Wireless Audio Device Market Introduction and Overview

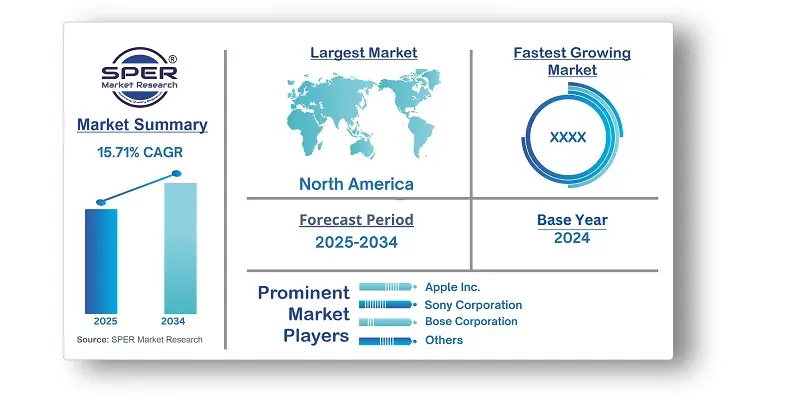

According to SPER Market Research, the Global Wireless Audio Device Market is estimated to reach USD 472.74 billion by 2034 with a CAGR of 15.71%.

The report includes an in-depth analysis of the Global Wireless Audio Device Market, including market size and trends, product mix, Applications, and supplier analysis.

Advancements in technology, along with the widespread use of smartphones, tablets, and other portable devices, evolving consumer lifestyles, and changing needs, are driving the introduction of innovative wireless audio devices that offer seamless connectivity and enhanced mobility. These factors are fueling market growth. Additionally, the COVID-19 pandemic led to a surge in demand for consumer electronics, particularly wearable devices, as people became more focused on their physical health. Travel restrictions during the pandemic also boosted the demand for consumer electronics, as people stayed indoors and turned to digital means to connect with family and friends, further driving the wireless audio device market. However, the increasing demand for personalized audio experiences and smart features in wireless audio devices presents challenges in continuously innovating and integrating advanced technologies to meet diverse consumer preferences. Additionally, the integration of these devices with health and fitness applications requires maintaining seamless functionality while catering to individual needs.

By Product:

The true wireless earbuds segment has become the dominant market leader due to their trendy design, comfort, and simplicity, particularly among Gen Z consumers. Their sleek, stylish appeal, as well as their fitness-oriented features like customizable sound settings, further enhance their popularity. For example, Sennheiser's new TWS earbuds are designed for athletes, offering adjustable sound profiles tailored to training needs. Additionally, the compatibility with various mobile devices boosts the global earbud market. The growing preference for online media, especially among millennials, also drives demand. The earphones segment is expected to see strong growth, as advancements in wireless technology and audio quality continue to appeal to busy, on-the-go consumers.

By Technology:

The Bluetooth segment dominated the market in 2024, driven by continuous advancements in Bluetooth technology that offer enhanced connectivity, convenience, and innovation. Bluetooth has evolved from a basic data transmission tool to a key element of seamless audio experiences. The introduction of Bluetooth Low Energy (BLE) has improved battery efficiency, allowing devices to last longer. Additionally, advancements in audio codecs like aptX and AAC have significantly boosted sound quality, narrowing the gap between wired and wireless audio. The Bluetooth + Wi-Fi segment is projected to grow rapidly, as these combined technologies continue to enhance user experience with improved connectivity and sound performance.

By Functionality:

The smart devices segment led the market in 2024, driven by technological advancements, growing consumer demand for convenience, and the integration of multifunctional features. Smart audio devices, enhanced with voice assistants like Alexa, Google Assistant, and Siri, are transforming traditional devices into versatile hubs for entertainment, connectivity, and smart functionality.

By Application:

In 2024, the residential/individual segment held the largest market share, driven by diverse consumer preferences, technological advancements, and evolving lifestyles. As homes transform into connected hubs, wireless audio devices provide personalized audio solutions, catering to specific needs—from wireless headphones for private listening to smart speakers that enhance the home environment.

By Regional Insights

North America holds a significant share of the market, driven by technological innovation, a strong consumer demand for high-quality audio, and changing lifestyle preferences. As a center for tech giants and innovators, the region leads the way in wireless communication advancements, promoting the adoption of Bluetooth, Wi-Fi, and proprietary protocols in audio products. The area's high disposable income and tech-savvy population also contribute to the growing demand for wireless audio solutions that seamlessly integrate with smart homes, offering enhanced convenience and entertainment experiences.

Market Competitive Landscape

The market is moderately consolidated. Some of the market key players are Apple Inc., Bose Corporation, GN Store Nord A/S (Jabra), Samsung, Sennheiser electronic GmbH & Co. KG, Sony Corporation, Xiaomi, Panasonic Corporation, Shure Incorporated, Plantronics, Inc., and others.

Recent Developments:

- In February 2024, Bose Corporation introduced a groundbreaking audio wearable, the Bose Ultra Open Earbuds, designed to let users enjoy music while staying aware of their surroundings. With a cuff-shaped design that blends style and functionality, these earbuds offer all-day comfort without compromising on sound quality or environmental awareness.

- In September 2023, Apple Inc. launched the second-generation AirPods Pro with MagSafe Charging (USB-C), further enhancing their popular headphones. The new AirPods Pro deliver exceptional sound, up to twice the Active Noise Cancellation of the previous model, an improved Transparency mode, a more immersive Spatial Audio experience, and a wider selection of ear tip sizes for a better fit.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Product, By Technology, By Functionality, By Application.

|

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa. |

| Companies Covered | Apple Inc., Bose Corporation, GN Store Nord A/S (Jabra), Samsung, Sennheiser electronic GmbH & Co. KG, Sony Corporation, Xiaomi, Panasonic Corporation, Shure Incorporated, Plantronics, Inc., and others. |

Key Topics Covered in the Report

- Global Wireless Audio Device Market Size (FY’2021-FY’2034)

- Overview of Global Wireless Audio Device Market

- Segmentation of Global Wireless Audio Device Market By Product (Earphone, Headphone, True Wireless Hearables/Earbuds, Speaker Systems, Soundbars, Headsets, Microphones)

- Segmentation of Global Wireless Audio Device Market By Technology (Bluetooth, Wi-Fi, Bluetooth + Wi-Fi, Airplay, Others)

- Segmentation of Global Wireless Audio Device Market By Functionality (Smart Devices, Non-smart Devices)

- Segmentation of Global Wireless Audio Device Market By Application (Residential/Individual, Commercial, Automotive, Others)

- Statistical Snap of Global Wireless Audio Device Market

- Expansion Analysis of Global Wireless Audio Device Market

- Problems and Obstacles in Global Wireless Audio Device Market

- Competitive Landscape in the Global Wireless Audio Device Market

- Details on Current Investment in Global Wireless Audio Device Market

- Competitive Analysis of Global Wireless Audio Device Market

- Prominent Players in the Global Wireless Audio Device Market

- SWOT Analysis of Global Wireless Audio Device Market

- Global Wireless Audio Device Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Wireless Audio Device Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Wireless Audio Device Market

7. Global Wireless Audio Device Market, By Product, (USD Million) 2021-2034

7.1. Earphone

7.2. Headphone

7.3. True Wireless Hearables/Earbuds

7.4. Speaker Systems

7.5. Soundbars

7.6. Headsets

7.7. Microphones

8. Global Wireless Audio Device Market, By Technology, (USD Million) 2021-2034

8.1. Bluetooth

8.2. Wi-Fi

8.3. Bluetooth + Wi-Fi

8.4. Airplay

8.5. Others

9. Global Wireless Audio Device Market, By Functionality, (USD Million) 2021-2034

9.1. Smart Devices

9.2. Non-smart Devices

10. Global Wireless Audio Device Market, By Application, (USD Million) 2021-2034

10.1. Residential/Individual

10.2. Commercial

10.3. Automotive

10.4. Others

11. Global Wireless Audio Device Market, (USD Million) 2021-2034

11.1. Global Wireless Audio Device Market Size and Market Share

12. Global Wireless Audio Device Market, By Region, 2021-2034 (USD Million)

12.1. Asia-Pacific

12.1.1. Australia

12.1.2. China

12.1.3. India

12.1.4. Japan

12.1.5. South Korea

12.1.6. Rest of Asia-Pacific

12.2. Europe

12.2.1. France

12.2.2. Germany

12.2.3. Italy

12.2.4. Spain

12.2.5. United Kingdom

12.2.6. Rest of Europe

12.3. Middle East and Africa

12.3.1. Kingdom of Saudi Arabia

12.3.2. United Arab Emirates

12.3.3. Qatar

12.3.4. South Africa

12.3.5. Egypt

12.3.6. Morocco

12.3.7. Nigeria

12.3.8. Rest of Middle-East and Africa

12.4. North America

12.4.1. Canada

12.4.2. Mexico

12.4.3. United States

12.5. Latin America

12.5.1. Argentina

12.5.2. Brazil

12.5.3. Rest of Latin America

13. Company Profile

13.1. Apple Inc.

13.1.1. Company details

13.1.2. Financial outlook

13.1.3. Product summary

13.1.4. Recent developments

13.2. Bose Corporation

13.2.1. Company details

13.2.2. Financial outlook

13.2.3. Product summary

13.2.4. Recent developments

13.3. GN Store Nord A/S (Jabra)

13.3.1. Company details

13.3.2. Financial outlook

13.3.3. Product summary

13.3.4. Recent developments

13.4. SAMSUNG

13.4.1. Company details

13.4.2. Financial outlook

13.4.3. Product summary

13.4.4. Recent developments

13.5. Sennheiser electronic GmbH& Co. KG

13.5.1. Company details

13.5.2. Financial outlook

13.5.3. Product summary

13.5.4. Recent developments

13.6. Sony Corporation

13.6.1. Company details

13.6.2. Financial outlook

13.6.3. Product summary

13.6.4. Recent developments

13.7. Xiaomi

13.7.1. Company details

13.7.2. Financial outlook

13.7.3. Product summary

13.7.4. Recent developments

13.8. Panasonic Corporation

13.8.1. Company details

13.8.2. Financial outlook

13.8.3. Product summary

13.8.4. Recent developments

13.9. Shure Incorporated

13.9.1. Company details

13.9.2. Financial outlook

13.9.3. Product summary

13.9.4. Recent developments

13.10. Plantronics, Inc.

13.10.1. Company details

13.10.2. Financial outlook

13.10.3. Product summary

13.10.4. Recent developments

13.11. Others

14. Conclusion

15. List of Abbreviations

16. Reference Links