segmentation of Global Interventional Radiology Market By Product (Angiography Systems, Ultrasound Imaging Systems, CT Scanners, MRI Systems, Fluoroscopy Systems, Biopsy Devices)

- Segmentation of Global Interventional Radiology Market By Application (Cardiology, Oncology, Gynaecology, Obstetrics, Urology and Gastroenterology)

- Segmentation of Global Interventional Radiology Market By End Use (Hospitals, Clinic, Ambulatory Surgical Centres, Others)

- Statistical Snap of Global Interventional Radiology Market

- Expansion Analysis of Global Interventional Radiology Market

- Problems and Obstacles in Global Interventional Radiology Market

- Competitive Landscape in the Global Interventional Radiology Market

- Details on Current Investment in Global Interventional Radiology Market

- Competitive Analysis of Global Interventional Radiology Market

- Prominent Players in the Global Interventional Radiology Market

- SWOT Analysis of Global Interventional Radiology Market

- Global Interventional Radiology Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Interventional Radiology Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Interventional Radiology Market

7. Global Interventional Radiology Market, By Product (USD Million) 2021-2034

7.1. Angiography Systems

7.2. Ultrasound Imaging Systems

7.3. CT Scanners

7.4. MRI Systems

7.5. Fluoroscopy Systems

7.6. Biopsy Devices

8. Global Interventional Radiology Market, By Application (USD Million) 2021-2034

8.1. Cardiology

8.2. Oncology

8.3. Gynaecology

8.4. Obstetrics

8.5. Urology

8.6. Gastroenterology

9. Global Interventional Radiology Market, By End-Use (USD Million) 2021-2034

9.1. Hospitals

9.2. Clinics

9.3. Ambulatory Surgical Centres

9.4. Others

10. Global Interventional Radiology Market, (USD Million) 2021-2034

10.1. Global Interventional Radiology Market Size and Market Share

11. Global Interventional Radiology Market, By Region, (USD Million) 2021-2034

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. Agfa-Gevaert Group

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. Canon Medical Systems Corporation

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. Carestream Healthcare Inc.

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. Esaote SPA

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. Fujifilm Corporation

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. GE Healthcare

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. Hologic Inc.

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. Samsung Healthcare (Samsung Electronics Co. Ltd.)

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. Siemens Healthineers

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. Teleflex Incorporated

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links