Digestive & Intestinal Remedies Market Introduction and Overview

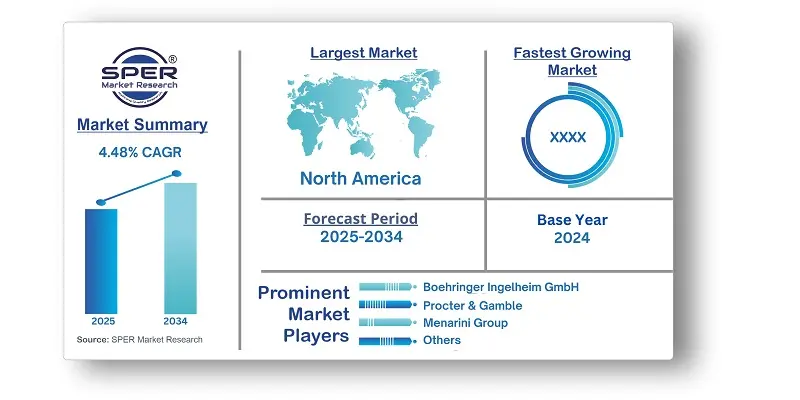

According to SPER Market Research, the Global Digestive & Intestinal Remedies Market is estimated to reach USD 33.32 billion by 2034 with a CAGR of 4.48%.

The report includes an in-depth analysis of the Global Digestive & Intestinal Remedies Market, including market size and trends, product mix, Applications, and supplier analysis. The market for digestive medicine products, such as Dulcolax, Iberogast, and Perenterol, is expanding quickly due to rising customer demand. The primary cause of this increase is the growing incidence of gastrointestinal illnesses around the globe. OTC therapies are getting more and more popular as conditions including GERD, irritable bowel syndrome, constipation, and inflammatory bowel disease (IBD) become more common. The need for easily available and efficient remedies is anticipated to continue driving market growth in the upcoming years as awareness of these disorders rises. Businesses have a great chance to profit from a booming industry thanks to this trend. However, challenges such as increasing competition from generic products and concerns over the side effects of long-term use of OTC medications. Additionally, regulatory hurdles and varying market dynamics across regions can impact growth.

By Type: The digestive medicines segment leads the market, widely used for treating acid reflux, heartburn, stomach ulcers, and excess stomach acid. Peptic ulcer disease (PUD) affects millions globally, with a significant portion of the population experiencing it at some point in their lifetime. This widespread condition is expected to drive the demand for digestive medicines. Additionally, the gastrointestinal remedies segment is anticipated to see substantial growth due to ongoing research and development in treatments for various gastrointestinal issues.

By Age Group: The adult and geriatric segment holds the largest share of the market, driven by the high prevalence of digestive diseases in these age groups. Reports indicate that digestive disorders affect a large number of individuals in Europe and the Mediterranean region, contributing to significant economic challenges. These conditions are particularly common among young children and the elderly, with the growing prevalence creating a notable opportunity within the segment.

By Distribution Channel: The offline segment captured a significant portion of the market in 2024 and is projected to see steady growth in the coming years. As the demand for digestive and intestinal remedies rises, consumers are increasingly drawn to physical stores that prioritize sustainability. Many believe these stores provide clearer information about product origins and offer more eco-friendly options than online alternatives. Consequently, sales in brick-and-mortar stores are expected to grow, positively influencing the overall market.

By Regional Insights: The North American digestive and intestinal remedies market holds a significant share, driven by the high prevalence of gastrointestinal disorders and a well-established healthcare infrastructure that supports both natural and synthetic treatments. The region benefits from advanced research efforts and a strong focus on patient-centered care, which encourages the development and use of innovative remedies for gastrointestinal issues. However, challenges such as rising healthcare costs and differences in insurance coverage may present barriers to further market growth.

Market Competitive Landscape:

The market is moderately consolidated. Some of the market key players are Abbott, Bayer AG, Boehringer Ingelheim GmbH, GSK plc., Johnson & Johnson Services Inc., Menarini Group, Procter & Gamble, Reckitt Benckiser Group PLC, Sanofi, Takeda Pharmaceutical Company Limited, and others.

Recent Developments:

- In August 2024, the U.S. FDA authorized VOQUEZNA (vonoprazan), a product of Phathom Pharmaceuticals, to treat adult patients' heartburn associated with non-erosive GERD. Market expansion is anticipated as a result of its approval.

- Iberogast is a plant-based digestive aid that was released by Bayer AG in April 2024 and is currently marketed in the United States. This product uses a special combination of six herbs that have been clinically shown to maximize the health benefits of nature. With its dual-action support, Iberogast helps to maintain general digestive health while also successfully easing occasional stomach discomfort.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Type, By Age Group, By Distribution Channel. |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa. |

| Companies Covered | Abbott, Bayer AG, Boehringer Ingelheim GmbH, GSK plc., Johnson & Johnson Services Inc., Menarini Group, Procter & Gamble, Reckitt Benckiser Group PLC, Sanofi, Takeda Pharmaceutical Company Limited, and others. |

Key Topics Covered in the Report:

- Global Digestive & Intestinal Remedies Market Size (FY’2021-FY’2034)

- Overview of Global Digestive & Intestinal Remedies Market

- Segmentation of Global Digestive & Intestinal Remedies Market By Type (Digestive Medicines, Remedies Against Gastrointestinal Complaints, Natural and Synthetic Agents)

- Segmentation of Global Digestive & Intestinal Remedies Market By Age Group, (Adult & Geriatric, Pediatric)

- Segmentation of Global Digestive & Intestinal Remedies Market By Distribution Channel (Offline, Online)

- Statistical Snap of Global Digestive & Intestinal Remedies Market

- Expansion Analysis of Global Digestive & Intestinal Remedies Market

- Problems and Obstacles in Global Digestive & Intestinal Remedies Market

- Competitive Landscape in the Global Digestive & Intestinal Remedies Market

- Details on Current Investment in Global Digestive & Intestinal Remedies Market

- Competitive Analysis of Global Digestive & Intestinal Remedies Market

- Prominent Players in the Global Digestive & Intestinal Remedies Market

- SWOT Analysis of Global Digestive & Intestinal Remedies Market

- Global Digestive & Intestinal Remedies Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Digestive & Intestinal Remedies Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Digestive & Intestinal Remedies Market

7. Global Digestive & Intestinal Remedies Market, By Type, (USD Million) 2021-2034

7.1. Digestive Medicines

7.2. Remedies Against Gastrointestinal Complaints

7.3. Natural and Synthetic Agents

8. Global Digestive & Intestinal Remedies Market, By Age Group, (USD Million) 2021-2034

8.1. Adult & Geriatric

8.2. Pediatric

9. Global Digestive & Intestinal Remedies Market, By Distribution Channel, (USD Million) 2021-2034

9.1. Offline

9.2. Online

10. Global Digestive & Intestinal Remedies Market, (USD Million) 2021-2034

10.1. Global Digestive & Intestinal Remedies Market Size and Market Share

11. Global Digestive & Intestinal Remedies Market, By Region, (USD Million) 2021-2034

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. Abbott

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. Bayer AG

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. Boehringer Ingelheim GmbH

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. GSK plc.

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. Johnson & Johnson Services Inc.

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. Menarini Group

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. Procter & Gamble

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. Reckitt Benckiser Group PLC

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. Sanofi

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. Takeda Pharmaceutical Company Limited

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.