LEO Terminal Market Introduction and Overview

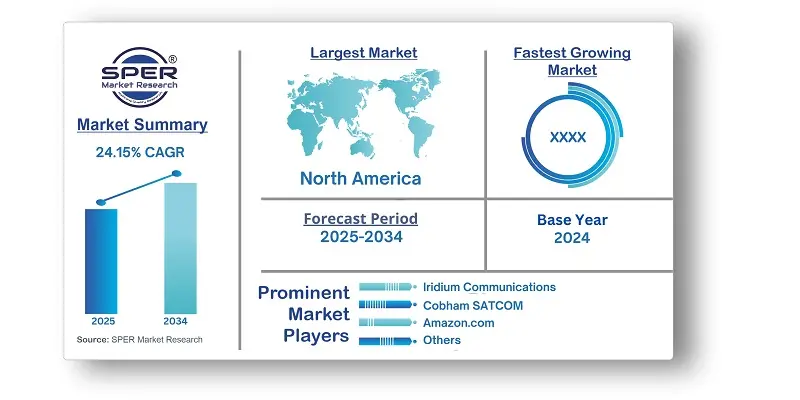

According to SPER Market Research, the Global LEO Terminal Market is estimated to reach USD 64.81 billion by 2034 with a CAGR of 24.15%.

The report includes an in-depth analysis of the Global LEO Terminal Market, including market size and trends, product mix, Applications, and supplier analysis. The growing need for worldwide connectivity, especially in remote locations, is propelling the market for LEO (Low Earth Orbit) terminals. High-speed satellite communications are made possible by these terminals, which benefit industries like internet services, defense, and telecommunications. The increasing use of data-driven applications, government efforts to upgrade digital infrastructure, and developments in satellite technology are some of the main factors. The growth of 5G networks and the Internet of Things also increases demand. Regulatory complexity, expensive installation costs, and worries about the effects of space debris on the environment all obstacles, nevertheless. Market expansion may also be hampered by competition from conventional terrestrial networks and other satellite constellations.

By Vertical Insights: LEO Terminal is classified into two categories based on Vertical: Commercial, Government and defense. The growing demand for satellite-based services across a range of industries has led to the commercial segments dominance of the worldwide LEO satellite market. Companies are concentrating on closing the digital divide by providing dependable and reasonably priced broadband services, which is further bolstered by the growing need for high-speed internet connectivity in both urban and rural locations.

By Platform: The market for LEO Terminal is segmented based on Platform, including fixed satellite services (FSS), Mobile satellite services (MSS) and Broadcast satellite services (BSS). The biggest market share during the predicted period was held by the mobile satellite services category. Mobile broadband and satellite-enabled services in distant or underserved locations are two examples of mobile communication applications that benefit greatly from low latency and high-speed data transfer capabilities offered by LEO satellites. LEO terminals provide a practical way for mobile network providers to increase coverage in areas that are difficult to reach while they look for alternatives to conventional terrestrial infrastructure.

By Frequency Band: The market for LEO Terminal is divided into based on Frequency Band, including Ku-band, Ka-band, X-band, S-band and L-band. While Ku-band continues to be frequently used for mobility applications, Ka-band is gaining popularity because to its increased data capacity. For upcoming high-throughput requirements, V-band is becoming more popular. Technology breakthroughs and expanding satellite installations are propelling frequency adoption, improving worldwide communication for enterprise, defense, and commercial applications.

By Regional: The United States leads the LEO (Low Earth Orbit) terminal market, mostly because of its robust space industry, technological innovations, and major investments in satellite infrastructure. Large corporations that offer worldwide internet access, such as SpaceX, dominate the market with their Starlink network. Strong legal frameworks and a competitive business climate are advantageous to the United States.

Market Competitive Landscape:

The growing need for satellite communications, technological breakthroughs, and creative product creation are all driving major changes in the Leo Terminal Market. This market is distinguished by a wide range of competitive firms that are always improving their products to meet the demands of many industries, including as transportation, defense, and telecommunication. Some of the key market players are Amazon.com, Inc., Cobham SATCOM, Globalstar, Hughes Network Systems, Inmarsat, Iridium Communications, Kymeta Corporation, L3Harris Technologies, OneWeb, SES S.A., SpaceX (Starlink), ST Engineering iDirect, Telesat, Thales Alenia Space, Viasat, Inc.

Recent Developments:

- In May 2024, the launch of Avanti Communications' LEO satellite relationship services in South Africa has been revealed by the multinational multi-orbit satellite technology provider. To provide smooth LEO connectivity from Eutelsat OneWeb, Avanti teamed up with Q-KON, a top satellite engineering company in southern Africa.

- In July 2023, The US Federal Trade Commission has given its approval for L3Harris Technologies to complete its acquisition of Aerojet Rocketdyne.

- In June 2023, SpaceXs Starlink satellite unit gets funding from the US government to provide Ukrainian military with services and equipment. The money from the Ukraine Security Assistance Initiative is probably going to be used to buy the terminals.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Vertical, By Platform, By Frequency Band. |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa. |

| Companies Covered | Amazon.com, Inc., Cobham SATCOM, Globalstar, Hughes Network Systems, Inmarsat, Iridium Communications, Kymeta Corporation, L3Harris Technologies, OneWeb, SES S.A., SpaceX (Starlink), ST Engineering iDirect, Telesat, Thales Alenia Space, Viasat, Inc. and others. |

Key Topics Covered in the Report:

- Global LEO Terminal Market Size (FY’2021-FY’2034)

- Overview of Global LEO Terminal Market

- Segmentation of Global LEO Terminal Market By Vertical (Commercial, Government and defense)

- Segmentation of Global LEO Terminal Market By Platform (fixed satellite services (FSS), Mobile satellite services (MSS), Broadcast satellite services (BSS))

- Segmentation of Global LEO Terminal Market By Frequency Band (Ku-band, Ka-band, X-band, S-band, L-band)

- Statistical Snap of Global LEO Terminal Market

- Expansion Analysis of Global LEO Terminal Market

- Problems and Obstacles in Global LEO Terminal Market

- Competitive Landscape in the Global LEO Terminal Market

- Details on Current Investment in Global LEO Terminal Market

- Competitive Analysis of Global LEO Terminal Market

- Prominent Players in the Global LEO Terminal Market

- SWOT Analysis of Global LEO Terminal Market

- Global LEO Terminal Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global LEO Terminal Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global LEO Terminal Market

7. Global LEO Terminal Market, By Vertical (USD Million) 2021-2034

7.1. Commercial

7.2. Government and defense

8. Global LEO Terminal Market, By Platform (USD Million) 2021-2034

8.1. Fixed satellite services (FSS)

8.2. Mobile satellite services (MSS)

8.3. Broadcast satellite services (BSS)

9. Global LEO Terminal Market, By Frequency Band (USD Million) 2021-2034

9.1. Ku-band

9.2. Ka-band

9.3. X-band

9.4. S-band

9.5. L-band

10. Global LEO Terminal Market, (USD Million) 2021-2034

10.1. Global LEO Terminal Market Size and Market Share

11. Global LEO Terminal Market, By Region, (USD Million) 2021-2034

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. Amazon.com, Inc.

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. Cobham SATCOM

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. Globalstar

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. Hughes Network Systems

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. Inmarsat

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. Iridium Communications

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. Kymeta Corporation

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. L3Harris Technologies

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. OneWeb

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. SES S.A.

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links