Blood Collection Market Introduction and Overview

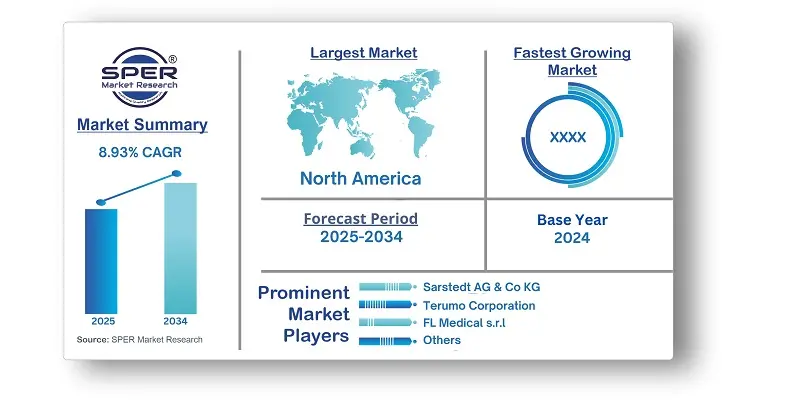

According to SPER Market Research, the Global Blood Collection Market is estimated to reach USD 9.08 billion by 2034 with a CAGR of 8.93%.

The report includes an in-depth analysis of the Global Blood Collection Market, including market size and trends, product mix, Applications, and supplier analysis. The global blood collection market was valued at USD 3.86 billion in 2024 and is expected to grow at a rate of 8.93% from 2025 to 2034. This growth is driven by more diagnostic procedures using blood samples, including disease screening and medication monitoring. Regular blood tests are important for evaluating and monitoring chronic illnesses like diabetes, cardiovascular disease, and cancer. The rise in chronic diseases will likely increase the need for diagnostic testing and blood collection equipment.

By Collection Site Insights: The venous segment led the market in 2024, holding the largest revenue share. There is an increasing demand for venous blood collection due to the need for detailed diagnostic testing in healthcare. As chronic diseases like diabetes, heart conditions, and cancer rise, more routine and advanced blood tests are needed, many requiring venous samples. Venous collection allows for larger samples for multiple tests from one draw, which is important for complex health cases. Additionally, the growth of decentralized trials and home health services boosts the demand for venous collection for reliable remote patient monitoring.

By Application Insights: Diagnostics held a major share of the market in 2024 and is expected to grow the fastest in the coming years, due to the rising demand for accurate, quick, and less invasive testing in healthcare. Blood collection for diagnostics is vital for detecting various medical issues, including common infections and chronic diseases. A notable example is blood tests for diabetes management, where regular blood draws track glucose levels and inform treatment.

By Method Insights: The manual blood collection segment led the market with a large share in 2024, mainly due to its common use in different healthcare settings, from primary care to specialized clinics, where reliable and affordable blood collection is important. Manual methods offer healthcare providers more control and flexibility, especially for patients with difficult vein access, including children and the elderly. This method is still popular in areas with limited access to advanced automated systems.

By End User Insights: The hospitals segment had a large market share in 2024. Hospitals and clinics serve many patients daily, performing routine blood tests, emergency care, and surgeries. The frequent blood tests create steady demand for vacuum blood collection tubes. Additionally, rising healthcare spending in developing countries is resulting in new hospital construction and upgrades to current facilities.

Regional Insights: In 2024, North America dominated the blood collection industry, accounting for the majority of revenue. Several factors are driving the expansion of the North American market, including an increase in the number of accidents, a rise in the frequency of chronic and lifestyle diseases, and a growing elderly population.

Market Competitive Landscape:

The blood collection industry is competitive, involving large global firms and smaller companies vying for market share. Success relies on regularly introducing new products and technologies. Major players greatly influence the market through significant R&D investments. Strategic partnerships and mergers and acquisitions are vital for expanding reach, though strict regulations pose challenges for newcomers. Key market players are Abbott, NIPRO Medical Corporation, BD, Terumo Corporation; Medtronic, QIAGEN, FL Medical s.r.l, Greiner AG, Haemonetics Corporation, F. Hoffmann-La Roche Ltd, Sarstedt AG & Co KG, Centogene N.V, SEKISUI CHEMICAL CO, LTD.

Recent Developments:

- In April 2024, Becton, Dickinson, and Company launched the BD Vacutainer UltraTouch push button blood collection set in India. This device uses BD RightGauge technology for a thinner needle and BD PentaPoint Technology to reduce insertion pain, enhancing patient comfort and blood collection efficiency.

- In December 2023, BD (Becton, Dickinson & Company) announced it received 510(k) clearance from the U. S. Food and Drug Administration (FDA) for a new blood collection device that obtains samples through a fingerstick.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Collection Site, By Application, By Method, By End User. |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa. |

| Companies Covered | Abbott, NIPRO Medical Corporation, BD, Terumo Corporation; Medtronic, QIAGEN, FL Medical s.r.l, Greiner AG, Haemonetics Corporation, F. Hoffmann-La Roche Ltd, Sarstedt AG & Co KG, Centogene N.V, SEKISUI CHEMICAL CO, LTD. and others. |

Key Topics Covered in the Report:

- Global Blood Collection Market Size (FY’2021-FY’2034)

- Overview of Global Blood Collection Market

- Segmentation of Global Blood Collection Market By Collection Site (Venous, Capillary)

- Segmentation of Global Blood Collection Market By Application (Diagnostics, Treatment)

- Segmentation of Global Blood Collection Market By Method (Manual, Automated)

- Segmentation of Global Blood Collection Market By End User (Hospitals, Diagnostics Centers, Blood Banks, Emergency Departments, Others)

- Statistical Snap of Global Blood Collection Market

- Expansion Analysis of Global Blood Collection Market

- Problems and Obstacles in Global Blood Collection Market

- Competitive Landscape in the Global Blood Collection Market

- Details on Current Investment in Global Blood Collection Market

- Competitive Analysis of Global Blood Collection Market

- Prominent Players in the Global Blood Collection Market

- SWOT Analysis of Global Blood Collection Market

- Global Blood Collection Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Blood Collection Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Blood Collection Market

7. Global Blood Collection Market, By Collection Site (USD Million) 2021-2034

7.1. Venous

7.1.1. Needles and Syringes

7.1.2. Double-Ended Needles

7.1.3. Winged Blood Collection Sets

7.1.4. Standard Hypodermic Needles

7.1.5. Other Blood Collection Needles

7. 2. Blood Collection Tubes

7.1.1. Serum-separating

7.1.2. EDTA

7.1.3. Heparin

7.1.4. Plasma-separating

7.1.5. Blood Bags

7.1.6. Others

7.3. Capillary

7.3.1. Lancets

7.3.2. Micro-Container Tubes

7.3.3. Micro-Hematocrit Tubes

7.3.4. Warming Devices

7.3.5. Others

8. Global Blood Collection Market, By Application (USD Million) 2021-2034

8.1. Diagnostics

8.2. Treatment

9. Global Blood Collection Market, By Method (USD Million) 2021-2034

9.1. Manual Blood Collection

9.2. Automated Blood Collection

10. Global Blood Collection Market, By End User (USD Million) 2021-2034

10.1. Hospitals

10.2. Diagnostics Centers

10.3. Blood Banks

10.4. Emergency Departments

10.5. Others

11. Global Blood Collection Market, (USD Million) 2021-2034

11.1. Global Blood Collection Market Size and Market Share

12. Global Blood Collection Market, By Region, (USD Million) 2021-2034

12.1. Asia-Pacific

12.1.1. Australia

12.1.2. China

12.1.3. India

12.1.4. Japan

12.1.5. South Korea

12.1.6. Rest of Asia-Pacific

12.2. Europe

12.2.1. France

12.2.2. Germany

12.2.3. Italy

12.2.4. Spain

12.2.5. United Kingdom

12.2.6. Rest of Europe

12.3. Middle East and Africa

12.3.1. Kingdom of Saudi Arabia

12.3.2. United Arab Emirates

12.3.3. Qatar

12.3.4. South Africa

12.3.5. Egypt

12.3.6. Morocco

12.3.7. Nigeria

12.3.8. Rest of Middle-East and Africa

12.4. North America

12.4.1. Canada

12.4.2. Mexico

12.4.3. United States

12.5. Latin America

12.5.1. Argentina

12.5.2. Brazil

12.5.3. Rest of Latin America

13. Company Profile

13.1. Abbott

13.1.1. Company details

13.1.2. Financial outlook

13.1.3. Product summary

13.1.4. Recent developments

13.2. NIPRO Medical Corporation

13.2.1. Company details

13.2.2. Financial outlook

13.2.3. Product summary

13.2.4. Recent developments

13.3. BD

13.3.1. Company details

13.3.2. Financial outlook

13.3.3. Product summary

13.3.4. Recent developments

13.4. Terumo Corporation

13.4.1. Company details

13.4.2. Financial outlook

13.4.3. Product summary

13.4.4. Recent developments

13.5. Medtronic

13.5.1. Company details

13.5.2. Financial outlook

13.5.3. Product summary

13.5.4. Recent developments

13.6. QIAGEN

13.6.1. Company details

13.6.2. Financial outlook

13.6.3. Product summary

13.6.4. Recent developments

13.7. FL Medical s.r.l

13.7.1. Company details

13.7.2. Financial outlook

13.7.3. Product summary

13.7.4. Recent developments

13.8. Greiner AG

13.8.1. Company details

13.8.2. Financial outlook

13.8.3. Product summary

13.8.4. Recent developments

13.9. Haemonetics Corporation

13.9.1. Company details

13.9.2. Financial outlook

13.9.3. Product summary

13.9.4. Recent developments

13.10. F. Hoffmann-La Roche Ltd

13.10.1. Company details

13.10.2. Financial outlook

13.10.3. Product summary

13.10.4. Recent developments

13.11. Sarstedt AG & Co. KG

13.11.1. Company details

13.11.2. Financial outlook

13.11.3. Product summary

13.11.4. Recent developments

13.12. Centogene N.V

13.12.1. Company details

13.12.2. Financial outlook

13.12.3. Product summary

13.12.4. Recent developments

13.13. Others

14. Conclusion

15. List of Abbreviations

16. Reference Links