Hydrogen Technology Testing, Inspection and Certification (TIC) Market Introduction and Overview

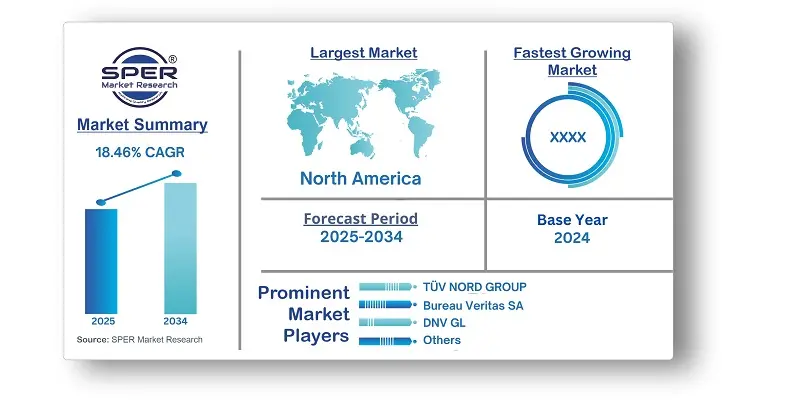

According to SPER Market Research, the Global Hydrogen Technology Testing, Inspection and Certification (TIC) Market is estimated to reach USD 19.34 billion by 2034 with a CAGR of 18.46%.

The report includes an in-depth analysis of the Global Hydrogen Technology Testing, Inspection and Certification (TIC) Market, including market size and trends, product mix, Applications, and supplier analysis. The growing share is fueled by the rising adoption of hydrogen as a clean energy source and the increasing demand for strict safety and performance standards. As nations prioritize hydrogen in their energy transition plans, the need for dependable testing, inspection, and certification (TIC) services is escalating. These services guarantee that hydrogen production, storage, and distribution technologies comply with regulatory standards and safety protocols, building trust among stakeholders. The development of hydrogen applications, including fuel cells and hydrogen-powered vehicles, requires thorough testing and certification to reduce risks and improve operational efficiency. However, Building a low-carbon hydrogen system is challenging due to limited clean hydrogen infrastructure, high costs of production, and lack of a global market. Green hydrogen is particularly expensive but essential for Net Zero goals.

By Service Type: In 2024, the testing segment led the market, driven by the growing adoption of hydrogen-based systems like fuel cells and storage solutions. Ensuring their safety, efficiency, and performance became essential, with testing identifying hazards such as leaks or material degradation, especially in high-pressure environments. Stricter regulations and increased research and development in hydrogen infrastructure further boosted demand. Meanwhile, the inspection segment is expected to see significant growth as the need for regular checks to prevent risks like leaks or equipment malfunctions rises with the expansion of hydrogen systems.

By Testing Type: In 2024, the hydrogen permeation and compatibility testing segment led the market, driven by the need to prevent material degradation, embrittlement, and leaks, which pose significant safety risks. As hydrogen use increases, ensuring the compatibility of materials like metals, polymers, and composites with hydrogen environments becomes essential, particularly in storage, transportation, and fuel cell systems. This growth is fueled by the demand for advanced testing solutions to meet strict regulatory standards. Meanwhile, the pressure cycle, leakage, and tightness testing segment is expected to experience the highest growth due to the risks associated with storing and transporting hydrogen under extreme pressure.

By Application: In 2024, the refining and chemical segment dominated the market, driven by hydrogen's role in refining operations like hydrocracking and desulfurization to produce cleaner fuels. As industries seek to meet stricter environmental standards, demand for hydrogen-based processes increases, fueling the need for comprehensive testing and inspection. Hydrogen's growing use in chemical production also boosts the need for TIC services. Meanwhile, the mobility segment is expected to grow the fastest, driven by the rise of hydrogen-powered vehicles and infrastructure.

By Process: In 2024, the generation segment led the market, driven by the growing focus on green hydrogen production and the need for strict quality control in hydrogen generation technologies. As industries transition to low-carbon hydrogen, particularly through electrolysis and renewable methods, ensuring efficiency, safety, and compliance becomes essential. Testing, inspection, and certification (TIC) of hydrogen generation plants are vital for meeting regulatory standards and optimizing performance.

By Regional Insights: The hydrogen technology testing, inspection, and certification market in North America is expected to experience the highest growth rate during the forecast period. The region's strong commitment to building a hydrogen economy, backed by government policies and private sector efforts, has increased the demand for extensive TIC services. Key drivers include significant investments in hydrogen research and development, the creation of hydrogen refueling networks, and collaborations aimed at scaling hydrogen production and usage.

Market Competitive Landscape:

The market is moderately consolidated. Some of the market key players are Applus+, Bureau Veritas SA, DEKRA SE, DNV GL, Intertek Group plc, SGS SA, TUV NORD GROUP, TUV Rheinland, TUV SUD, UL LLC, and others.

Recent Developments:

- The Baker Hughes Company opened a new hydrogen testing facility in January 2024 with the goal of confirming that their NovaLT industrial turbines can run on hydrogen mixtures of up to 100%. In addition to offering complete fuel flexibility, the facility has a test bench that can do full-load testing, accommodate pressures up to 300 psi, and store 2,450 kg of fuel. A key location for the Baker Hughes Company's customer partnerships in the growing hydrogen economy will be this new hydrogen testing facility.

- In November 2023, the first phase of an investment program for USD 10 million was launched by London-based TIC services provider Element Materials Technology. Purchasing cutting-edge hydrogen testing apparatus and growing its worldwide hydrogen technology staff are two aspects of this commitment.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Service Type, By Process, By Testing Type, By Application. |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa. |

| Companies Covered | Applus+, Bureau Veritas SA, DEKRA SE, DNV GL, Intertek Group plc, SGS SA, TUV NORD GROUP, TUV Rheinland, TUV SUD, UL LLC, and others. |

Key Topics Covered in the Report:

- Global Hydrogen Technology Testing, Inspection and Certification (TIC) Market Size (FY’2021-FY’2034)

- Overview of Global Hydrogen Technology Testing, Inspection and Certification (TIC) Market

- Segmentation of Global Hydrogen Technology Testing, Inspection and Certification (TIC) Market By Service Type (Testing, Inspection, Certification)

- Segmentation of Global Hydrogen Technology Testing, Inspection and Certification (TIC) Market By Process (Generation, Storage, Transportation)

- Segmentation of Global Hydrogen Technology Testing, Inspection and Certification (TIC) Market By Testing Type (Overpressure, Burst, And Flow Testing, Pressure Cycle, Leakage, And Tightness Testing, Hydrogen Permeation And Compatibility Testing)

- Segmentation of Global Hydrogen Technology Testing, Inspection and Certification (TIC) Market By Application (Mobility, Refining & Chemical, Energy, Others)

- Statistical Snap of Global Hydrogen Technology Testing, Inspection and Certification (TIC) Market

- Expansion Analysis of Global Hydrogen Technology Testing, Inspection and Certification (TIC) Market

- Problems and Obstacles in Global Hydrogen Technology Testing, Inspection and Certification (TIC) Market

- Competitive Landscape in the Global Hydrogen Technology Testing, Inspection and Certification (TIC) Market

- Details on Current Investment in Global Hydrogen Technology Testing, Inspection and Certification (TIC) Market

- Competitive Analysis of Global Hydrogen Technology Testing, Inspection and Certification (TIC) Market

- Prominent Players in the Global Hydrogen Technology Testing, Inspection and Certification (TIC) Market

- SWOT Analysis of Global Hydrogen Technology Testing, Inspection and Certification (TIC) Market

- Global Hydrogen Technology Testing, Inspection and Certification (TIC) Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Hydrogen Technology Testing, Inspection and Certification (TIC) Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Hydrogen Technology Testing, Inspection and Certification (TIC) Market

7. Global Hydrogen Technology Testing, Inspection and Certification (TIC) Market, By Service Type, (USD Million) 2021-2034

7.1. Testing

7.2. Inspection

7.3. Certification

8. Global Hydrogen Technology Testing, Inspection and Certification (TIC) Market, By Process, (USD Million) 2021-2034

8.1. Generation

8.2. Storage

8.3. Transportation

9. Global Hydrogen Technology Testing, Inspection and Certification (TIC) Market, By Testing Type, (USD Million) 2021-2034

9.1. Overpressure, Burst, And Flow Testing

9.2. Pressure Cycle, Leakage, And Tightness Testing

9.3. Hydrogen Permeation And Compatibility Testing

10. Global Hydrogen Technology Testing, Inspection and Certification (TIC) Market, By Application, (USD Million) 2021-2034

10.1. Mobility

10.2. Refining & Chemical

10.3. Energy

10.4. Others

11. Global Hydrogen Technology Testing, Inspection and Certification (TIC) Market, (USD Million) 2021-2034

11.1. Global Hydrogen Technology Testing, Inspection and Certification (TIC) Market Size and Market Share

12. Global Hydrogen Technology Testing, Inspection and Certification (TIC) Market, By Region, (USD Million) 2021-2034

12.1. Asia-Pacific

12.1.1. Australia

12.1.2. China

12.1.3. India

12.1.4. Japan

12.1.5. South Korea

12.1.6. Rest of Asia-Pacific

12.2. Europe

12.2.1. France

12.2.2. Germany

12.2.3. Italy

12.2.4. Spain

12.2.5. United Kingdom

12.2.6. Rest of Europe

12.3. Middle East and Africa

12.3.1. Kingdom of Saudi Arabia

12.3.2. United Arab Emirates

12.3.3. Qatar

12.3.4. South Africa

12.3.5. Egypt

12.3.6. Morocco

12.3.7. Nigeria

12.3.8. Rest of Middle-East and Africa

12.4. North America

12.4.1. Canada

12.4.2. Mexico

12.4.3. United States

12.5. Latin America

12.5.1. Argentina

12.5.2. Brazil

12.5.3. Rest of Latin America

13. Company Profile

13.1. Applus+

13.1.1. Company details

13.1.2. Financial outlook

13.1.3. Product summary

13.1.4. Recent developments

13.2. Bureau Veritas SA

13.2.1. Company details

13.2.2. Financial outlook

13.2.3. Product summary

13.2.4. Recent developments

13.3. DEKRA SE

13.3.1. Company details

13.3.2. Financial outlook

13.3.3. Product summary

13.3.4. Recent developments

13.4. DNV GL

13.4.1. Company details

13.4.2. Financial outlook

13.4.3. Product summary

13.4.4. Recent developments

13.5. Intertek Group plc

13.5.1. Company details

13.5.2. Financial outlook

13.5.3. Product summary

13.5.4. Recent developments

13.6. SGS SA

13.6.1. Company details

13.6.2. Financial outlook

13.6.3. Product summary

13.6.4. Recent developments

13.7. TUV NORD GROUP

13.7.1. Company details

13.7.2. Financial outlook

13.7.3. Product summary

13.7.4. Recent developments

13.8. TUV Rheinland

13.8.1. Company details

13.8.2. Financial outlook

13.8.3. Product summary

13.8.4. Recent developments

13.9. TUV SUD

13.9.1. Company details

13.9.2. Financial outlook

13.9.3. Product summary

13.9.4. Recent developments

13.10. UL LLC

13.10.1. Company details

13.10.2. Financial outlook

13.10.3. Product summary

13.10.4. Recent developments

13.11. Others

14. Conclusion

15. List of Abbreviations

16. Reference Links