Digital Signage Market Introduction and Overview

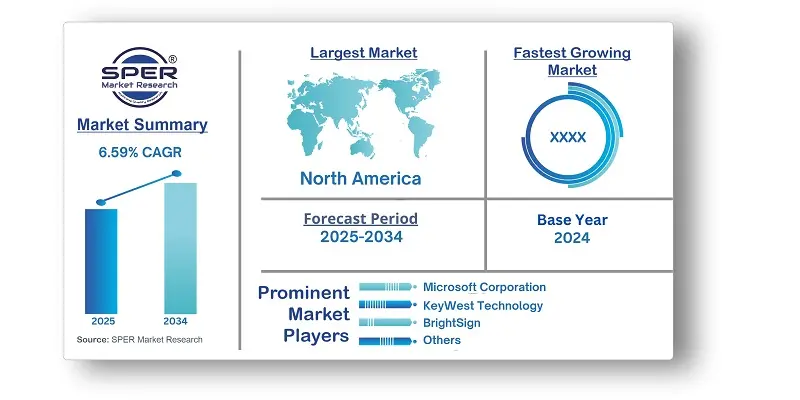

According to SPER Market Research, the Global Digital Signage Market is estimated to reach USD 38.5 billion by 2034 with a CAGR of 6.59%.

The report includes an in-depth analysis of the Global Digital Signage Market, including market size and trends, product mix, Applications, and supplier analysis. The global digital signage market was valued at USD 20.34 billion in 2024, and it is expected to increase at a CAGR of 6.59% between 2025 and 2034. The rising adoption of digital signage in commercial applications, growing demand for digital signage in infrastructure applications, increasing demand for advanced displays such as 4K and 8K displays, and constantly evolving display-related technological advancements are the major factors driving the growth of the digital signage industry.

By Type Insights: The video walls segment had the largest market share in 2024, and this trend is expected to persist. Video screens and kiosks also held a significant share in 2024, with kiosks projected to generate the most revenue by 2030, becoming the largest segment. Kiosks are mainly used for information and advertising in various institutions and retail settings.

By Component Insights: The hardware components segment had the largest market share in 2024 and is expected to keep this position during the forecast period. This segment includes displays and components for digital panels and banners. Hardware needs are more significant than software, giving it a large industry share. Innovative display technologies like 1080p, 4K, and 8K are likely to increase hardware demand. Advances in 3D technology have led to glasses-free 3D displays.

By Technology Insights: LED segment accounted for the largest market share in 2024. LCD technology is widely used in the advertisement and marketing industry. The ease and lower costs of producing LCDs contribute to their popularity in digital posters. However, LEDs stand out for their high-quality display, with manufacturers focusing on designing larger, brighter, and slimmer displays.

By Resolution Insights: The resolution segment is divided into 8K, 4K, full high definition (FHD), high definition (HD), and lower than HD. 8K displays in digital signage offer realistic graphics, ideal for video walls, shop displays, and digital signage, enhancing advertising and promotional content with more detail and clarity.

By Application Insights: The retail sector had the largest market share in 2024 and is the leading sector for digitized advertisements to market products and services. Increased competition and diverse product offerings have raised the need for effective marketing strategies. Consequently, digital posters are widely used in retail to attract target consumers.

Regional Insights: In 2024, North America dominated the market with a large revenue share, followed by Europe. The high percentage is explained by the expansion of devoted product providers as well as the expanding need for signage in the retail sector. As a result of growing government initiatives to install digital signage at various locations for continuous information flow systems and an increase in R&D activities by corporations to improve product quality, the U.S. in particular is expected to see significant development.

Market Competitive Landscape:

Key market players in the digital signage industry are focusing on partnerships, technology innovation, and geographic expansion to improve their market position. Companies are working with tech providers to add advanced features like AI, IoT, and cloud-based content management to their signage solutions, boosting functionality and customer engagement. They are also expanding product offerings for various sectors, including retail, healthcare, and transportation, while investing in emerging markets to meet rising demand and achieve growth.

Recent Developments:

- Shanghai Xianshi Electronic Technology Co., Ltd. added a new display technology to its signage items in March 2024. High resolution, ultra-thin design, curved panels for a variety of uses, holographic displays, and energy efficiency are all features of this technology.

- In February 2024, Barco partnered with Ingram Micro, a top IT distributor in Asia Pacific, to distribute G-series projection and image processing solutions in Singapore. This partnership will improve access to Barco's products, including G-series projectors, ImagePro-4K, and PDS-4K, in the area.

- In May 2024, Samsung Electronics America teamed up with Quest Technology Management and Telarus to launch a managed digital signage service for SMBs. The service uses Samsung's displays and VXT Content Management System for easy content creation and device management. It provides an all-in-one solution, including installation and cloud integration, to improve brand impact and operational efficiency.

- In September 2023, SAMSUNG launched 'The Wall for Virtual Production' in Europe, featuring two models, P1.68 and P2.1. These ultra-large LED walls enhance virtual content creation with better visual effects, lower production time and costs, a curvature range up to 5,800R, genlock for signal alignment, and Virtual Production Management (VPM) software.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Type, By Component, By Technology, By Resolution, By Application. |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa. |

| Companies Covered | ADFLOW Networks, BrightSign, LLC, Cisco Systems, Inc, Intel Corporation, KeyWest Technology, Inc, LG Electronics, Microsoft Corporation, NEC Display Solutions, Omnivex Corporation, Panasonic Corporation. and others. |

Key Topics Covered in the Report:

- Global Digital Signage Market Size (FY’2021-FY’2034)

- Overview of Global Digital Signage Market

- Segmentation of Global Digital Signage Market By Type (Video Walls, Video Screen, Transparent LED Screen, Digital Poster, Billboards, Kiosks, others)

- Segmentation of Global Digital Signage Market By Component (Hardware, Software, Service)

- Segmentation of Global Digital Signage Market By Technology (LCD, LED, OLED, Projection)

- Segmentation of Global Digital Signage Market By Resolution (8K, 4K, Full High Definition, High Definition, Lower than HD)

- Segmentation of Global Digital Signage Market By Application (Retail, Hospitality, Entertainment, Stadiums & Playgrounds, Corporate, Banking, Healthcare, Education, Transport)

- Statistical Snap of Global Digital Signage Market

- Expansion Analysis of Global Digital Signage Market

- Problems and Obstacles in Global Digital Signage Market

- Competitive Landscape in the Global Digital Signage Market

- Details on Current Investment in Global Digital Signage Market

- Competitive Analysis of Global Digital Signage Market

- Prominent Players in the Global Digital Signage Market

- SWOT Analysis of Global Digital Signage Market

- Global Digital Signage Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Digital Signage Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Digital Signage Market

7. Global Digital Signage Market, By Type (USD Million) 2021-2034

7.1. Video Walls

7.2. Video Screen

7.3. Transparent LED Screen

7.4. Digital Poster

7.5. Billboards

7.6. Kiosks

7.7.Interactive Kiosks

7.8. Self-service Kiosks

7.9. Others

7.10. Others

8. Global Digital Signage Market, By Component (USD Million) 2021-2034

8.1. Hardware

8.1.1. Displays

8.1.2. Media Players

8.1.3. Projectors

8.1.4. Others

8.2. Software

8.3. Service

8.3.1. Installation Services

8.3.2. Maintenance & Support Services

8.3.3. Consulting Services

8.3.4. Others

9. Global Digital Signage Market, By Technology (USD Million) 2021-2034

9.1. LCD

9.2. LED

9.3. OLED

9.4. Projection

10. Global Digital Signage Market, By Resolution (USD Million) 2021-2034

10.1. 8K

10.2. 4K

10.3. Full High Definition (FHD)

10.4. High Definition (HD)

10.5. Lower than HD

11. Global Digital Signage Market, By Application (USD Million) 2021-2034

11.1. Retail

11.2. Hospitality

11.3. Entertainment

11.4. Stadiums & Playgrounds

11.5. Corporate

11.6. Banking

11.7. Healthcare

11.8. Education

11.9. Transport

12. Global Digital Signage Market, (USD Million) 2021-2034

12.1. Global Digital Signage Market Size and Market Share

13. Global Digital Signage Market, By Region, (USD Million) 2021-2034

13.1. Asia-Pacific

13.1.1. Australia

13.1.2. China

13.1.3. India

13.1.4. Japan

13.1.5. South Korea

13.1.6. Rest of Asia-Pacific

13.2. Europe

13.2.1. France

13.2.2. Germany

13.2.3. Italy

13.2.4. Spain

13.2.5. United Kingdom

13.2.6. Rest of Europe

13.3. Middle East and Africa

13.3.1. Kingdom of Saudi Arabia

13.3.2. United Arab Emirates

13.3.3. Qatar

13.3.4. South Africa

13.3.5. Egypt

13.3.6. Morocco

13.3.7. Nigeria

13.3.8. Rest of Middle-East and Africa

13.4. North America

13.4.1. Canada

13.4.2. Mexico

13.4.3. United States

13.5. Latin America

13.5.1. Argentina

13.5.2. Brazil

13.5.3. Rest of Latin America

14. Company Profile

14.1. ADFLOW Networks

14.1.1. Company details

14.1.2. Financial outlook

14.1.3. Product summary

14.1.4. Recent developments

14.2. BrightSign, LLC

14.2.1. Company details

14.2.2. Financial outlook

14.2.3. Product summary

14.2.4. Recent developments

14.3. Cisco Systems, Inc

14.3.1. Company details

14.3.2. Financial outlook

14.3.3. Product summary

14.3.4. Recent developments

14.4. Intel Corporation

14.4.1. Company details

14.4.2. Financial outlook

14.4.3. Product summary

14.4.4. Recent developments

14.5. KeyWest Technology, Inc

14.5.1. Company details

14.5.2. Financial outlook

14.5.3. Product summary

14.5.4. Recent developments

14.6. LG Electronics

14.6.1. Company details

14.6.2. Financial outlook

14.6.3. Product summary

14.6.4. Recent developments

14.7. Microsoft Corporation

14.7.1. Company details

14.7.2. Financial outlook

14.7.3. Product summary

14.7.4. Recent developments

14.8. NEC Display Solutions

14.8.1. Company details

14.8.2. Financial outlook

14.8.3. Product summary

14.8.4. Recent developments

14.9. Omnivex Corporation

14.9.1. Company details

14.9.2. Financial outlook

14.9.3. Product summary

14.9.4. Recent developments

14.10. Panasonic Corporation

14.10.1. Company details

14.10.2. Financial outlook

14.10.3. Product summary

14.10.4. Recent developments

14.11. Others

15. Conclusion

16. List of Abbreviations

17. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.