Medical Tricorder Market Introduction and Overview

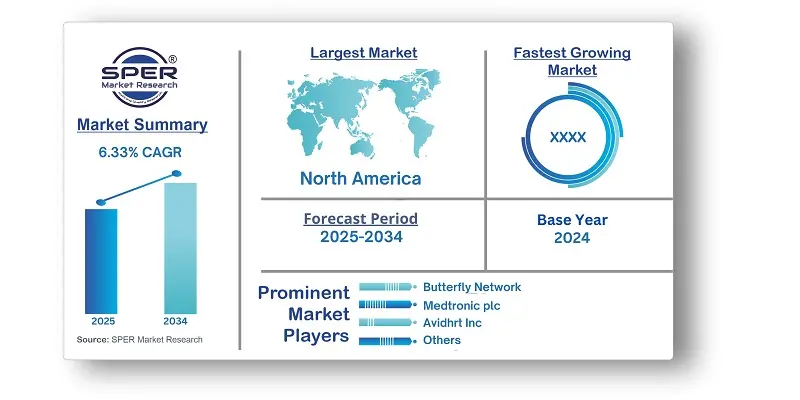

According to SPER Market Research, the Global Medical Tricorder Market is estimated to reach USD 7.26 billion by 2034 with a CAGR of 6.33%.

The report includes an in-depth analysis of the Global Medical Tricorder Market, including market size and trends, product mix, Applications, and supplier analysis. The Medical Tricorder market was valued at USD 3.93 billion in 2024 and is expected to increase at a CAGR of 6.33% between 2025 and 2034. The market is expanding as the prevalence of chronic diseases rises, sensor technology advances, and there is a greater emphasis on preventative care. The growing prevalence of chronic diseases such as diabetes, cardiovascular disease, and respiratory problems is propelling the industry forward. This trend is driven by ageing populations, sedentary lifestyles, bad diets, and rising obesity rates.

By Technology Insights: The market is divided into sensors and biosensors, and imaging technology, with sensors and biosensors having a significant share in 2024. These devices can measure various health indicators like heart rate, blood pressure, and glucose levels. Their flexibility allows medical tricorders to be used for many health monitoring tasks, from regular check-ups to managing chronic diseases. Non-invasive or minimally invasive monitoring is preferred, enhancing patient comfort and making these devices desirable for daily use.

By Application Insights: The medical tricorder market is divided into monitoring and diagnosis, with the monitoring segment expected to lead. There is a rising need for ongoing health monitoring due to increasing chronic diseases like diabetes, hypertension, and cardiovascular issues. Medical tricorders with monitoring features provide real-time health data, assisting in better management. These technologies also support preventive care by detecting potential health problems early, leading to timely interventions, improved patient outcomes, and reduced healthcare costs. This has fueled the growth of the monitoring segment.

By Distribution Channel Insights: Based on distribution channel, the medical tricorder market is divided into brick & mortar and E-commerce. The brick & mortar segment had a larger market share in 2024. Many consumers like buying medical devices in physical stores because they can see and check the product before purchasing. Knowledgeable staff can help answer questions and provide demonstrations, fostering trust in the products effectiveness. Additionally, physical stores allow customers to buy and take home a medical tricorder immediately, which is especially helpful for urgent needs.

By End-User Insights: The medical tricorder market is divided into hospitals & clinics, homecare, and other users. The hospitals & clinics segment is expected to grow significantly over time. Healthcare professionals in hospitals and clinics are skilled in using medical tricorders and interpreting their data. These tools are crucial for patient care, as they rely on accurate diagnostics. Hospitals handle many patients each day, needing efficient tools for various medical conditions. Medical tricorders provide fast and non-invasive diagnostics, helping healthcare providers quickly assess patients, improve workflow, and increase the use of these devices.

Regional Insights: North America is the markets dominant region. In North America, severe laws such as the Drug Supply Chain Security Act (DSCSA) encourage the use of modern diagnostic instruments, such as medical tricorders. These laws require improved pharmaceutical tracking and monitoring, which encourages the adoption of advanced compliance devices. Furthermore, North America has a well-established and technologically advanced healthcare system. The region's strong focus on innovation and ability to deploy innovative healthcare solutions make it easier to integrate cutting-edge technologies, such as medical tricorders.

Market Competitive Landscape:

The medical tricorder market is characterised by the presence of various established and growing players that provide a wide range of innovative diagnostic and monitoring technologies. Market participants compete on a number of critical factors, including sensor and biosensor precision, the integration of innovative technologies such as artificial intelligence for data analysis, adherence to stringent regulatory standards, and the efficacy of real-time health monitoring capabilities. Key market players are AliveCor, Inc, Avidhrt Inc, Basil Leaf Technologies, LLC, Biosense Technologies Private Limited, Butterfly Network, Inc, Cardiomo Inc, among others.

Recent Developments:

- In February 2024, Butterfly Network, Inc. launched its third-generation handheld point-of-care ultrasound system, Butterfly iQ3. It features an advanced semiconductor chip with double the data transfer rate of the previous model, improving product offerings and expanding the customer base.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Technology, By Application, By Distribution Channel, By End-User. |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa. |

| Companies Covered | AliveCor, Inc, Avidhrt Inc, Basil Leaf Technologies, LLC, Biosense Technologies Private Limited, Butterfly Network, Inc, Cardiomo Inc, ChroniSense Medical, Ltd, Medtronic plc, MEDWAND SOLUTIONS, INC, TytoCare Ltd, VitalConnect. and others. |

Key Topics Covered in the Report:

- Global Medical Tricorder Market Size (FY’2021-FY’2034)

- Overview of Global Medical Tricorder Market

- Segmentation of Global Medical Tricorder Market By Technology (Sensors & Biosensors, Imaging Technology)

- Segmentation of Global Medical Tricorder Market By Application (Monitoring, Diagnosis)

- Segmentation of Global Medical Tricorder Market By Distribution Channel (Brick & Mortar, E-Commerce)

- Segmentation of Global Medical Tricorder Market By End-User (Hospitals & Clinics, Homecare)

- Statistical Snap of Global Medical Tricorder Market

- Expansion Analysis of Global Medical Tricorder Market

- Problems and Obstacles in Global Medical Tricorder Market

- Competitive Landscape in the Global Medical Tricorder Market

- Details on Current Investment in Global Medical Tricorder Market

- Competitive Analysis of Global Medical Tricorder Market

- Prominent Players in the Global Medical Tricorder Market

- SWOT Analysis of Global Medical Tricorder Market

- Global Medical Tricorder Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Medical Tricorder Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Medical Tricorder Market

7. Global Medical Tricorder Market, By Technology (USD Million) 2021-2034

7.1. Sensors and Biosensors

7.2. Imaging Technology

8. Global Medical Tricorder Market, By Application (USD Million) 2021-2034

8.1. Monitoring

8.2. Diagnosis

9. Global Medical Tricorder Market, By Distribution Channel (USD Million) 2021-2034

9.1. Brick & Mortar

9.2. E-commerce

10. Global Medical Tricorder Market, By End-User (USD Million) 2021-2034

10.1. Hospitals & Clinics

10.2. Homecare

10.3. Other End-Users

11. Global Medical Tricorder Market, (USD Million) 2021-2034

11.1. Global Medical Tricorder Market Size and Market Share

12. Global Medical Tricorder Market, By Region, (USD Million) 2021-2034

12.1. Asia-Pacific

12.1.1. Australia

12.1.2. China

12.1.3. India

12.1.4. Japan

12.1.5. South Korea

12.1.6. Rest of Asia-Pacific

12.2. Europe

12.2.1. France

12.2.2. Germany

12.2.3. Italy

12.2.4. Spain

12.2.5. United Kingdom

12.2.6. Rest of Europe

12.3. Middle East and Africa

12.3.1. Kingdom of Saudi Arabia

12.3.2. United Arab Emirates

12.3.3. Qatar

12.3.4. South Africa

12.3.5. Egypt

12.3.6. Morocco

12.3.7. Nigeria

12.3.8. Rest of Middle-East and Africa

12.4. North America

12.4.1. Canada

12.4.2. Mexico

12.4.3. United States

12.5. Latin America

12.5.1. Argentina

12.5.2. Brazil

12.5.3. Rest of Latin America

13. Company Profile

13.1. AliveCor, Inc

13.1.1. Company details

13.1.2. Financial outlook

13.1.3. Product summary

13.1.4. Recent developments

13.2. Avidhrt Inc

13.2.1. Company details

13.2.2. Financial outlook

13.2.3. Product summary

13.2.4. Recent developments

13.3. Basil Leaf Technologies, LLC

13.3.1. Company details

13.3.2. Financial outlook

13.3.3. Product summary

13.3.4. Recent developments

13.4. Biosense Technologies Private Limited

13.4.1. Company details

13.4.2. Financial outlook

13.4.3. Product summary

13.4.4. Recent developments

13.5. Butterfly Network, Inc

13.5.1. Company details

13.5.2. Financial outlook

13.5.3. Product summary

13.5.4. Recent developments

13.6. Cardiomo Inc

13.6.1. Company details

13.6.2. Financial outlook

13.6.3. Product summary

13.6.4. Recent developments

13.7. ChroniSense Medical, Ltd

13.7.1. Company details

13.7.2. Financial outlook

13.7.3. Product summary

13.7.4. Recent developments

13.8. Medtronic plc

13.8.1. Company details

13.8.2. Financial outlook

13.8.3. Product summary

13.8.4. Recent developments

13.9. MEDWAND SOLUTIONS, INC

13.9.1. Company details

13.9.2. Financial outlook

13.9.3. Product summary

13.9.4. Recent developments

13.10. TytoCare Ltd

13.10.1. Company details

13.10.2. Financial outlook

13.10.3. Product summary

13.10.4. Recent developments

13.11. VitalConnect

13.11.1. Company details

13.11.2. Financial outlook

13.11.3. Product summary

13.11.4. Recent developments

13.12. Others

14. Conclusion

15. List of Abbreviations

16. Reference Links