Temperature Sensor Market Introduction and Overview

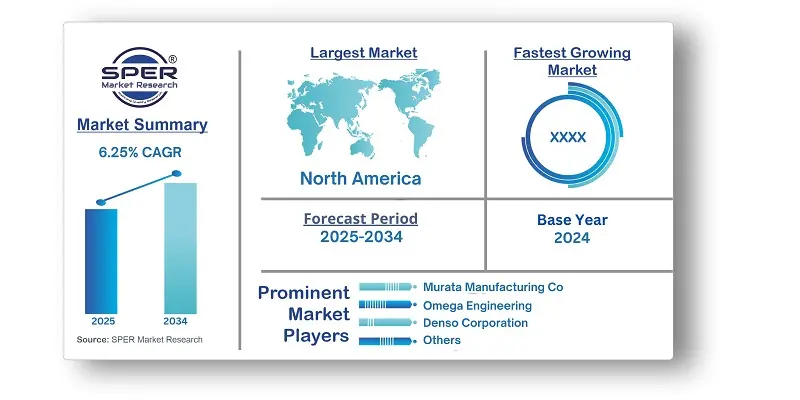

According to SPER Market Research, the Global Temperature Sensor Market is estimated to reach USD 13.09 billion by 2034 with a CAGR of 6.25%.

The report includes an in-depth analysis of the Global Temperature Sensor Market, including market size and trends, product mix, Applications, and supplier analysis. The market for temperature sensors is expanding rapidly as a result of rising demand from sectors such consumer electronics, healthcare, automotive, and industrial automation. These sensors are essential for keeping an eye on and managing temperature-sensitive operations, guaranteeing efficiency, safety, and legal compliance. Growing IoT and smart device use, technological improvements in sensor precision and downsizing, and strict environmental restrictions are some of the main motivators. However, Market expansion is hampered, by issues like fierce competition, price sensitivity, and calibration difficulties. Concerns are also raised by cyber security threats in linked systems and integration problems in sophisticated applications. Despite these obstacles, there are encouraging growth prospects due to ongoing innovation and growing applications in wearable technology and electric cars.

By Product Insights: Temperature Sensor is classified into two categories based on Product: Contact, Contactless. The market was led by the contact segment because of the growing need for contact temperature sensors in the manufacturing, food, chemical, and medical industries. Physical contact between the monitored surfaces or objects is necessary for contact temperature sensors to function. The growing use of contactless temperature sensors, which use infrared radiation to monitor temperatures with any contact, is anticipated to drive a significant CAGR in the contactless category over the course of the projection period.

By Output Insights: The market for Temperature Sensor is segmented based on Output, including Analog, Digital. Increased demand in industries including electronics, food, and real estate led to the greatest market revenue share going to the Analog segment. Applications for Analog temperature sensors include HVAC, rice cookers, freezers, refrigerators, food warmers, thermostat control, and fan control, among others. The quickest CAGR is anticipated to be recorded by the digital segment during the forecast period. Due to their ability to produce more precise readings and use less power, digital temperature sensors are becoming more and more popular.

By Connectivity Insights: The market for Temperature Sensor is segmented based on Connectivity, including Wired, Wireless. The market was dominated by the wired segment. This is due to the sturdy and dependable nature of the sensors. Over the course of the forecast period, the wireless category is anticipated to develop at the quickest CAGR. The rise is driven by the growing need for wireless sensors in automation and Internet of Things systems. These sensors are suitable for application in smart homes, healthcare, and logistics because of their adaptability and ease of installation.

By Application Insights: The market for Temperature Sensor is segmented based on applications, including Automotive, Consumer Electronics, Environmental, Healthcare/Medical and Process Industries. The market was dominated by the automotive category. This can be linked to the expansion of the automotive industry and the rise in demand for temperature sensors as a result of their growing use in the production of automobiles. Over the course of the projection period, the environmental segment is anticipated to develop at the quickest CAGR. The growing use of temperature sensors in sectors like industry, science, and chemicals is what's causing the growth.

By Regional Insights: The market was dominated by North America. It can be attributed to the growing use of temperature sensors in advanced industries including technology, automotive, and medicine. Sensors are in greater demand in the production of electronic products, medical equipment, HVAC systems, and other items. Additionally, the market in this area has grown as a result of the incorporation of temperature sensors into smart home appliances and building automation.

Market Competitive Landscape:

Organizations are concentrating on enhancing sensors capacity to collect data through innovations and partnerships. In industries including automotive, healthcare, and communications, the corporations are concentrating on diversifying their applications. Some of the key market players are STMicroelectronics. NXP Semiconductors, Omega Engineering, Inc., Yokogawa Electric Corporation, Murata Manufacturing Co., Ltd., IFM Electronic GmbH, Dwyer Instruments, LLC, Vishay Intertechnology, Inc., Panasonic Corporation, Denso Corporation, Kongsberg Maritime, Ametek, Inc., AMS-Osram AG.

Recent Developments:

- In November 2023, The Sensors and Controls division of SDI Group bought Peak Sensors, increasing SDI's product line and market share.

- In October 2023, The HANI temperature sensors were recently upgraded, according to Omega Engineering, Inc. All HANI devices now have an IP67 designation, which protects the sensors from submersion. The objective of this update was to improve the sensors' resilience in challenging wash-down conditions.

- In June 2023, Omega Engineering, Inc. introduced the HANI Temperature Sensor, a non-invasive monitoring sensor for metal tanks. Without the hassle of installing invasive in-tank temperature sensors, the sensor can read the temperatures of in-tank process media.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Product, By Output, By Connectivity, By Application. |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa. |

| Companies Covered | STMicroelectronics. NXP Semiconductors, Omega Engineering, Inc., Yokogawa Electric Corporation, Murata Manufacturing Co., Ltd., IFM Electronic GmbH, Dwyer Instruments, LLC, Vishay Intertechnology, Inc., Panasonic Corporation, Denso Corporation, Kongsberg Maritime, Ametek, Inc., AMS-Osram AG. other. |

Key Topics Covered in the Report:

- Global Temperature Sensor Market Size (FY’2021-FY’2034)

- Overview of Global Temperature Sensor Market

- Segmentation of Global Temperature Sensor Market By Product (Contact, Contactless)

- Segmentation of Global Temperature Sensor Market By Output (Analog, Digital)

- Segmentation of Global Temperature Sensor Market By Connectivity (Wired, Wireless)

- Segmentation of Global Temperature Sensor Market By Application (Automotive, Consumer Electronics, Environmental, Healthcare/Medical, Process Industries)

- Statistical Snap of Global Temperature Sensor Market

- Expansion Analysis of Global Temperature Sensor Market

- Problems and Obstacles in Global Temperature Sensor Market

- Competitive Landscape in the Global Temperature Sensor Market

- Details on Current Investment in Global Temperature Sensor Market

- Competitive Analysis of Global Temperature Sensor Market

- Prominent Players in the Global Temperature Sensor Market

- SWOT Analysis of Global Temperature Sensor Market

- Global Temperature Sensor Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Temperature Sensor Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Temperature Sensor Market

7. Global Temperature Sensor Market, By Product (USD Million) 2021-2034

7.1. Contact

7.2. Contactless

8. Global Temperature Sensor Market, By Output (USD Million) 2021-2034

8.1. Analog

8.2. Digital

9. Global Temperature Sensor Market, By Connectivity (USD Million) 2021-2034

9.1. Wired

9.2. Wireless

10. Global Temperature Sensor Market, By Application (USD Million) 2021-2034

10.1. Automotive

10.2. Consumer Electronics

10.3. Environmental

10.4. Healthcare/Medical

10.5. Process Industries

11. Global Temperature Sensor Market, (USD Million) 2021-2034

11.1. Global Temperature Sensor Market Size and Market Share

12. Global Temperature Sensor Market, By Region, (USD Million) 2021-2034

12.1. Asia-Pacific

12.1.1. Australia

12.1.2. China

12.1.3. India

12.1.4. Japan

12.1.5. South Korea

12.1.6. Rest of Asia-Pacific

12.2. Europe

12.2.1. France

12.2.2. Germany

12.2.3. Italy

12.2.4. Spain

12.2.5. United Kingdom

12.2.6. Rest of Europe

12.3. Middle East and Africa

12.3.1. Kingdom of Saudi Arabia

12.3.2. United Arab Emirates

12.3.3. Qatar

12.3.4. South Africa

12.3.5. Egypt

12.3.6. Morocco

12.3.7. Nigeria

12.3.8. Rest of Middle-East and Africa

12.4. North America

12.4.1. Canada

12.4.2. Mexico

12.4.3. United States

12.5. Latin America

12.5.1. Argentina

12.5.2. Brazil

12.5.3. Rest of Latin America

13. Company Profile

13.1. Ametek, Inc.

13.1.1. Company details

13.1.2. Financial outlook

13.1.3. Product summary

13.1.4. Recent developments

13.2. AMS-Osram AG

13.2.1. Company details

13.2.2. Financial outlook

13.2.3. Product summary

13.2.4. Recent developments

13.3. Denso Corporation

13.3.1. Company details

13.3.2. Financial outlook

13.3.3. Product summary

13.3.4. Recent developments

13.4. Dwyer Instruments, LLC

13.4.1. Company details

13.4.2. Financial outlook

13.4.3. Product summary

13.4.4. Recent developments

13.5. IFM Electronic GmbH

13.5.1. Company details

13.5.2. Financial outlook

13.5.3. Product summary

13.5.4. Recent developments

13.6. Kongsberg Maritime

13.6.1. Company details

13.6.2. Financial outlook

13.6.3. Product summary

13.6.4. Recent developments

13.7. Murata Manufacturing Co., Ltd.

13.7.1. Company details

13.7.2. Financial outlook

13.7.3. Product summary

13.7.4. Recent developments

13.8. NXP Semiconductors

13.8.1. Company details

13.8.2. Financial outlook

13.8.3. Product summary

13.8.4. Recent developments

13.9. Omega Engineering, Inc.

13.9.1. Company details

13.9.2. Financial outlook

13.9.3. Product summary

13.9.4. Recent developments

13.10. Panasonic Corporation

13.10.1. Company details

13.10.2. Financial outlook

13.10.3. Product summary

13.10.4. Recent developments

13.11. Others

14. Conclusion

15. List of Abbreviations

16. Reference Links