Sample Preparation Market Introduction and Overview

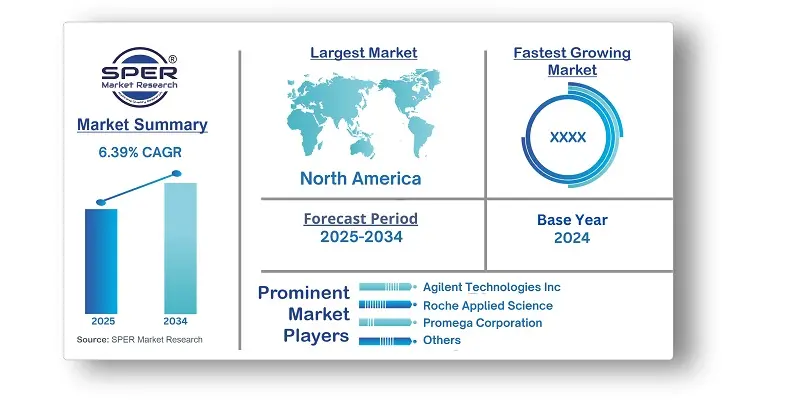

According to SPER Market Research, the Global Sample Preparation Market is estimated to reach USD 14.81 billion by 2034 with a CAGR of 6.39%.

The report includes an in-depth analysis of the Global Sample Preparation Market, including market size and trends, product mix, Applications, and supplier analysis. The size of the global sample preparation market was estimated at USD 7.97 billion in 2024, and it is projected to expand at a compound annual growth rate (CAGR) of 6.39% between 2025 and 2034. Technological developments in sample preparation methods, growing laboratory automation, the creation of bio-clusters to support research activities, rising R&D expenditures in the biotechnology and pharmaceutical sectors, and ongoing genomics and proteomics research are the main factors propelling this market's expansion. Furthermore, there should be substantial market expansion prospects due to the expanding use of sample preparation in developing nations and the growing emphasis on customized medications.

By Product Insights: The consumables segment led the market in 2024 and is expected to grow the fastest in the future. Consumables are mostly used repeatedly and are less affected by seasonal changes than instruments. The instruments segment is projected to have stable growth. Instruments are purchased less frequently due to their longer lifespan and higher cost compared to consumables. Accurate quality instruments are crucial for End-uses to prevent contamination from samples.

By Technique Insights: The protein preparation segment led the market in 2024 and is projected to grow the fastest in the future. Innovations in proteomics are likely to boost the overall market. The extraction process can cause protein loss by removing contaminants and reducing data reproducibility. In July 2022, Babraham Institute researchers improved sample preparation protocols in proteomics to enhance the capture of difficult cellular proteins, improving proteomics readouts.

By Application Insights: The market was dominated by the genomics sector in 2024, and it is anticipated to develop at the fastest rate throughout the projected period. Companies in the market for genomics applications are anticipated to increase their strategic endeavors, which would accelerate the industry's overall growth rate.

By End User Insights: The market was dominated by the diagnostic center segment in 2024, and it is anticipated to develop at the quickest rate during the projected period. The sample preparation market is thought to be skewed toward more developed regions, primarily in North America, Japan, and Western Europe. The industry will probably be driven by rising human health spending in emerging nations, nevertheless.

By Regional Insights: North America sample preparation market has established global dominance in 2024. The key reason for the largest market share is the presence of well-established suppliers and buyers of sample preparation solutions in the region, speeding up delivery at minimal costs. Additionally, increased funding accessibility supports startup companies.

Market Competitive Landscape:

Businesses in the sample preparation industry are continuously pursuing a variety of tactics to increase their revenue, including technological advancement, product line innovation, partnerships, establishing a strong market presence through mergers and acquisitions, startups, and regional expansion. Key market players are Merck KGaA, Thermo Fisher Scientific Inc, Bio-RAD Laboratories Inc, Tecan Group Ltd, Agilent Technologies Inc, Hamilton Company, Promega Corporation, among others.

Recent Developments:

- Merck KGaA extended its cell culture media production facility in Kansas, USA, in July 2023 to meet present and future demand.

- The EZ2 Connect MDx platform was introduced by QIAGEN N.V. in January 2023 for automated sample processing in diagnostic labs.

- In November 2023, QIAGEN launched two new solutions to help researchers process various materials like bone, tissue, and soil samples. The TissueLyser III and RNeasy PowerMax Soil Pro Kit show QIAGEN's commitment to improving automated sample preparation and enhancing efficiency in analysis workflows.

- In September 2023, DPX Technologies, a maker of lab supplies for sample preparation, announced its business expansion. This includes new product lines for proteomics and genomics testing and a larger storage facility to support growth and future product development.

Scope of the Report:

| Report Metric | Details |

| Market size available for years | 2021-2034 |

| Base year considered | 2024 |

| Forecast period | 2025-2034 |

| Segments covered | By Product, By Technique, By Application, By End User. |

| Regions covered | North America, Latin America, Asia-Pacific, Europe, and Middle East & Africa. |

| Companies Covered | Merck KGaA, Thermo Fisher Scientific Inc, Bio-RAD Laboratories Inc, Tecan Group Ltd, Agilent Technologies Inc, Hamilton Company, Promega Corporation, Illumina Inc, Roche Applied Science, Danaher Corporation, Qiagen N.V. and others. |

Key Topics Covered in the Report:

- Global Sample Preparation Market Size (FY’2021-FY’2034)

- Overview of Global Sample Preparation Market

- Segmentation of Global Sample Preparation Market By Product (Instruments, Consumable, Kits)

- Segmentation of Global Sample Preparation Market By Technique (Protein Preparation, Solid-phase extraction, Liquid-liquid extraction)

- Segmentation of Global Sample Preparation Market By Application (Genomics, Proteomics, Epigenomics, Transcriptomics, Metabolomics, Others)

- Segmentation of Global Sample Preparation Market By End User (Hospitals, Diagnostic Centers, Pharmaceutical and Biotechnology Industry, Others)

- Statistical Snap of Global Sample Preparation Market

- Expansion Analysis of Global Sample Preparation Market

- Problems and Obstacles in Global Sample Preparation Market

- Competitive Landscape in the Global Sample Preparation Market

- Details on Current Investment in Global Sample Preparation Market

- Competitive Analysis of Global Sample Preparation Market

- Prominent Players in the Global Sample Preparation Market

- SWOT Analysis of Global Sample Preparation Market

- Global Sample Preparation Market Future Outlook and Projections (FY’2025-FY’2034)

- Recommendations from Analyst

1. Introduction

1.1. Scope of the report

1.2. Market segment analysis

2. Research Methodology

2.1. Research data source

2.1.1. Secondary Data

2.1.2. Primary Data

2.1.3. SPERs internal database

2.1.4. Premium insight from KOLs

2.2. Market size estimation

2.2.1. Top-down and Bottom-up approach

2.3. Data triangulation

3. Executive Summary

4. Market Dynamics

4.1. Driver, Restraint, Opportunity and Challenges analysis

4.1.1. Drivers

4.1.2. Restraints

4.1.3. Opportunities

4.1.4. Challenges

5. Market variable and outlook

5.1. SWOT Analysis

5.1.1. Strengths

5.1.2. Weaknesses

5.1.3. Opportunities

5.1.4. Threats

5.2. PESTEL Analysis

5.2.1. Political Landscape

5.2.2. Economic Landscape

5.2.3. Social Landscape

5.2.4. Technological Landscape

5.2.5. Environmental Landscape

5.2.6. Legal Landscape

5.3. PORTERs Five Forces

5.3.1. Bargaining power of suppliers

5.3.2. Bargaining power of buyers

5.3.3. Threat of Substitute

5.3.4. Threat of new entrant

5.3.5. Competitive rivalry

5.4. Heat Map Analysis

6. Competitive Landscape

6.1. Global Sample Preparation Market Manufacturing Base Distribution, Sales Area, Product Type

6.2. Mergers & Acquisitions, Partnerships, Product Launch, and Collaboration in Global Sample Preparation Market

7. Global Sample Preparation Market, By Product (USD Million) 2021-2034

7.1. Instruments

7.1.1. Extraction System

7.1.2. Workstation

7.1.3. Automated Evaporation System

7.1.4. Liquid Handling Instrument

7.1.5. Liquid handling workstations

7.1.6. Pipetting systems

7.1.7. Reagents dispensers

7.1.8. Microplate washer

7.1.9. Other liquid handling systems

7.2. Consumable

7.3. Kits

7.3.1. Purification Kit

7.3.2. Isolation Kit

7.3.3. Extraction Kit

8. Global Sample Preparation Market, By Technique (USD Million) 2021-2034

8.1. Protein Preparation

8.2. Solid-phase extraction

8.3. Liquid-liquid extraction

9. Global Sample Preparation Market, By Application (USD Million) 2021-2034

9.1. Genomics

9.2. Proteomics

9.3. Epigenomics

9.4. Transcriptomics

9.5. Metabolomics

9.6. Others

10. Global Sample Preparation Market, By End User (USD Million) 2021-2034

10.1. Hospitals

10.2. Diagnostic Centers

10.3. Pharmaceutical and Biotechnology Industry

10.4. Others

11. Global Sample Preparation Market, (USD Million) 2021-2034

11.1. Global Sample Preparation Market Size and Market Share

12. Global Sample Preparation Market, By Region, (USD Million) 2021-2034

12.1. Asia-Pacific

12.1.1. Australia

12.1.2. China

12.1.3. India

12.1.4. Japan

12.1.5. South Korea

12.1.6. Rest of Asia-Pacific

12.2. Europe

12.2.1. France

12.2.2. Germany

12.2.3. Italy

12.2.4. Spain

12.2.5. United Kingdom

12.2.6. Rest of Europe

12.3. Middle East and Africa

12.3.1. Kingdom of Saudi Arabia

12.3.2. United Arab Emirates

12.3.3. Qatar

12.3.4. South Africa

12.3.5. Egypt

12.3.6. Morocco

12.3.7. Nigeria

12.3.8. Rest of Middle-East and Africa

12.4. North America

12.4.1. Canada

12.4.2. Mexico

12.4.3. United States

12.5. Latin America

12.5.1. Argentina

12.5.2. Brazil

12.5.3. Rest of Latin America

13. Company Profile

13.1. Merck KGaA

13.1.1. Company details

13.1.2. Financial outlook

13.1.3. Product summary

13.1.4. Recent developments

13.2. Thermo Fisher Scientific Inc

13.2.1. Company details

13.2.2. Financial outlook

13.2.3. Product summary

13.2.4. Recent developments

13.3. Bio-RAD Laboratories Inc

13.3.1. Company details

13.3.2. Financial outlook

13.3.3. Product summary

13.3.4. Recent developments

13.4. Tecan Group Ltd

13.4.1. Company details

13.4.2. Financial outlook

13.4.3. Product summary

13.4.4. Recent developments

13.5. Agilent Technologies Inc

13.5.1. Company details

13.5.2. Financial outlook

13.5.3. Product summary

13.5.4. Recent developments

13.6. Hamilton Company

13.6.1. Company details

13.6.2. Financial outlook

13.6.3. Product summary

13.6.4. Recent developments

13.7. Promega Corporation

13.7.1. Company details

13.7.2. Financial outlook

13.7.3. Product summary

13.7.4. Recent developments

13.8. Illumina Inc

13.8.1. Company details

13.8.2. Financial outlook

13.8.3. Product summary

13.8.4. Recent developments

13.9. Danaher

13.9.1. Company details

13.9.2. Financial outlook

13.9.3. Product summary

13.9.4. Recent developments

13.10. Qiagen N.V

13.10.1. Company details

13.10.2. Financial outlook

13.10.3. Product summary

13.10.4. Recent developments

13.11. Others

14. Conclusion

15. List of Abbreviations

16. Reference Links

SPER Market Research’s methodology uses great emphasis on primary research to ensure that the market intelligence insights are up to date, reliable and accurate. Primary interviews are done with players involved in each phase of a supply chain to analyze the market forecasting. The secondary research method is used to help you fully understand how the future markets and the spending patterns look likes.

The report is based on in-depth qualitative and quantitative analysis of the Product Market. The quantitative analysis involves the application of various projection and sampling techniques. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The data gathered as a result of these processes are validated through experts opinion. Our research methodology entails an ideal mixture of primary and secondary initiatives.