Drug Testing Market Introduction and Overview

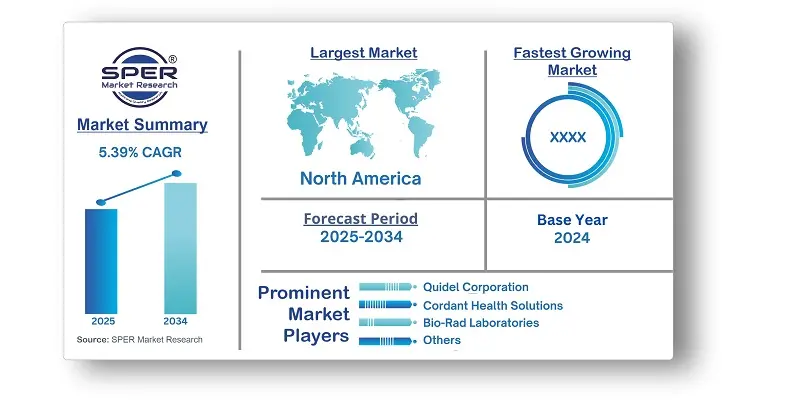

According to SPER Market Research, the Global Drug Testing Market is estimated to reach USD 23.51 billion by 2034 with a CAGR of 5.39%.

The report includes an in-depth analysis of the Global Drug Testing Market, including market size and trends, product mix, Applications, and supplier analysis. The growing prevalence of substance abuse globally has led to a higher demand for testing solutions. Additionally, stringent regulations from government bodies requiring alcohol and substance testing for safety purposes, along with increased efforts to monitor and combat substance abuse, are expected to further boost market growth. The expansion of the global market is fueled by factors such as the rising number of individuals using illicit drugs and alcohol, as well as technological advancements in testing solutions. However, Challenges in the drug testing market include high costs, privacy concerns, evolving drug trends, inconsistent regulations, and limited access, all of which hinder market growth and the effectiveness of testing solutions.

By Product: The consumables segment holds the largest revenue share in the drug testing market, as they play a crucial role in testing procedures. These items, which include reagents, columns, kits, calibrators, specimens, blue dye tablets, temperature strips, and controls, are essential for confirmation testing. Many kits come with calibration tools to ensure the accuracy of reagents and instruments. The growing demand for consumables is expected to drive further market growth. For example, a recent initiative by the Office of Addiction Services and Supports led to the distribution of nearly 100,000 xylazine test strips to help address the growing risks of xylazine contamination in illicit drugs. Additionally, rapid testing devices are anticipated to grow quickly, offering faster testing, though with some limitations in sensitivity and the ability to detect multiple substances at once.

By Sample: Urine samples dominate the drug testing market due to their widespread acceptance and reliability, making them the preferred method for sample collection. Urine provides accurate results for detecting solutes, cells, and particulates in the body, effectively identifying illicit metabolites and substances. These metabolites, produced when the body processes drugs, indicate drug intake. Urine analysis is also endorsed by regulatory bodies like the Department of Health and the Department of Transportation for both point-of-care and lab testing. Meanwhile, oral fluid samples are growing in popularity, offering non-invasive, easier administration and a broader detection window for recent substance use, making them ideal for workplace safety and compliance.

By Drug: The cannabis/marijuana segment led the market in 2024, driven by the growing global use of marijuana as an illicit drug. As the most commonly used illegal substance worldwide, the demand for testing kits and instruments remains high. Marijuana's widespread use, particularly among young adults, has contributed to a rise in substance use disorders. On the other hand, the opioid segment is expected to experience significant growth. The increasing misuse of opioids, including heroin and prescription pain relievers, has led to a rise in opioid-related disorders. Additionally, the growing use of opioids among athletes and in workplace settings is expected to boost the demand for opioid testing solutions.

By End User: The drug testing laboratories segment led the market in 2024, owing to the widespread presence and comprehensive services provided by these labs. These laboratories benefit from advanced equipment, such as High-Performance Liquid Chromatography (HPLC) and spectroscopy, along with skilled personnel who ensure accurate and reliable test results. As a result, laboratories offer higher sensitivity and specificity compared to rapid testing methods. Additionally, these labs are certified by health authorities and perform tests to verify sample authenticity, ensuring no adulteration. In countries like the U.S., only laboratories certified by the Department of Health & Human Services (HHS) are authorized to conduct drug testing.

By Regional Insights: In 2024, North America dominated the drug testing market, gaining a sizeable portion because to the presence of important international companies including Bio-Rad Laboratories, F. Hoffmann-La Roche Ltd., and Laboratory Corporation of America Holdings. Rising substance usage rates, active screening programs, and stringent government regulations are other factors driving the region's industry expansion. Governments are working to lower the use of dangerous drugs in an effort to lessen the financial strain brought on by drug-related problems.

Market Competitive Landscape:

The market is moderately consolidated. Some of the market key players are Abbott, Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Clinical Reference Laboratory, Inc., Cordant Health Solutions, F. Hoffmann-La Roche Ltd., Laboratory Corporation of America Holdings, Quest Diagnostics Incorporated, Quidel Corporation, Siemens Healthcare GmbH, Thermo Fisher Scientific, Inc., and others.

Recent Developments:

- In February 2024, OraSure Technologies and Veriteque USA signed a distribution agreement that enables OraSure to sell Veriteque's SwabTek surface test kits in addition to its oral fluid drug screening solutions. Drug identification is made accessible for use at home, in schools, and in the workplace with SwabTek's single-use, dry reagent tests for narcotics and explosives.

- In April 2023, MIP Discovery introduced its first drug of abuse reagent designed to target norfentanyl, the primary urinary metabolite of fentanyl, in response to the escalating synthetic opioid crisis. Utilizing their advanced nanoMIP technology, known for its sensitivity and durability, MIP Discovery seeks to aid in the development of portable, field-based tests for detecting fentanyl metabolites.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Product, By Sample, By Drug, By End Use. |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa. |

| Companies Covered | Abbott, Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Clinical Reference Laboratory, Inc., Cordant Health Solutions, F. Hoffmann-La Roche Ltd., Laboratory Corporation of America Holdings, Quest Diagnostics Incorporated, Quidel Corporation, Siemens Healthcare GmbH, Thermo Fisher Scientific, Inc., and others. |

Key Topics Covered in the Report:

- Global Drug Testing Market Size (FY’2021-FY’2034)

- Overview of Global Drug Testing Market

- Segmentation of Global Drug Testing Market By Product (Consumables, Instruments, Rapid Testing Devices, Services)

- Segmentation of Global Drug Testing Market By Sample (Hair Samples, Oral Fluid Samples, Urine Samples, Other Samples)

- Segmentation of Global Drug Testing Market By Drug (Alcohol, Amphetamine & Methamphetamine, Cannabis/Marijuana, Cocaine, LSD, Opioids, Others)

- Segmentation of Global Drug Testing Market By End Use (Drug Testing Laboratories, Hospitals, Workplaces, Others)

- Statistical Snap of Global Drug Testing Market

- Expansion Analysis of Global Drug Testing Market

- Problems and Obstacles in Global Drug Testing Market

- Competitive Landscape in the Global Drug Testing Market

- Details on Current Investment in Global Drug Testing Market

- Competitive Analysis of Global Drug Testing Market

- Prominent Players in the Global Drug Testing Market

- SWOT Analysis of Global Drug Testing Market

- Global Drug Testing Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Drug Testing Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Drug Testing Market

7. Global Drug Testing Market, By Product, (USD Million) 2021-2034

7.1. Consumables

7.2. Instruments

7.3. Rapid Testing Devices

7.4. Services

8. Global Drug Testing Market, By Sample, (USD Million) 2021-2034

8.1. Hair Samples

8.2. Oral Fluid Samples

8.3. Urine Samples

8.4. Other Samples

9. Global Drug Testing Market, By Drug, (USD Million) 2021-2034

9.1. Alcohol

9.2. Amphetamine & Methamphetamine

9.3. Cannabis/Marijuana

9.4. Cocaine

9.5. LSD

9.6. Opioids

9.7. Others

10. Global Drug Testing Market, By End Use, (USD Million) 2021-2034

10.1. Drug Testing Laboratories

10.2. Hospitals

10.3. Workplaces

10.4. Others

11. Global Drug Testing Market, (USD Million) 2021-2034

11.1. Global Drug Testing Market Size and Market Share

12. Global Drug Testing Market, By Region, (USD Million) 2021-2034

12.1. Asia-Pacific

12.1.1. Australia

12.1.2. China

12.1.3. India

12.1.4. Japan

12.1.5. South Korea

12.1.6. Rest of Asia-Pacific

12.2. Europe

12.2.1. France

12.2.2. Germany

12.2.3. Italy

12.2.4. Spain

12.2.5. United Kingdom

12.2.6. Rest of Europe

12.3. Middle East and Africa

12.3.1. Kingdom of Saudi Arabia

12.3.2. United Arab Emirates

12.3.3. Qatar

12.3.4. South Africa

12.3.5. Egypt

12.3.6. Morocco

12.3.7. Nigeria

12.3.8. Rest of Middle-East and Africa

12.4. North America

12.4.1. Canada

12.4.2. Mexico

12.4.3. United States

12.5. Latin America

12.5.1. Argentina

12.5.2. Brazil

12.5.3. Rest of Latin America

13. Company Profile

13.1. Abbott

13.1.1. Company details

13.1.2. Financial outlook

13.1.3. Product summary

13.1.4. Recent developments

13.2. Agilent Technologies, Inc.

13.2.1. Company details

13.2.2. Financial outlook

13.2.3. Product summary

13.2.4. Recent developments

13.3. Bio-Rad Laboratories, Inc.

13.3.1. Company details

13.3.2. Financial outlook

13.3.3. Product summary

13.3.4. Recent developments

13.4. Clinical Reference Laboratory, Inc.

13.4.1. Company details

13.4.2. Financial outlook

13.4.3. Product summary

13.4.4. Recent developments

13.5. Cordant Health Solutions

13.5.1. Company details

13.5.2. Financial outlook

13.5.3. Product summary

13.5.4. Recent developments

13.6. F. Hoffmann-La Roche Ltd.

13.6.1. Company details

13.6.2. Financial outlook

13.6.3. Product summary

13.6.4. Recent developments

13.7. Laboratory Corporation of America Holdings

13.7.1. Company details

13.7.2. Financial outlook

13.7.3. Product summary

13.7.4. Recent developments

13.8. Quest Diagnostics Incorporated

13.8.1. Company details

13.8.2. Financial outlook

13.8.3. Product summary

13.8.4. Recent developments

13.9. Quidel Corporation

13.9.1. Company details

13.9.2. Financial outlook

13.9.3. Product summary

13.9.4. Recent developments

13.10. Siemens Healthcare GmbH

13.10.1. Company details

13.10.2. Financial outlook

13.10.3. Product summary

13.10.4. Recent developments

13.11. Thermo Fisher Scientific, Inc.

13.11.1. Company details

13.11.2. Financial outlook

13.11.3. Product summary

13.11.4. Recent developments

13.12. Others

14. Conclusion

15. List of Abbreviations

16. Reference Links