Dental Implants Market Introduction and Overview

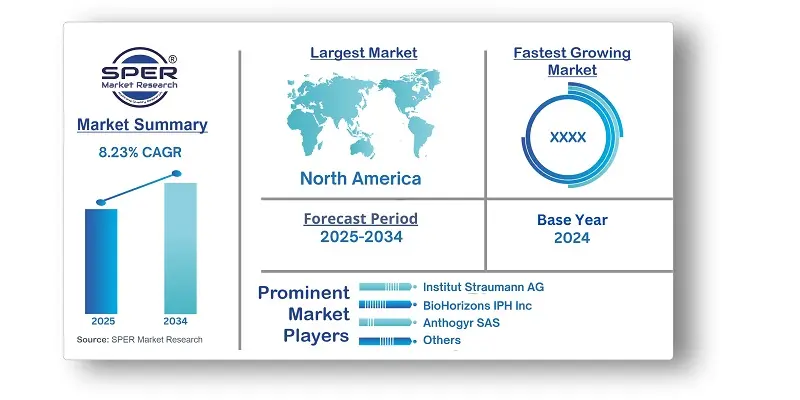

According to SPER Market Research, the Global Dental Implants Market is estimated to reach USD 14.78 billion by 2034 with a CAGR of 8.23%.

The report includes an in-depth analysis of the Global Dental Implants Market, including market size and trends, product mix, Applications, and supplier analysis. The global dental implants market is experiencing significant growth due to rising cases of tooth loss, increasing demand for cosmetic dentistry, and advancements in implant technology. Dental implants provide a long-lasting and effective solution for missing teeth, offering better functionality and aesthetics compared to traditional dentures and bridges. Key drivers include an aging population, growing awareness of oral health, technological innovations such as 3D printing and AI-driven treatment planning, and the increasing adoption of minimally invasive procedures. However, challenges such as the high cost of implants, limited insurance coverage, and the need for skilled professionals can hinder market expansion. Despite these challenges, continued advancements in materials and techniques are expected to drive further growth in the dental implants market.

By Implant Insights: Based on the kind of implant, the market is divided into titanium and zirconium implants. Because titanium dental implants are so widely used, the titanium category accounted for the biggest portion of total revenue in 2024. The primary advantage of using pure titanium is that it is biocompatible. Since titanium dioxide is extremely harmful to humans, it must be eliminated from titanium implants. Over the course of the forecast period, the zirconium segment is expected to increase at the fastest rate.

By Regional Insights: With the largest percentage of global sales in 2024, the North American dental implants market led the world. The increasing number of elderly people in the area, their high prevalence of dental disorders, and their high level of awareness of oral preventative and restorative care are some of the main factors driving the region.

Market Competitive Landscape:

Key players in the market include Nobel Biocare Services AG, Zimmer Biomet Holdings, Inc. , OSSTEM IMPLANT, Institut Straumann AG, and DENTSPLY Sirona. Nobel Biocare, part of Danaher Corporation, offers dental implant systems and digital solutions, focusing on research and high-quality care. Companies are pursuing strategies like new product customization, partnerships, and mergers to grow in dental implantology.

Recent Developments:

- In October 2024, Dentsply Sirona and the McGuire Institute (iMc) launched the PrimeTaper EV Implant Registry to evaluate the devices functionality in a range of actual clinical settings. The registry has thus far revealed an impressive 99% survival rate for the PrimeTaper EV Implant, with more than 300 doctors across the country providing data on around 2,000 implants.

- In May 2023, Straumann announced the acquisition of GalvoSurge, a Swiss manufacturer of oral medical equipment. The business specializes in implant maintenance and care products. With a CE mark, the GalvoSurge Dental Implant Cleaning System GS 1000 has been available since 2020 and aids in the treatment of peri-implantitis.

- In May 2023, T-Plus declared that its ST implant device was now accessible for sale in the Chinese market after an 8-year NMPA registration procedure.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Implant. |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa. |

| Companies Covered | Anthogyr SAS, Bicon LLC, BioHorizons IPH Inc, DENTIS, DENTSPLY Sirona, Institut Straumann AG, Leader Italy, Nobel Biocare Services AG, OSSTEM IMPLANT, Zimmer Biomet Holdings Inc. and others. |

Key Topics Covered in the Report:

- Global Dental Implants Market Size (FY’2021-FY’2034)

- Overview of Global Dental Implants Market

- Segmentation of Global Dental Implants Market By Implant (Titanium Implants, Zirconia Implants)

- Statistical Snap of Global Dental Implants Market

- Expansion Analysis of Global Dental Implants Market

- Problems and Obstacles in Global Dental Implants Market

- Competitive Landscape in the Global Dental Implants Market

- Details on Current Investment in Global Dental Implants Market

- Competitive Analysis of Global Dental Implants Market

- Prominent Players in the Global Dental Implants Market

- SWOT Analysis of Global Dental Implants Market

- Global Dental Implants Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Dental Implants Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Dental Implants Market

7. Global Dental Implants Market, By Implant (USD Million) 2021-2034

7.1. Titanium Implants

7.2. Zirconia Implants

8. Global Dental Implants Market, (USD Million) 2021-2034

8.1. Global Dental Implants Market Size and Market Share

9. Global Dental Implants Market, By Region, (USD Million) 2021-2034

9.1. Asia-Pacific

9.1.1. Australia

9.1.2. China

9.1.3. India

9.1.4. Japan

9.1.5. South Korea

9.1.6. Rest of Asia-Pacific

9.2. Europe

9.2.1. France

9.2.2. Germany

9.2.3. Italy

9.2.4. Spain

9.2.5. United Kingdom

9.2.6. Rest of Europe

9.3. Middle East and Africa

9.3.1. Kingdom of Saudi Arabia

9.3.2. United Arab Emirates

9.3.3. Qatar

9.3.4. South Africa

9.3.5. Egypt

9.3.6. Morocco

9.3.7. Nigeria

9.3.8. Rest of Middle-East and Africa

9.4. North America

9.4.1. Canada

9.4.2. Mexico

9.4.3. United States

9.5. Latin America

9.5.1. Argentina

9.5.2. Brazil

9.5.3. Rest of Latin America

10. Company Profile

10.1. Anthogyr SAS

10.1.1. Company details

10.1.2. Financial outlook

10.1.3. Product summary

10.1.4. Recent developments

10.2. Bicon, LLC

10.2.1. Company details

10.2.2. Financial outlook

10.2.3. Product summary

10.2.4. Recent developments

10.3. BioHorizons IPH, Inc

10.3.1. Company details

10.3.2. Financial outlook

10.3.3. Product summary

10.3.4. Recent developments

10.4. DENTIS

10.4.1. Company details

10.4.2. Financial outlook

10.4.3. Product summary

10.4.4. Recent developments

10.5. DENTSPLY Sirona

10.5.1. Company details

10.5.2. Financial outlook

10.5.3. Product summary

10.5.4. Recent developments

10.6. Institut Straumann AG

10.6.1. Company details

10.6.2. Financial outlook

10.6.3. Product summary

10.6.4. Recent developments

10.7. Leader Italy

10.7.1. Company details

10.7.2. Financial outlook

10.7.3. Product summary

10.7.4. Recent developments

10.8. Nobel Biocare Services AG

10.8.1. Company details

10.8.2. Financial outlook

10.8.3. Product summary

10.8.4. Recent developments

10.9. OSSTEM IMPLANT

10.9.1. Company details

10.9.2. Financial outlook

10.9.3. Product summary

10.9.4. Recent developments

10.10. Zimmer Biomet Holdings, Inc

10.10.1. Company details

10.10.2. Financial outlook

10.10.3. Product summary

10.10.4. Recent developments

10.11. Others

11. Conclusion

12. List of Abbreviations

13. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.