SiC and GaN Power Semiconductor Market Introduction and Overview

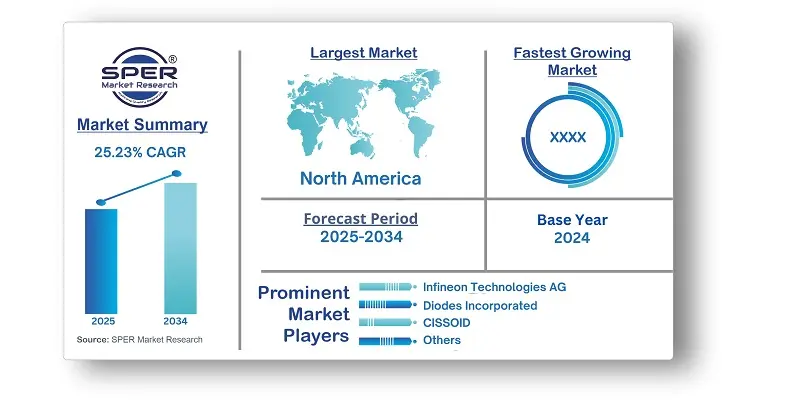

According to SPER Market Research, the Global SiC and GaN Power Semiconductor Market is estimated to reach USD 26.61 billion by 2034 with a CAGR of 25.23%.

The report includes an in-depth analysis of the Global SiC and GaN Power Semiconductor Market, including market size and trends, product mix, Applications, and supplier analysis. The market for silicon carbide (SiC) and gallium nitride (GaN) power semiconductors is expanding quickly as a result of rising demand for high-performance, energy-efficient power electronics. Compared to conventional silicon-based semiconductors, these wide-bandgap materials have better thermal conductivity, a higher breakdown voltage, and faster switching speeds, which makes them perfect for use in telecommunications, industrial automation, renewable energy, and electric vehicles (EVs). The growing popularity of EVs, improvements in fast-charging infrastructure, and a greater emphasis on sustainability are some of the main motivators. However, obstacles to wider adoption include expensive production costs, intricate fabrication procedures, and a shortage of high-quality wafers. Economies of scale and ongoing technical advancements are anticipated to propel future market growth in spite of these obstacles.

By Processor Insights: SiC and GaN Power Semiconductor is classified into three categories based On Processor: SiC power module, GaN power module, Discrete SiC, Discrete GaN. The market is dominated by the discrete SiC power module segment. Discrete SiC components are used in a number of sectors, such as power electronics, telecommunications, automotive, and aerospace. They are used in high-voltage rectification, motor control, power conversion systems, and other applications that call for dependable and strong semiconductor solutions. With the help of discrete SiC semiconductors, engineers may create electronic systems that are dependable and compact while optimizing circuit designs for better power management and energy efficiency.

By Power Range Insights: The market for SiC and GaN Power Semiconductor is segmented based on Power Range, including Low-power, Medium-power, High-power. The market segment with the quickest rate of growth is medium power. Power supply, motor drives, industrial machinery, and renewable energy systems like solar inverters and electric car chargers frequently use medium-power SiC devices. They are perfect for harsh settings where efficiency and compactness are critical design and performance elements because of their benefits, which include reduced switching losses, higher working temperatures, and improved dependability.

By Vertical Insights: The market for SiC and GaN Power Semiconductor is divided into many Vertical, including Power supplies, Industrial motor drives, H/EV, PV inverters, Traction. The market will be dominated by the power supplies sector during the forecast period. There are numerous advantages to SiC semiconductor devices in the energy and power sector. In electric vehicle charging, for example, silicon carbide (SiC) semiconductor devices like diodes and MOSFETs lower system costs, minimize component size, and improve power efficiency.

By Regional Insights: Asia Pacific was the market leader for SiC and GaN power semiconductors worldwide. As a large producer and consumer, China has a big impact on the market. To support industries like telecommunications, renewable energy, and electric vehicles (EVs), the nation is making significant investments in semiconductor technologies. The development and production of SiC and GaN power semiconductors by Chinese enterprises aims to improve technological self-sufficiency and satisfy domestic demand.

Market Competitive Landscape:

The business emphasizes innovation in reliability, performance, and power efficiency to meet the changing needs of international markets. Integrated circuits, power modules, and discrete semiconductors are all part of AOS's product line, which supports a variety of applications where small size and energy efficiency are essential. Some of the key market players are Alpha & Omega Semiconductor, CISSOID, Diodes Incorporated, Fuji Electric Co., Ltd., Infineon Technologies AG, Littelfuse, Inc., Microsemi Corporation, Mitsubishi Electric Corporation, Nexperia, ON Semiconductor Corporation, Panasonic Corporation, Renesas Electronics Corporation, ROHM CO., LTD., SANKEN ELECTRIC CO., LTD. and SEMIKRON.

Recent Developments:

- In April 2023, The RSL10-Solar-Cell Multi-Sensor Platform was launched by ON Semiconductor, showing their commitment to sustainable Internet of Things technologies. Energy harvesting for Web of Things applications is made possible by this cutting-edge platform, which combines solar cell technology with environmental sensors. The system promotes environmental sustainability by reducing dependency on external power sources and increasing device autonomy through making use of solar power.

- In March 2023, The German Company MERACON GmbH, which specialises in lidar and sensor technology, has been bought by Infineon technology AG. By expanding its line of cutting-edge sensing technologies, this calculated step strengthens Infineon's position in the industrial and auto sectors.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Processor, By Power Range, By Vertical. |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa. |

| Companies Covered | Alpha & Omega Semiconductor, CISSOID, Diodes Incorporated, Fuji Electric Co., Ltd., Infineon Technologies AG, Littelfuse, Inc., Microsemi Corporation, Mitsubishi Electric Corporation, Nexperia, ON Semiconductor Corporation, Panasonic Corporation, Renesas Electronics Corporation, ROHM CO., LTD., SANKEN ELECTRIC CO., LTD., SEMIKRON. other. |

Key Topics Covered in the Report:

- Global SiC and GaN Power Semiconductor Market Size (FY’2021-FY’2034)

- Overview of Global SiC and GaN Power Semiconductor Market

- Segmentation of Global SiC and GaN Power Semiconductor Market By Processor (SiC power module, GaN power module, Discrete SiC, Discrete GaN)

- Segmentation of Global SiC and GaN Power Semiconductor Market By Power Range (Low-power, Medium-power, High-power)

- Segmentation of Global SiC and GaN Power Semiconductor Market By Vertical (Power supplies, Industrial motor drives, H/EV, PV inverters, Traction)

- Statistical Snap of Global SiC and GaN Power Semiconductor Market

- Expansion Analysis of Global SiC and GaN Power Semiconductor Market

- Problems and Obstacles in Global SiC and GaN Power Semiconductor Market

- Competitive Landscape in the Global SiC and GaN Power Semiconductor Market

- Details on Current Investment in Global SiC and GaN Power Semiconductor Market

- Competitive Analysis of Global SiC and GaN Power Semiconductor Market

- Prominent Players in the Global SiC and GaN Power Semiconductor Market

- SWOT Analysis of Global SiC and GaN Power Semiconductor Market

- Global SiC and GaN Power Semiconductor Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global SiC and GaN Power Semiconductor Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global SiC and GaN Power Semiconductor Market

7. Global SiC and GaN Power Semiconductor Market, By Processor (USD Million) 2021-2034

7.1. SiC power module

7.2. GaN power module

7.3. Discrete SiC

7.4. Discrete GaN

8. Global SiC and GaN Power Semiconductor Market, By Power Range (USD Million) 2021-2034

8.1. Low-power

8.2. Medium-power

8.3. High-power

9. Global SiC and GaN Power Semiconductor Market, By Vertical (USD Million) 2021-2034

9.1. Power supplies

9.2. Industrial motor drives

9.3. H/EV

9.4. PV inverters

9.5. Traction

10. Global SiC and GaN Power Semiconductor Market, (USD Million) 2021-2034

10.1. Global SiC and GaN Power Semiconductor Market Size and Market Share

11. Global SiC and GaN Power Semiconductor Market, By Region, (USD Million) 2021-2034

11.1. Asia-Pacific

11.1.1. Australia

11.1.2. China

11.1.3. India

11.1.4. Japan

11.1.5. South Korea

11.1.6. Rest of Asia-Pacific

11.2. Europe

11.2.1. France

11.2.2. Germany

11.2.3. Italy

11.2.4. Spain

11.2.5. United Kingdom

11.2.6. Rest of Europe

11.3. Middle East and Africa

11.3.1. Kingdom of Saudi Arabia

11.3.2. United Arab Emirates

11.3.3. Qatar

11.3.4. South Africa

11.3.5. Egypt

11.3.6. Morocco

11.3.7. Nigeria

11.3.8. Rest of Middle-East and Africa

11.4. North America

11.4.1. Canada

11.4.2. Mexico

11.4.3. United States

11.5. Latin America

11.5.1. Argentina

11.5.2. Brazil

11.5.3. Rest of Latin America

12. Company Profile

12.1. Alpha & Omega Semiconductor

12.1.1. Company details

12.1.2. Financial outlook

12.1.3. Product summary

12.1.4. Recent developments

12.2. CISSOID

12.2.1. Company details

12.2.2. Financial outlook

12.2.3. Product summary

12.2.4. Recent developments

12.3. Diodes Incorporated

12.3.1. Company details

12.3.2. Financial outlook

12.3.3. Product summary

12.3.4. Recent developments

12.4. Fuji Electric Co., Ltd.

12.4.1. Company details

12.4.2. Financial outlook

12.4.3. Product summary

12.4.4. Recent developments

12.5. Infineon Technologies AG

12.5.1. Company details

12.5.2. Financial outlook

12.5.3. Product summary

12.5.4. Recent developments

12.6. Littelfuse, Inc.

12.6.1. Company details

12.6.2. Financial outlook

12.6.3. Product summary

12.6.4. Recent developments

12.7. Microsemi Corporation

12.7.1. Company details

12.7.2. Financial outlook

12.7.3. Product summary

12.7.4. Recent developments

12.8. Mitsubishi Electric Corporation

12.8.1. Company details

12.8.2. Financial outlook

12.8.3. Product summary

12.8.4. Recent developments

12.9. Nexperia

12.9.1. Company details

12.9.2. Financial outlook

12.9.3. Product summary

12.9.4. Recent developments

12.10. ON Semiconductor Corporation

12.10.1. Company details

12.10.2. Financial outlook

12.10.3. Product summary

12.10.4. Recent developments

12.11. Others

13. Conclusion

14. List of Abbreviations

15. Reference Links