Plant-Based Butter Market Introduction and Overview

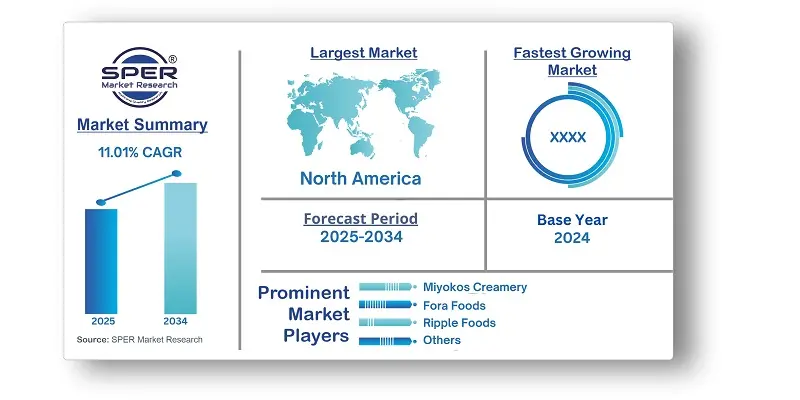

According to SPER Market Research, the Global Plant-Based Butter Market is estimated to reach USD 2.56 billion by 2034 with a CAGR of 11.01%.

Consumers are increasingly looking for dairy alternatives due to lactose intolerance, allergies, and a desire for low-calorie, nutrient-dense solutions. Furthermore, scientific breakthroughs and product innovation have improved the flavor and texture of plant-based butters, making them more desirable. Furthermore, the growing popularity of veganism and flexitarianism, as more individuals throughout the world move to plant-based diets, has broadened the consumer base. Furthermore, supporting government policies and laws promoting plant-based diets in various countries have helped to expand the market, creating a favorable atmosphere for the plant-based butter industry's growth.

- June 2024: Bunge introduced Beleaf PlantBetter, a plant-based butter replacement, in North America. Designed for food producers and bakers, it mimics the sensory properties of traditional dairy butter with all-natural ingredients such as rapeseed, coconut, and cocoa butter. Beleaf PlantBetter is vegan, lactose-free, dairy-free, and free of soy and palm. Blind sensory experiments reveal that it performs similarly to premium butter products, with significant cost savings and lower price volatility. It has the same melting point, volume, plasticity, lamination, and emulsification as regular butter, making it ideal for baking and cooking.

- September 2023: Dutch plant-based dairy startup Willicroft introduced its first non-cheese product, plant-based fermented butter. Unlike margarine, this butter spreads, bakes, and cooks like regular butter. It was created via precision fermentation to recreate the flavor of high-end dairy butter without the use of chemical flavorings such as butyric acid. The product, created from Austrian beans and European soybeans, contains less saturated fat than other plant-based butters and is equally spreadable and meltable.

By Source: Coconut Butter dominates the plant-based butter market.

Coconut oil, the key ingredient in coconut-based butter, has a naturally creamy texture and mild flavor that is similar to typical dairy butter. This makes it a popular choice among people looking for a familiar taste and mouthfeel in plant-based alternatives. Furthermore, coconut oil is solid at room temperature, making it an ideal base for spreads and baking recipes.

By Nature: Conventional Plant-Based Butter accounts for the largest revenue share.

Conventional plant-based butter has a wider distribution network and is more commonly found in supermarkets, grocery stores, and convenience stores. Many people choose conventional products because they are easily accessible. Furthermore, ordinary plant-based butters are often less expensive than organic alternatives, making them more accessible to consumers.

By Flavor: Non-Flavored plant-based butter is dominating the market.

Non-flavored plant-based butters are popular because of their versatility and ability to mimic the taste and functionality of regular dairy butter. These products often strive to reproduce butter's neutral, creamy taste without adding any other flavors, appealing to consumers who want a familiar taste for general cooking, baking, and spreading.

By Distribution Channel: Sales through B2C is dominating the industry.

B2C channels target individual consumers who buy plant-based butters for personal usage at home. This dominance is strengthened by expanding consumer awareness and access to plant-based alternatives, which are being driven by rising health consciousness, ethical concerns, and dietary preferences such as veganism.

By Region: North America, notably the United States, dominates the global plant-based butter market. The US market is being led by rising health consciousness, worries about animal welfare, and environmental sustainability. The rise of flexitarian diets, in which people limit but do not eliminate animal products, has increased demand.

Market Competitive Landscape:

The Global Plant-Based Butter Market is highly consolidated. Some of the market players are Califia Farms, LLC, Conagra, Inc, Elmhurst Buttered Direct, LLC, Fora Foods, Kite Hill, Milkadamia, Miyoko’s Creamery, Naturli’ Foods A/S, Ripple Foods, PBC, Upfield and others.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Source, By Nature, By Flavor, By Distribution Channel. |

| Regions covered | North America, Asia-Pacific, Latin America, Middle East & Africa and Europe. |

| Companies Covered | Califia Farms, LLC, Conagra, Inc, Elmhurst Buttered Direct, LLC, Fora Foods, Kite Hill, Milkadamia, Miyokos Creamery, Naturli’ Foods A/S, Ripple Foods, PBC, Upfield. |

Key Topics Covered in the Report:

- Global Plant-Based Butter Market Size (FY’2021-FY’2034)

- Overview of Global Plant-Based Butter Market

- Segmentation of Global Plant-Based Butter Market By Source (Almond, Oat, Soy, Coconut)

- Segmentation of Global Plant-Based Butter Market By Nature (Organic, Conventional)

- Segmentation of Global Plant-Based Butter Market By Flavor (Flavored Butter, Non-Flavored Butter)

- Segmentation of Global Plant-Based Butter Market By Distribution Channel (B2B, B2C)

- Statistical Snap of Global Plant-Based Butter Market

- Expansion Analysis of Global Plant-Based Butter Market

- Problems and Obstacles in Global Plant-Based Butter Market

- Competitive Landscape in the Global Plant-Based Butter Market

- Details on Current Investment in Global Plant-Based Butter Market

- Competitive Analysis of Global Plant-Based Butter Market

- Prominent Players in the Global Plant-Based Butter Market

- SWOT Analysis of Global Plant-Based Butter Market

- Global Plant-Based Butter Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Plant-Based Butter Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Plant-Based Butter Market

7. Global Plant-Based Butter Market, By Source (USD Million) 2021-2034

7.1. Almond

7.2. Oat

7.3. Soy

7.4. Coconut

8. Global Plant-Based Butter Market, By Nature (USD Million) 2021-2034

8.1. Organic

8.2. Conventional

9. Global Plant-Based Butter Market, By Flavor (USD Million) 2021-2034

9.1. Flavored Butter

9.2. Non Flavored Butter

10. Global Plant-Based Butter Market, By Distribution Channel (USD Million) 2021-2034

10.1. B2B

10.2. B2C

10.2.1. Hypermarkets & Supermarkets

10.2.2. Specialty Stores

10.2.3. Online

11. Global Plant-Based Butter Market, (USD Million) 2021-2034

11.1. Global Plant-Based Butter Market Size and Market Share

12. Global Plant-Based Butter Market, By Region, (USD Million) 2021-2034

12.1. Asia-Pacific

12.1.1. Australia

12.1.2. China

12.1.3. India

12.1.4. Japan

12.1.5. South Korea

12.1.6. Rest of Asia-Pacific

12.2. Europe

12.2.1. France

12.2.2. Germany

12.2.3. Italy

12.2.4. Spain

12.2.5. United Kingdom

12.2.6. Rest of Europe

12.3. Middle East and Africa

12.3.1. Kingdom of Saudi Arabia

12.3.2. United Arab Emirates

12.3.3. Qatar

12.3.4. South Africa

12.3.5. Egypt

12.3.6. Morocco

12.3.7. Nigeria

12.3.8. Rest of Middle-East and Africa

12.4. North America

12.4.1. Canada

12.4.2. Mexico

12.4.3. United States

12.5. Latin America

12.5.1. Argentina

12.5.2. Brazil

12.5.3. Rest of Latin America

13. Company Profile

13.1. Califia Farms, LLC

13.1.1. Company details

13.1.2. Financial outlook

13.1.3. Product summary

13.1.4. Recent developments

13.2. Conagra, Inc

13.2.1. Company details

13.2.2. Financial outlook

13.2.3. Product summary

13.2.4. Recent developments

13.3. Elmhurst Buttered Direct, LLC

13.3.1. Company details

13.3.2. Financial outlook

13.3.3. Product summary

13.3.4. Recent developments

13.4. Fora Foods

13.4.1. Company details

13.4.2. Financial outlook

13.4.3. Product summary

13.4.4. Recent developments

13.5. Kite Hill

13.5.1. Company details

13.5.2. Financial outlook

13.5.3. Product summary

13.5.4. Recent developments

13.6. Milkadamia

13.6.1. Company details

13.6.2. Financial outlook

13.6.3. Product summary

13.6.4. Recent developments

13.7. Miyokos Creamery

13.7.1. Company details

13.7.2. Financial outlook

13.7.3. Product summary

13.7.4. Recent developments

13.8. Naturli Foods A/S

13.8.1. Company details

13.8.2. Financial outlook

13.8.3. Product summary

13.8.4. Recent developments

13.9. Ripple Foods, PBC

13.9.1. Company details

13.9.2. Financial outlook

13.9.3. Product summary

13.9.4. Recent developments

13.10. Upfield

13.10.1. Company details

13.10.2. Financial outlook

13.10.3. Product summary

13.10.4. Recent developments

13.11. Others

14. Conclusion

15. List of Abbreviations

16. Reference Links