Level Sensor Market Introduction and Overview

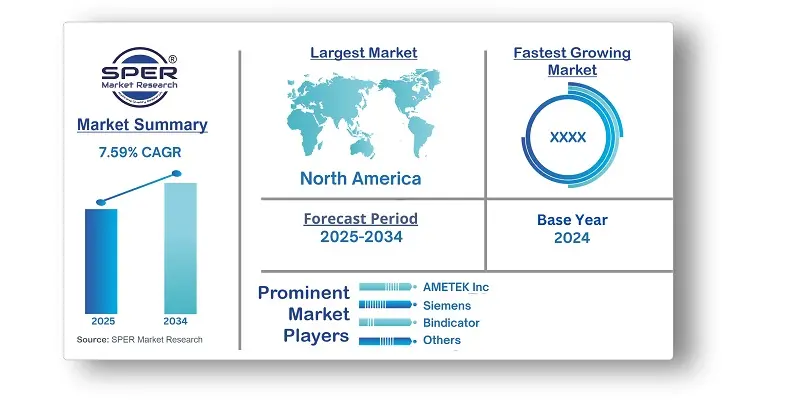

According to SPER Market Research, the Global Level Sensor Market is estimated to reach USD 11.57 billion by 2034 with a CAGR of 7.59%.

The report includes an in-depth analysis of the Global Level Sensor Market, including market size and trends, product mix, Applications, and supplier analysis. Level sensors measure liquid, slurry, and granular material levels across various industries. Growing demand for accurate solutions, along with advancements in MEMS, machine learning, radar, and optical sensing, is boosting market adoption. Digital level sensors, including MEMS-based non-contact technology, are gaining popularity in gas flow measurement and can easily interface with computers. The demand for intelligent instruments with microprocessors, offering performance insights, is expected to boost market growth. These sensors provide higher accuracy, efficiency, and ease of installation and maintenance, further driving industry expansion. The rising adoption of smart multiphase sensors in sectors like oil & gas, food, and water is also contributing to enhanced market growth. However, High maintenance costs for advanced sensors can limit adoption, especially for smaller businesses, diverting resources from innovation and R&D. Mature industries like oil & gas may also resist new technologies, opting to maintain existing systems.

By Technology: The market is divided into contact and non-contact types based on technology. The non-contact type segment holds the largest revenue share and is expected to grow at the fastest rate. The shift from contact to non-contact sensors is driven by their flexibility, accuracy in measurement, and lower maintenance needs. Non-contact level sensors use electromagnetic fields for level measurement, offering faster operation and greater application versatility. Technologies in this category include photoelectric, capacitive, and ultrasonic sensors.

By Application: The market is segmented based on applications into automobile, consumer electronics, healthcare, industrial process, oil & gas, dry bulk, and others. The industrial process segment holds the largest share due to the rising demand for automation and process control in industries like oil and gas, chemicals, and food and beverage. Level sensors are essential for monitoring and controlling liquid and solid levels in these processes, playing a key role in enhancing efficiency and safety. The industrial and municipal wastewater management sector is also expected to grow significantly, driven by strict regulations in developed regions such as the UK, Germany, and the U.S., along with increasing government support for water treatment in emerging economies. Manufacturers are focusing on improving reliability and reducing repair costs.

By Regional Insights: North America leads the market, with the U.S. driving growth through initiatives like the EPA's research program on low-cost O3 and NO2 sensors. The U.S. regional level sensor industry is growing due to the rising adoption of sensors in new cars. The introduction of regulations, such as the TREAD Act, which mandates pressure sensors in vehicles to alert for underinflated tires, is expected to further boost demand in the U.S. market.

Market Competitive Landscape:

The market is moderately consolidated. Some of the market key players are ABB, AMETEK Inc., Garner Industries Inc., Bindicator, Emerson Electric Co., Electro-Sensors Inc., Endress+Hauser Group Services AG, Gems Sensors Inc., Honeywell International Inc., Magnetrol International Inc., OMEGA Engineering Inc., MTS Systems Corporation, Pepperl+Fuchs GmbH, Siemens, Senix Corporation, and others.

Recent Developments:

- Endress+Hauser unveiled an enhanced version of their Micropilot 80 GHz radar sensors in June 2023, with the goal of provide solutions for a variety of sectors and uses. These sensors are made to withstand harsh situations with extreme process temperatures and conditions, dusty surroundings, and challenging-to-reach measurement locations.

- Temperature measurement innovation business OMEGA Engineering Inc. revealed in December 2022 that their latest HANI Clamp-On Temperature Sensor, a HANI Clamp Sensor for plastic pipe applications, was now available.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Technology, By Application. |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa. |

| Companies Covered | ABB, AMETEK Inc., Garner Industries Inc., Bindicator, Emerson Electric Co., Electro-Sensors Inc., Endress+Hauser Group Services AG, Gems Sensors Inc., Honeywell International Inc., Magnetrol International Inc., OMEGA Engineering Inc., MTS Systems Corporation, Pepperl+Fuchs GmbH, Siemens, Senix Corporation, and others. |

Key Topics Covered in the Report:

- Global Level Sensor Market Size (FY’2021-FY’2034)

- Overview of Global Level Sensor Market

- Segmentation of Global Level Sensor Market By Technology (Contact Type, Non-contact Type)

- Segmentation of Global Level Sensor Market By Application (Automotive, Consumer Electronics, Healthcare, Industrial Process, Oil & Gas, Dry Bulk, Others)

- Statistical Snap of Global Level Sensor Market

- Expansion Analysis of Global Level Sensor Market

- Problems and Obstacles in Global Level Sensor Market

- Competitive Landscape in the Global Level Sensor Market

- Details on Current Investment in Global Level Sensor Market

- Competitive Analysis of Global Level Sensor Market

- Prominent Players in the Global Level Sensor Market

- SWOT Analysis of Global Level Sensor Market

- Global Level Sensor Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Level Sensor Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Level Sensor Market

7. Global Level Sensor Market, By Technology, (USD Million) 2021-2034

7.1. Contact Type

7.2. Non-contact Type

8. Global Level Sensor Market, By Application, (USD Million) 2021-2034

8.1. Automotive

8.2. Consumer Electronics

8.3. Healthcare

8.4. Industrial Process

8.5. Oil & Gas

8.6. Dry Bulk

8.7. Others

9. Global Level Sensor Market, (USD Million) 2021-2034

9.1. Global Level Sensor Market Size and Market Share

10. Global Level Sensor Market, By Region, (USD Million) 2021-2034

10.1. Asia-Pacific

10.1.1. Australia

10.1.2. China

10.1.3. India

10.1.4. Japan

10.1.5. South Korea

10.1.6. Rest of Asia-Pacific

10.2. Europe

10.2.1. France

10.2.2. Germany

10.2.3. Italy

10.2.4. Spain

10.2.5. United Kingdom

10.2.6. Rest of Europe

10.3. Middle East and Africa

10.3.1. Kingdom of Saudi Arabia

10.3.2. United Arab Emirates

10.3.3. Qatar

10.3.4. South Africa

10.3.5. Egypt

10.3.6. Morocco

10.3.7. Nigeria

10.3.8. Rest of Middle-East and Africa

10.4. North America

10.4.1. Canada

10.4.2. Mexico

10.4.3. United States

10.5. Latin America

10.5.1. Argentina

10.5.2. Brazil

10.5.3. Rest of Latin America

11. Company Profile

11.1. ABB

11.1.1. Company details

11.1.2. Financial outlook

11.1.3. Product summary

11.1.4. Recent developments

11.2. AMETEK. Inc.

11.2.1. Company details

11.2.2. Financial outlook

11.2.3. Product summary

11.2.4. Recent developments

11.3. Garner Industries, Inc.

11.3.1. Company details

11.3.2. Financial outlook

11.3.3. Product summary

11.3.4. Recent developments

11.4. Bindicator

11.4.1. Company details

11.4.2. Financial outlook

11.4.3. Product summary

11.4.4. Recent developments

11.5. Emerson Electric Co.

11.5.1. Company details

11.5.2. Financial outlook

11.5.3. Product summary

11.5.4. Recent developments

11.6. Electro-Sensors, Inc.

11.6.1. Company details

11.6.2. Financial outlook

11.6.3. Product summary

11.6.4. Recent developments

11.7. Endress+Hauser Group Services AG

11.7.1. Company details

11.7.2. Financial outlook

11.7.3. Product summary

11.7.4. Recent developments

11.8. Gems Sensors, Inc.

11.8.1. Company details

11.8.2. Financial outlook

11.8.3. Product summary

11.8.4. Recent developments

11.9. Honeywell International, Inc

11.9.1. Company details

11.9.2. Financial outlook

11.9.3. Product summary

11.9.4. Recent developments

11.10. Magnetrol International, Inc.

11.10.1. Company details

11.10.2. Financial outlook

11.10.3. Product summary

11.10.4. Recent developments

11.11. OMEGA Engineering inc.

11.11.1. Company details

11.11.2. Financial outlook

11.11.3. Product summary

11.11.4. Recent developments

11.12. MTS System Corporation

11.12.1. Company details

11.12.2. Financial outlook

11.12.3. Product summary

11.12.4. Recent developments

11.13. Pepperl+Fuchs GmbH

11.13.1. Company details

11.13.2. Financial outlook

11.13.3. Product summary

11.13.4. Recent developments

11.14. Siemens

11.14.1. Company details

11.14.2. Financial outlook

11.14.3. Product summary

11.14.4. Recent developments

11.15. Senix Corporation

11.15.1. Company details

11.15.2. Financial outlook

11.15.3. Product summary

11.15.4. Recent developments

11.16. Others

12. Conclusion

13. List of Abbreviations

14. Reference Links