Automated Breach and Attack Simulation Market Introduction and Overview

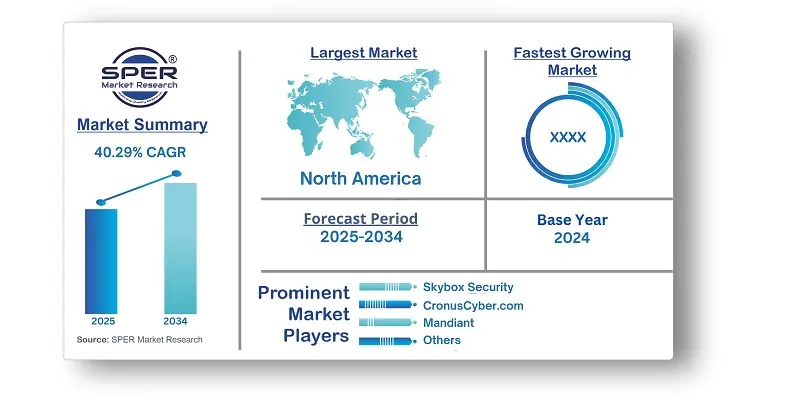

According to SPER Market Research, the Global Automated Breach and Attack Simulation Market is estimated to reach USD 13430.13 million by 2034 with a CAGR of 40.29%.

The report includes an in-depth analysis of the Global Automated Breach and Attack Simulation Market, including market size and trends, product mix, Applications, and supplier analysis. The rising number and complexity of cyber threats are significantly fueling the growth of the automated breach and attack simulation market. As cybercriminals adopt more sophisticated tactics, organizations are continuously exposed to risks like data breaches, ransomware attacks, and other malicious activities. Traditional security measures often struggle to detect and prevent these advanced threats, making a more proactive approach essential. However, The shortage of skilled cybersecurity professionals hampers the growth of the Automated Breach and Attack Simulation market, leaving many organizations vulnerable to attacks. Smaller firms face challenges with high costs, limited resources, and scalability issues when implementing BAS. Cloud solutions and managed services offer flexibility but require prioritization and automation to optimize resources.

By Offering: The platform and tools segment holds the largest market share in the automated breach and attack simulation market, driven by the ease of integrating these tools into existing security frameworks. This interoperability allows organizations to strengthen their security measures without overhauling their entire infrastructure, making the tools more appealing. On the other hand, the services segment is expected to see substantial growth, fueled by the need for continuous security testing, especially among small and medium-sized enterprises lacking in-house expertise. Service providers address this gap by offering scalable, cost-effective solutions, enabling organizations to access advanced security assessments without heavy investments in resources and technology.

By Deployment Mode: The cloud segment dominates the automated breach and attack simulation market, driven by its scalability and flexibility. Cloud solutions allow organizations to easily expand their security testing capabilities as needs grow, providing comprehensive assessments without the limitations of on-premises infrastructure. This flexibility benefits businesses of all sizes. Meanwhile, the on-premises segment is expected to experience significant growth, especially in industries like finance and healthcare, where strict regulatory requirements necessitate the use of on-premises solutions for data security. These tools help organizations meet compliance standards by keeping all data within their controlled environments, ensuring secure and regulatory-compliant testing.

By Application: The threat management segment holds the largest market share in the automated breach and attack simulation market, driven by the increasing frequency and complexity of cyber threats. As organizations face ongoing risks from attacks like ransomware, phishing, and advanced persistent threats, threat management tools within BAS platforms allow them to simulate these attacks, evaluate their defenses, and identify vulnerabilities before they are exploited.

By End User: The enterprises and data centers segment hold the largest market share, driven by the need for proactive measures against evolving cybersecurity threats. Automated breach and attack simulation tools help organizations simulate attacks and test defenses, ensuring continuous validation and timely identification of vulnerabilities. Meanwhile, the managed service providers segment is expected to grow significantly, as these providers manage multiple clients' IT infrastructure and security. The need for robust security testing across diverse environments boosts the adoption of automated breach and attack simulation, driving market growth.

By Regional Insights: North America holds a significant share of the automated breach and attack simulation market, driven by increasing awareness of cybersecurity risks among businesses in the region. Enterprises are increasingly recognizing the importance of proactive security solutions, like automated breach and attack simulation, to conduct continuous testing and validation. This approach helps identify and address vulnerabilities before they can be exploited by cybercriminals.

Market Competitive Landscape:

The market is moderately consolidated. Some of the market key players are AttackIQ, CronusCyber.com, Cymulate, FireMon, LLC, IronNet, Inc., Keysight Technologies, Mandiant, Qualys, Inc., Rapid7, ReliaQuest, LLC, SafeBreach Inc., SCYTHE, Skybox Security, Inc., Sophos Ltd., XM Cyber.

Recent Developments:

- AttackIQ launched AttackIQ Ready!, a completely managed breach and attack simulation solution, in March 2023. Through an automated platform, this solution expedites the implementation of continuous security validation programs by providing real-time results and speedier correction. AttackIQ Ready!, designed to be widely accessible, offers adversarial campaign testing, weekly and monthly reporting, and helpful repair guidance. By using AI-powered simulations and evaluations in line with MITRE ATT&CK, it improves security posture.

- Darktrace improved cybersecurity protections in July 2023 by launching the Heal AI security platform, which includes attack simulation. Using sophisticated behavioral analysis and artificial intelligence, the platform can autonomously identify and react to cyberthreats in real time. Organizations are able to proactively test their security against changing cyberthreats.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Offering, By Deployment Mode, By Application, By End User. |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa. |

| Companies Covered | AttackIQ, CronusCyber.com, Cymulate, FireMon, LLC, IronNet, Inc., Keysight Technologies, Mandiant, Qualys, Inc., Rapid7, ReliaQuest, LLC, SafeBreach Inc., SCYTHE, Skybox Security, Inc., Sophos Ltd., XM Cyber. and other. |

Key Topics Covered in the Report:

- Global Automated Breach and Attack Simulation Market Size (FY’2021-FY’2034)

- Overview of Global Automated Breach and Attack Simulation Market

- Segmentation of Global Automated Breach and Attack Simulation Market By Offering (Platforms and Tools, Services)

- Segmentation of Global Automated Breach and Attack Simulation Market By Deployment Mode (Cloud, On-premises)

- Segmentation of Global Automated Breach and Attack Simulation Market By Application (Configuration Management, Patch Management, Threat Management, Others)

- Segmentation of Global Automated Breach and Attack Simulation Market By End User (Enterprises and Data Centers, Managed Service Providers)

- Statistical Snap of Global Automated Breach and Attack Simulation Market

- Expansion Analysis of Global Automated Breach and Attack Simulation Market

- Problems and Obstacles in Global Automated Breach and Attack Simulation Market

- Competitive Landscape in the Global Automated Breach and Attack Simulation Market

- Details on Current Investment in Global Automated Breach and Attack Simulation Market

- Competitive Analysis of Global Automated Breach and Attack Simulation Market

- Prominent Players in the Global Automated Breach and Attack Simulation Market

- SWOT Analysis of Global Automated Breach and Attack Simulation Market

- Global Automated Breach and Attack Simulation Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Automated Breach and Attack Simulation Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Automated Breach and Attack Simulation Market

7. Global Automated Breach and Attack Simulation Market, By Offering, (USD Million) 2021-2034

7.1. Platforms and Tools

7.2. Services

7.2.1. Training

7.2.2. On-demand Analyst

7.2.3. Others

8. Global Automated Breach and Attack Simulation Market, By Deployment Mode, (USD Million) 2021-2034

8.1. Cloud

8.2. On-premises

9. Global Automated Breach and Attack Simulation Market, By Application, (USD Million) 2021-2034

9.1. Configuration Management

9.2. Patch Management

9.3. Threat Management

9.4. Others

10. Global Automated Breach and Attack Simulation Market, By End User, (USD Million) 2021-2034

10.1. Enterprises and Data Centers

10.2. Managed Service Providers

11. Global Automated Breach and Attack Simulation Market, (USD Million) 2021-2034

11.1. Global Automated Breach and Attack Simulation Market Size and Market Share

12. Global Automated Breach and Attack Simulation Market, By Region, (USD Million) 2021-2034

12.1. Asia-Pacific

12.1.1. Australia

12.1.2. China

12.1.3. India

12.1.4. Japan

12.1.5. South Korea

12.1.6. Rest of Asia-Pacific

12.2. Europe

12.2.1. France

12.2.2. Germany

12.2.3. Italy

12.2.4. Spain

12.2.5. United Kingdom

12.2.6. Rest of Europe

12.3. Middle East and Africa

12.3.1. Kingdom of Saudi Arabia

12.3.2. United Arab Emirates

12.3.3. Qatar

12.3.4. South Africa

12.3.5. Egypt

12.3.6. Morocco

12.3.7. Nigeria

12.3.8. Rest of Middle-East and Africa

12.4. North America

12.4.1. Canada

12.4.2. Mexico

12.4.3. United States

12.5. Latin America

12.5.1. Argentina

12.5.2. Brazil

12.5.3. Rest of Latin America

13. Company Profile

13.1. AttackIQ

13.1.1. Company details

13.1.2. Financial outlook

13.1.3. Product summary

13.1.4. Recent developments

13.2. CronusCyber.com.

13.2.1. Company details

13.2.2. Financial outlook

13.2.3. Product summary

13.2.4. Recent developments

13.3. Cymulate

13.3.1. Company details

13.3.2. Financial outlook

13.3.3. Product summary

13.3.4. Recent developments

13.4. FireMon, LLC.

13.4.1. Company details

13.4.2. Financial outlook

13.4.3. Product summary

13.4.4. Recent developments

13.5. IronNet, Inc.

13.5.1. Company details

13.5.2. Financial outlook

13.5.3. Product summary

13.5.4. Recent developments

13.6. Keysight Technologies

13.6.1. Company details

13.6.2. Financial outlook

13.6.3. Product summary

13.6.4. Recent developments

13.7. Mandiant

13.7.1. Company details

13.7.2. Financial outlook

13.7.3. Product summary

13.7.4. Recent developments

13.8. Qualys, Inc.

13.8.1. Company details

13.8.2. Financial outlook

13.8.3. Product summary

13.8.4. Recent developments

13.9. Rapid7

13.9.1. Company details

13.9.2. Financial outlook

13.9.3. Product summary

13.9.4. Recent developments

13.10. ReliaQuest, LLC

13.10.1. Company details

13.10.2. Financial outlook

13.10.3. Product summary

13.10.4. Recent developments

13.11. SafeBreach Inc.

13.11.1. Company details

13.11.2. Financial outlook

13.11.3. Product summary

13.11.4. Recent developments

13.12. SCYTHE

13.12.1. Company details

13.12.2. Financial outlook

13.12.3. Product summary

13.12.4. Recent developments

13.13. Skybox Security, Inc.

13.13.1. Company details

13.13.2. Financial outlook

13.13.3. Product summary

13.13.4. Recent developments

13.14. Sophos Ltd.

13.14.1. Company details

13.14.2. Financial outlook

13.14.3. Product summary

13.14.4. Recent developments

13.15. XM Cyber

13.15.1. Company details

13.15.2. Financial outlook

13.15.3. Product summary

13.15.4. Recent developments

13.16. Others

14. Conclusion

15. List of Abbreviations

16. Reference Links