Fiber Laser Market Introduction and Overview

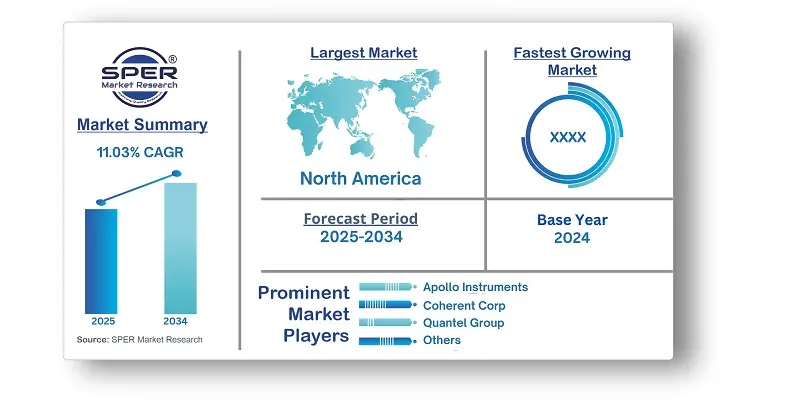

According to SPER Market Research, the Global Fiber Laser Market is estimated to reach USD 21.6 billion by 2034 with a CAGR of 11.03%.

The report includes an in-depth analysis of the Global Fiber Laser Market, including market size and trends, product mix, Applications, and supplier analysis. The growing demand for efficiency, precision, and reliability is fueling the fiber laser market's expansion. Fiber lasers are used in manufacturing, medicine, telecommunications, and electronics for their energy efficiency and precision. Integration with AI optimizes performance, improves quality control, enables predictive maintenance, and enhances automation, boosting safety and productivity across industries like 3D printing, diagnostics, and robotics. Fiber lasers are gaining traction across industries like automotive, aerospace, and manufacturing for their precision and efficiency in cutting, welding, and marking. Advancements in high-power fiber lasers enable faster processing, improved productivity, and handling of thicker materials, driving market growth. However, Fiber lasers are vulnerable to contamination, especially within the fiber optic delivery system. Dust, debris, or minor damage can impact laser performance and beam quality. As a result, frequent cleaning and maintenance are required, potentially hindering market growth.

By Type: The fiber laser market is segmented by type into Infrared, Ultraviolet, Ultrafast, and Visible Fiber Lasers. Infrared fiber lasers dominate the market due to their widespread use in industrial applications like metal cutting, welding, and marking, offering high power and precision. The fastest-growing segment is Ultrafast Fiber Lasers, driven by their rising use in scientific research, materials processing, and medical fields.

By Application: The fiber laser market is segmented by application into High Power, Marking, Fine Processing, and Micro Processing. High-power applications lead the market, driven by demand from industries like automotive, aerospace, and manufacturing for cutting and welding thick materials. The fastest-growing segment is marking, fueled by the rising use of fiber lasers for product identification, labeling, and engraving in sectors such as electronics, packaging, and medical devices.

By Regional Insights: Regional market insights for North America, Europe, Asia-Pacific, and the rest of the world are provided by the report. With a robust manufacturing sector, especially in the automotive, aerospace, and electronics industries, where fiber lasers are widely used for cutting, welding, and marking, North America is predicted to lead the fiber laser market. Furthermore, the expansion of fitness centers and health clubs will boost regional market expansion.

Market Competitive Landscape:

The market is moderately consolidated. Some of the market key players are Amonics Ltd, Apollo Instruments, Inc, Coherent Corp, CY Laser SRL, IPG Photonics Corporation, Jenoptik Group, NKT Photonics A/S, Quantel Group, and Toptica Photonics AG.

Recent Developments:

- IPG Photonics introduced three deep ultraviolet (Deep UV) lasers in January 2023. These lasers use patented non-linear crystals, which offer more versatile and durable solutions than lasers that use traditional frequency conversion materials for micromachining applications. It is anticipated that this key product introduction will boost IPG Photonics' fiber laser sales.

- Coherent unveiled a brand-new 4000 W "HighLight FL4000CSM-ARM" fiber laser in June 2020 that is perfect for automotive applications. In addition to meeting the welding specifications for energy storage, e-mobility, and general electrical interconnects made of disparate materials, this new technology provides improved welding capabilities for metals that are challenging to weld.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Type, By Application. |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa. |

| Companies Covered | Amonics Ltd, Apollo Instruments, Inc, Coherent Corp, CY Laser SRL, IPG Photonics Corporation, Jenoptik Group, NKT Photonics A/S, Quantel Group, and Toptica Photonics AG. and others. |

Key Topics Covered in the Report:

- Global Fiber Laser Market Size (FY’2021-FY’2034)

- Overview of Global Fiber Laser Market

- Segmentation of Global Fiber Laser Market By Type (Infrared Fiber Laser, Ultraviolet Fiber Laser, Ultrafast Fiber Laser, Visible Fiber Laser)

- Segmentation of Global Fiber Laser Market By Application (High power, Marking, Fine Processing, Micro-processing)

- Statistical Snap of Global Fiber Laser Market

- Expansion Analysis of Global Fiber Laser Market

- Problems and Obstacles in Global Fiber Laser Market

- Competitive Landscape in the Global Fiber Laser Market

- Details on Current Investment in Global Fiber Laser Market

- Competitive Analysis of Global Fiber Laser Market

- Prominent Players in the Global Fiber Laser Market

- SWOT Analysis of Global Fiber Laser Market

- Global Fiber Laser Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Fiber Laser Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Fiber Laser Market

7. Global Fiber Laser Market, By Type, (USD Million) 2021-2034

7.1. Infrared Fiber Laser

7.2. Ultraviolet Fiber Laser

7.3. Ultrafast Fiber Laser

7.4. Visible Fiber Laser

8. Global Fiber Laser Market, By Application, (USD Million) 2021-2034

8.1. High power

8.2. Marking

8.3. Fine Processing

8.4. Micro-processing

9. Global Fiber Laser Market, (USD Million) 2021-2034

9.1. Global Fiber Laser Market Size and Market Share

10. Global Fiber Laser Market, By Region, (USD Million) 2021-2034

10.1. Asia-Pacific

10.1.1. Australia

10.1.2. China

10.1.3. India

10.1.4. Japan

10.1.5. South Korea

10.1.6. Rest of Asia-Pacific

10.2. Europe

10.2.1. France

10.2.2. Germany

10.2.3. Italy

10.2.4. Spain

10.2.5. United Kingdom

10.2.6. Rest of Europe

10.3. Middle East and Africa

10.3.1. Kingdom of Saudi Arabia

10.3.2. United Arab Emirates

10.3.3. Qatar

10.3.4. South Africa

10.3.5. Egypt

10.3.6. Morocco

10.3.7. Nigeria

10.3.8. Rest of Middle-East and Africa

10.4. North America

10.4.1. Canada

10.4.2. Mexico

10.4.3. United States

10.5. Latin America

10.5.1. Argentina

10.5.2. Brazil

10.5.3. Rest of Latin America

11. Company Profile

11.1. Amonics Ltd

11.1.1. Company details

11.1.2. Financial outlook

11.1.3. Product summary

11.1.4. Recent developments

11.2. Apollo Instruments, Inc

11.2.1. Company details

11.2.2. Financial outlook

11.2.3. Product summary

11.2.4. Recent developments

11.3. Coherent Corp

11.3.1. Company details

11.3.2. Financial outlook

11.3.3. Product summary

11.3.4. Recent developments

11.4. CY Laser SRL

11.4.1. Company details

11.4.2. Financial outlook

11.4.3. Product summary

11.4.4. Recent developments

11.5. IPG Photonics Corporation

11.5.1. Company details

11.5.2. Financial outlook

11.5.3. Product summary

11.5.4. Recent developments

11.6. Jenoptik Group

11.6.1. Company details

11.6.2. Financial outlook

11.6.3. Product summary

11.6.4. Recent developments

11.7. NKT Photonics A/S

11.7.1. Company details

11.7.2. Financial outlook

11.7.3. Product summary

11.7.4. Recent developments

11.8. Quantel Group

11.8.1. Company details

11.8.2. Financial outlook

11.8.3. Product summary

11.8.4. Recent developments

11.9. Toptica Photonics AG

11.9.1. Company details

11.9.2. Financial outlook

11.9.3. Product summary

11.9.4. Recent developments

11.10. Others

12. Conclusion

13. List of Abbreviations

14. Reference Links