Industrial Metaverse Market Introduction and Overview

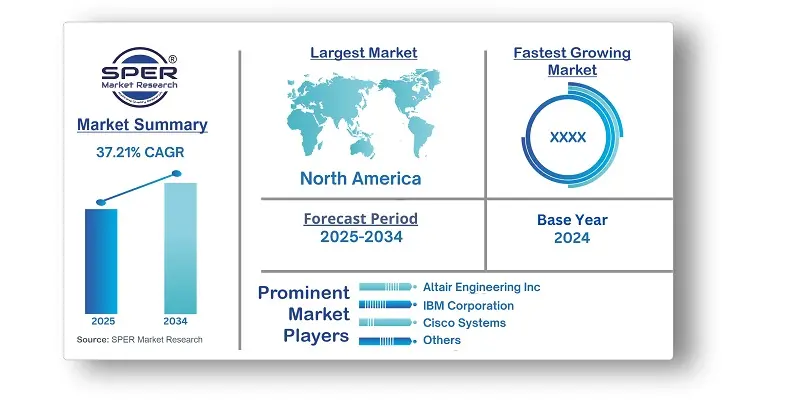

According to SPER Market Research, the Global Industrial Metaverse Market is estimated to reach USD 660.35 billion by 2034 with a CAGR of 37.21%.

The report includes an in-depth analysis of the Global Industrial Metaverse Market, including market size and trends, product mix, Applications, and supplier analysis. The global industrial metaverse market was valued at USD 27.92 billion in 2024 and is expected to grow at a 37.21% CAGR from 2025 to 2034. The incorporation of digital twins has considerably enhanced the industrial metaverse industry by providing virtual representations of physical assets and processes, hence driving efficiency and innovation. Digital twins enable real-time monitoring, predictive analytics, and simulation capabilities, allowing industrial metaverses to optimise processes, increase efficiency, and reduce hazards. This technology encourages seamless cooperation and decision-making across several industrial sectors, accelerating the emergence of interconnected virtual environments.

By Technology Insights: The industrial metaverse market is divided into several technology segments, including AR/VR, digital twin, autonomous robots, cloud computing, AI/ML, 5G/6G, blockchain, IoT, location services, edge computing, exoskeleton, and quantum computing. By 2025, cloud computing is predicted to hold the largest market share. This dominance is due to its ability to deliver IT resources on-demand via the Internet with pay-as-you-go pricing, improve operational efficiency in hosting the industrial metaverse, and minimize outages while protecting personal information.

By Application Insights:

By Application: The Prototyping, Testing, and Simulation Segment to Dominate the Industrial Metaverse Market in 2024 The industrial metaverse market is divided into several applications, including prototyping, testing, and simulation, predictive maintenance, training, facility optimization, research & development, workplace safety, warehousing & logistics, customer interactions, and more. In 2024, the prototyping, testing, and simulation segment is predicted to hold the largest market share due to benefits like faster product development, fewer costly mistakes, a flexible approach to product development, and real-time collaboration among teams in different locations.

By End-use Industry Insights: The industrial metaverse market is divided by end-use industry into automotive, industrial goods & manufacturing, power & utilities, transportation, supply chain & logistics, and others. In 2024, the industrial goods & manufacturing segment is projected to hold the largest share. This is due to complex product development, dependence on simulation and testing, and ongoing innovation needs.

Regional Insights: North America dominated the industrial metaverse market in 2024, holding the largest revenue share. The region has a strong industrial base in sectors like manufacturing, automotive, aerospace, and healthcare, which are early adopters of these technologies to boost productivity, efficiency, and innovation. Additionally, North America's digital connectivity infrastructure supports the integration and deployment of industrial metaverse solutions for collaboration and data sharing.

Market Competitive Landscape:

The market has strong competition, with a few major global competitors holding a large share. The main priority is to develop new products and collaborate among key players. HTC is a leading technology company known for its innovative products and strong user experience. They are influencing the industrial metaverse by providing advanced virtual reality and augmented reality solutions for different industries. HTC's goal is to create immersive experiences that improve collaboration, training, and productivity in the industrial sector. Their focus on the metaverse helps drive digital transformation and creates new growth opportunities.

Recent Developments:

- In March 2024, NVIDIA partnered with Microsoft Corporation to provide NVIDIA Omniverse Cloud, a service that helps companies integrate digitalization, connect 3D design tools, create digital twins of factories, and test vehicle performance.

- In June 2024, Siemens, NVIDIA, and AWS partnered to enhance the industrial metaverse. They will use Siemens expertise, NVIDIAs Omniverse platform, and AWSs cloud services to create real-time, collaborative digital twin solutions for improved design and operations.

- In January 2024, Siemens AG announced key partnerships and AI advancements to enhance the industrial metaverse. They introduced a new immersive engineering solution with Sony, combining Sonys head-mounted displays with the Siemens Xcelerator platform. This initiative seeks to support global innovators and change industrial design and manufacturing.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Technology, By Application, By End-use Industry. |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa. |

| Companies Covered | ABB Ltd, Siemens AG, IBM Corporation, Robert Bosch GmbH, Oracle Corporation, Microsoft Corporation, Nvidia Corporation, Cisco Systems, Inc, Dassault Systemes SE, Altair Engineering Inc, PTC Inc, Intel Corporation, Penguin Solutions, SAP SE, Arm Limited. and others. |

Key Topics Covered in the Report:

- Global Industrial Metaverse Market Size (FY’2021-FY’2034)

- Overview of Global Industrial Metaverse Market

- Segmentation of Global Industrial Metaverse Market By Technology (AR/VR, Digital Twin, Autonomous Robots, Cloud Computing, AI/ML, 5G/6G, Blockchain, IoT, Location Services, Edge Computing, Exoskeleton)

- Segmentation of Global Industrial Metaverse Market By Application (Prototyping, Testing, and Simulation, Predictive Maintenance, Training, Facility Optimization, Research & Development, Workplace Safety, Warehousing & Logistics, Customer Interactions, Other Applications)

- Segmentation of Global Industrial Metaverse Market By End-use Industry (Automotive, Industrial Goods & Manufacturing, Power & Utilities, Transportation, Supply Chain & Logistics, Other End-use Industries)

- Statistical Snap of Global Industrial Metaverse Market

- Expansion Analysis of Global Industrial Metaverse Market

- Problems and Obstacles in Global Industrial Metaverse Market

- Competitive Landscape in the Global Industrial Metaverse Market

- Details on Current Investment in Global Industrial Metaverse Market

- Competitive Analysis of Global Industrial Metaverse Market

- Prominent Players in the Global Industrial Metaverse Market

- SWOT Analysis of Global Industrial Metaverse Market

- Global Industrial Metaverse Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Industrial Metaverse Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Industrial Metaverse Market

7. Global Industrial Metaverse Market, By Technology (USD Million) 2021-2034

7.1. AR/VR

7.2. Digital Twin

7.3. Autonomous Robots

7.4. Cloud Computing

7.5. AI/ML

7.6. 5G/6G

7.7. Blockchain

7.8. IoT

7.9. Location Services

7.10. Edge Computing

7.11. Exoskeleton

8. Global Industrial Metaverse Market, By Application (USD Million) 2021-2034

8.1. Prototyping, Testing, and Simulation

8.2. Predictive Maintenance

8.3. Training

8.4. Facility Optimization

8.5. Research & Development

8.6. Workplace Safety

8.7. Warehousing & Logistics

8.8. Customer Interactions

8.9. Other Applications

9. Global Industrial Metaverse Market, By End-use Industry (USD Million) 2021-2034

9.1. Automotive

9.2. Industrial Goods & Manufacturing

9.3. Power & Utilities

9.4. Transportation

9.5. Supply Chain & Logistics

9.6. Other End-use Industries

10. Global Industrial Metaverse Market, (USD Million) 2021-2034

10.1. Global Industrial Metaverse Market Size and Market Share

11. Global Industrial Metaverse Market, By Region, (USD Million) 2021-2034

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. ABB Ltd

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. Siemens AG

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. IBM Corporation

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. Robert Bosch GmbH

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. Oracle Corporation

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. Microsoft Corporation

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. Nvidia Corporation

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. Cisco Systems, Inc

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. Dassault Systèmes SE

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. Altair Engineering Inc

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. PTC Inc

12.11.1. Company details

12.11.2. Financial outlook

12.11.3. Product summary

12.11.4. Recent developments

12.12. Intel Corporation

12.12.1. Company details

12.12.2. Financial outlook

12.12.3. Product summary

12.12.4. Recent developments

12.13. Penguin Solutions

12.13.1. Company details

12.13.2. Financial outlook

12.13.3. Product summary

12.13.4. Recent developments

12.14. SAP SE

12.14.1. Company details

12.14.2. Financial outlook

12.14.3. Product summary

12.14.4. Recent developments

12.15. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links